On September 8, 2016, BlackRock introduced four thematic ETFs, based on STOXX indices, that aim to capture the economic upside of prominent and truly disruptive topics: ageing population, healthcare innovation, automation and robotics, and digitalization. Since then, three additional funds have been launched, targeting the electric vehicles, digital security and smart city infrastructure themes.

The seven iShares ETFs provide investors a transparent, rules-based, systematic and cost-efficient way to capitalize on macro trends that are powerfully transforming our society. Thematic investing offers exposure to areas of high economic growth and therefore has the potential to outpace the market’s performance. As such, investors have poured record capital flows into thematic products. The seven BlackRock ETFs had more than $12 billion in assets this month.

The underlying STOXX thematic indices also incorporate ESG exclusionary screens.1 This is an important design consideration as investors become increasingly sustainability-aware, and one that has shown to be generally beneficial to performance.

Five years on from the launch of the first thematic ETFs resulting from the collaboration between BlackRock and Qontigo, we reflect on the performance of the seven thematic strategies.

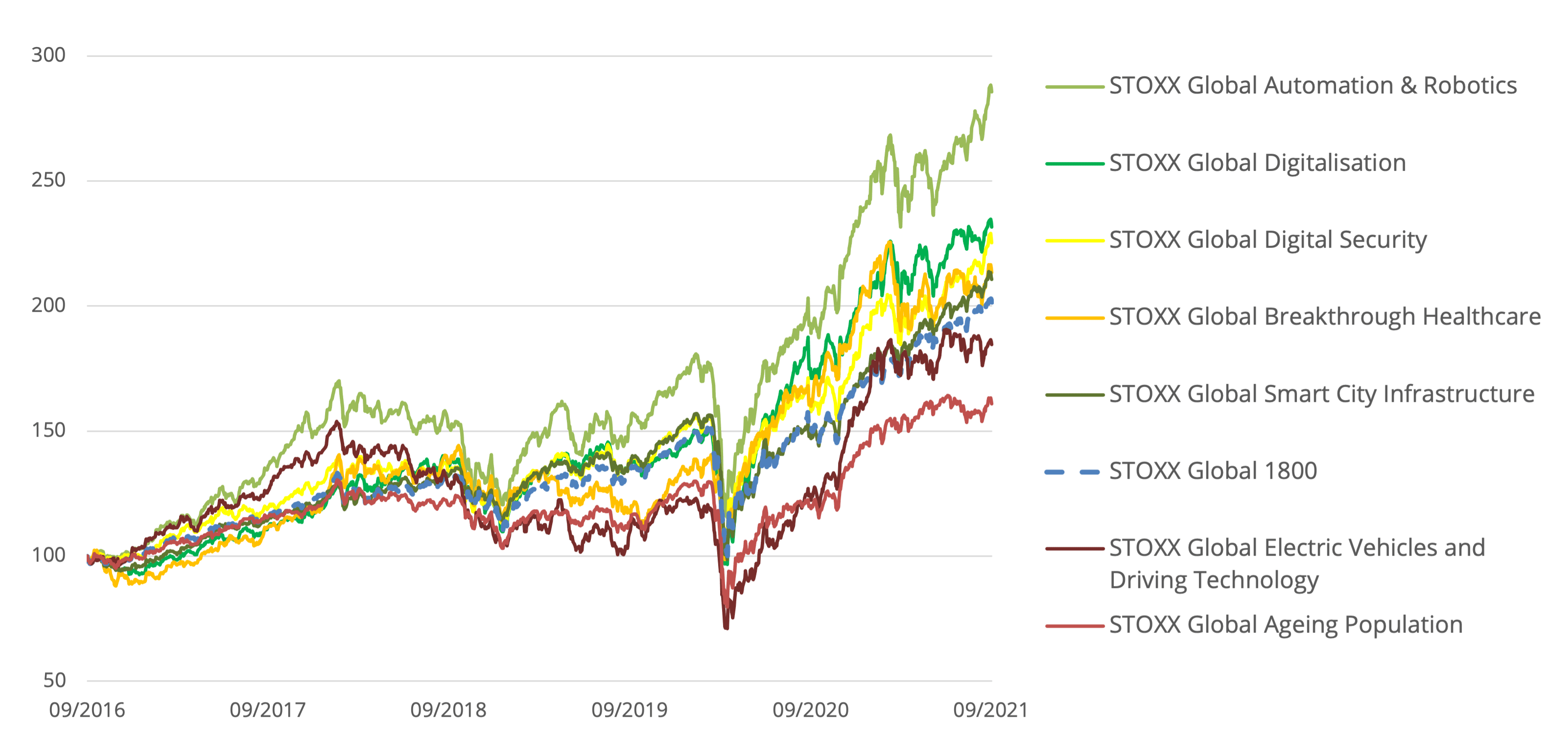

Figure 1 shows the gross returns in dollars of the STOXX thematic indices that underlie the iShares ETFs. The benchmark STOXX® Global 1800 Index appears in dotted blue lines.

STOXX Global 1800

Figure 1: five-year index returns

As the chart shows, five of the seven indices have outperformed the broader market over the last five years.

Growth bias and stock selection key

Thematic investing implies an active investment decision, where the investor takes on sector and style tilts and the consequent potential to both outperform and underperform.

A Qontigo research paper in 2019 found that, overall, strong biases towards specific industries have contributed to positive active returns in the STOXX Thematic Indices. This is quite intuitive given that most of the thematic indices tackle targeted sectors in order to benefit from the megatrend in question.

In many instances, the so-called specific return contributed positively to overall returns, indicating a relatively favorable stock selection. This may reflect the benefit of revenue-screened indices to identify the true ‘winners’ of themes.

A bias towards growth was also observed during the study in most of the thematic indices, which may also be expected since thematic indices attempt to obtain exposure to a particular megatrend as it is evolving.

WHITEPAPER

Indexing Thematic Megatrends

The term “megatrend” was coined by US political scientist and author John Naisbitt at the start of the 1980s. It refers to powerful macroeconomic transformative forces that have a major impact on countries, businesses and societies around the world, disrupting the way products and services are produced, delivered and consumed.

Download >

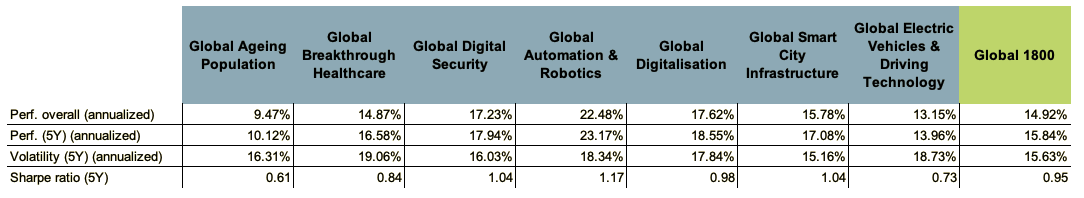

Strong returns despite higher volatility

Another characteristic of the thematic indices has been higher volatility relative to the market (Table 1). While this is not surprising given the more concentrated and targeted nature of the indices, it is important for investors to be compensated for taking on this additional risk.

When viewing the indices through this lens, we observe that a majority of them do exhibit higher risk-adjusted returns, measured by Sharpe ratios, than the market.

Table 1: Risk and returns

Record flows and assets

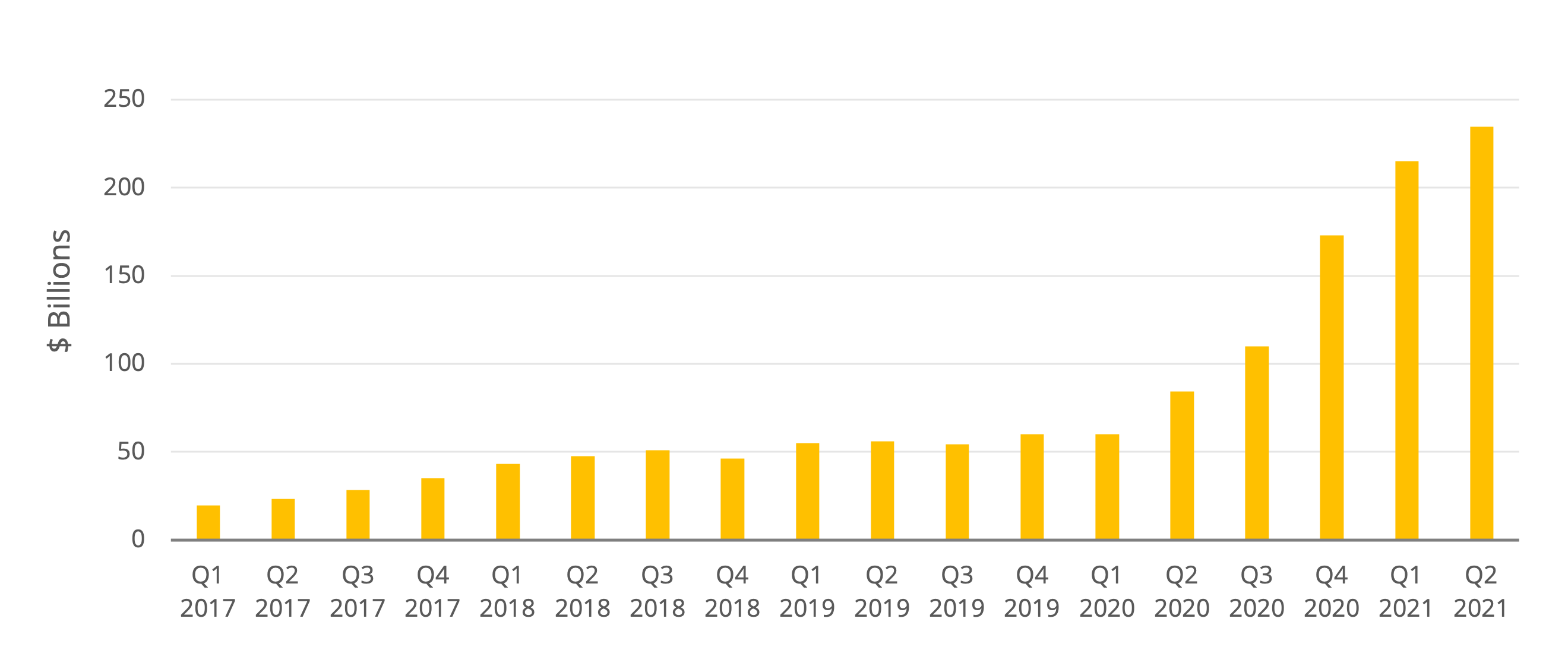

With markets touching all-time highs, investors have looked to thematic strategies to tactically complement their core equity allocations, and this trend shows no sign of losing traction. According to Morningstar, thematic ETFs worldwide attracted a record $58 billion in 2020, helping assets under management nearly treble in a year when markets were whipsawed by the COVID-19 pandemic (Figure 2). The ETFs saw in the first quarter of 2021 the highest net sales since Morningstar data begins.

Figure 2: global thematic ETF assets

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Interest in the strategies is likely to persist as the dynamism of our modern societies and the rapid pace of innovation and change offer the opportunity for groundbreaking thematic strategies to be continuously brought to market.

The COVID-19 outbreak has crystallized these modern paradigms, acting as an important accelerator for far-reaching change on many social and economic fronts. The pandemic presents strong opportunities to tackle new themes, including, for example, growth in the digital entertainment and education businesses.

We celebrate the fifth anniversary of our thematics collaboration with BlackRock, and look forward to designing new, innovative products with our clients, enabling access to the growth themes of a world in disruption.

1 The exclusions cover global norms, controversial weapons, weapons, tobacco, nuclear power, thermal coal, oil & gas, and companies involved in severe ESG controversies.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.