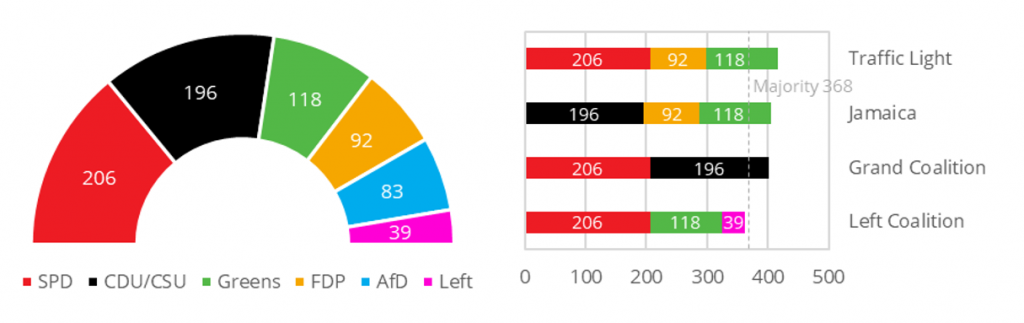

The votes from Germany’s federal election have been counted, but the result was far from decisive. We may be weeks, or even months, away from knowing who will succeed Angela Merkel as the next chancellor. The conservative Christian Democratic Union (CDU/CSU) and the center-left Social Democratic Party (SPD) are head-to-head, with neither having enough votes to form a government by itself. Given the wide dispersion of seats across six factions, the two most likely options for the next government will be three-way coalitions of either of the two leading parties with both the Green Party and the liberal Free Democratic Party (FDP). A continuation of the ‘grand coalition’ of CDU/CSU and SPD has already been ruled out by both parties. Given the wide range of political agendas in either constellation, we expect any potential market impact to be limited, although stocks, high-yield corporate bonds, and the euro could all benefit from fiscal stimulus and higher interest rates.

Election results and possible coalition options (seats)

Broadly speaking, the Social Democrats and the Greens are more likely to increase government spending—funded by higher taxes and more debt—while the Union and FDP will almost certainly insist on (re-)applying the ‘debt brake’1. Therefore, each feasible coalition will have at least one party that insists on spending more and one that will try to limit additional borrowing. That said, any new government will still have to deal with the ongoing COVID crisis, which will make any fiscal consolidation challenging—especially with the European Central Bank also intending to reduce its support at some point. Surging consumer prices and rising interest rates in other parts of the world are bound to put additional upward pressure on German borrowing costs.

Yet, higher sovereign yields are not necessarily a bad thing. On the contrary, given the current positive correlation between long-term government rates on the one hand, and share prices and exchange rates on the other, stock markets and the euro could even appreciate. Tighter credit spreads may also benefit corporate bonds—especially at the lower end of the rating spectrum. To estimate the impact of rising Bund yields on these different asset classes, we performed a range of so-called transitive stress tests using Axioma Risk™, Qontigo’s multi-asset class analysis platform. We applied a moderate upward shock of 30-basis points to the 10-year German Bund yield, which from its current level would just about turn it positive. Covariances and betas with other pricing factors, such as credit spreads, share prices, and exchange rates, were estimated using weekly returns over the six months following each of the past four federal elections. The 2021 numbers were calibrated from the most recent 6-month period ending September 24.

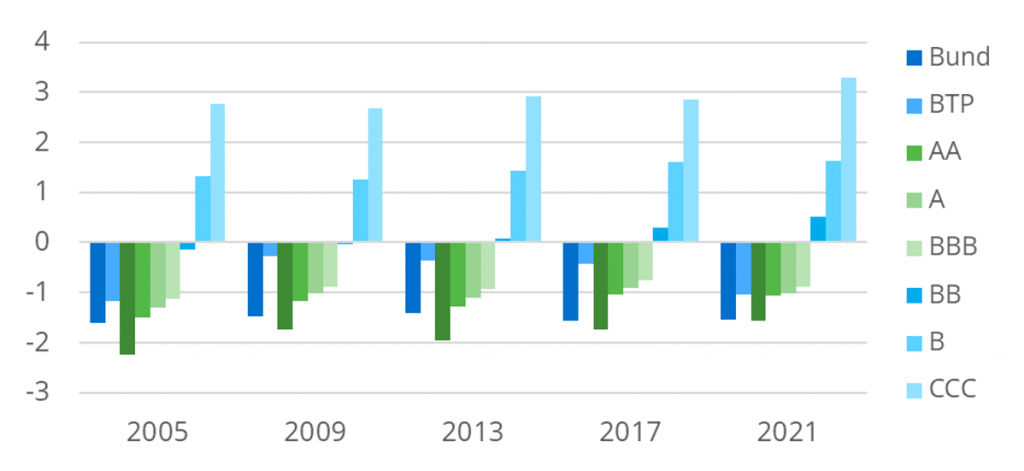

The chart below shows the simulated performance of a portfolio of euro-denominated sovereign and corporate bonds, broken down by broad rating. The modelled returns include the effects of higher risk-free rates, as well as the estimated contributions from accompanying changes in credit spreads and accrued interest over half a year (assuming current yields to maturity). The calculation of price moves presumes an average modified duration of 5 years.

Simulated total returns for a 30-basis point rise in 10-year Bund yields over six months

Despite very different economic environments in the various calibration periods, the simulated returns look quite similar. The performance of German Bunds is mostly driven by the shock in the 10-year benchmark rate. With the assumed duration of 5 years and current yields close to zero, the 30-basis point rate shock roughly translates into an expected total return of -1.5%. The highest rated corporate-bond category (AAA) shows a similar or slightly worse performance. However, losses for the rest of the investment-grade universe (AA to BBB) are slightly lower, as they seem to benefit from tighter credit spreads, while the interest-income effect is still negligible. It is also worth noting how homogenous their returns are, not only in all scenarios, but also across ratings—almost as if relative creditworthiness was not a major concern for investment-grade investors.

The picture is very different, however, once we move into speculative grade. Especially when descending further on the rating spectrum to single-B and triple-C, expected returns become more and more positive. Admittedly, much of this is due to the considerable yield premia of these securities, which account for almost all the predicted income. Yet, the implied changes in credit spreads also offset most of the detrimental effects of higher risk-free rates

It is worth examining the predicted performance of Italian government bonds in more detail. Peripheral sovereign issuers often also benefit from tighter credit-risk premia. Particularly in the 2009, 2013, and 2017 scenarios, BTPs exhibited much smaller losses than corporate securities with comparable ratings. However, these periods also represented times of heightened volatility for Italian debt, namely the recovery from the Eurozone debt crisis of 2011/12 and the run-up to the Italian general election in 2018. More recently, euro-sovereign debt in general has been bolstered by the European Central Bank’s pandemic emergency purchase program. For the time being, the support mechanism remains in place, but the relative performance of Italian versus German debt could also depend on the dominant forces in Berlin. Both the CDU/CSU and FDP have rejected a European fiscal union, while the Greens and Social Democrats may be more willing to extend the current joint borrowing program beyond the corona crisis. An agenda set by the latter two could, therefore, result in greater convergence of borrowing rates among Eurozone governments and, subsequently, in a tighter BTP-Bund spread.

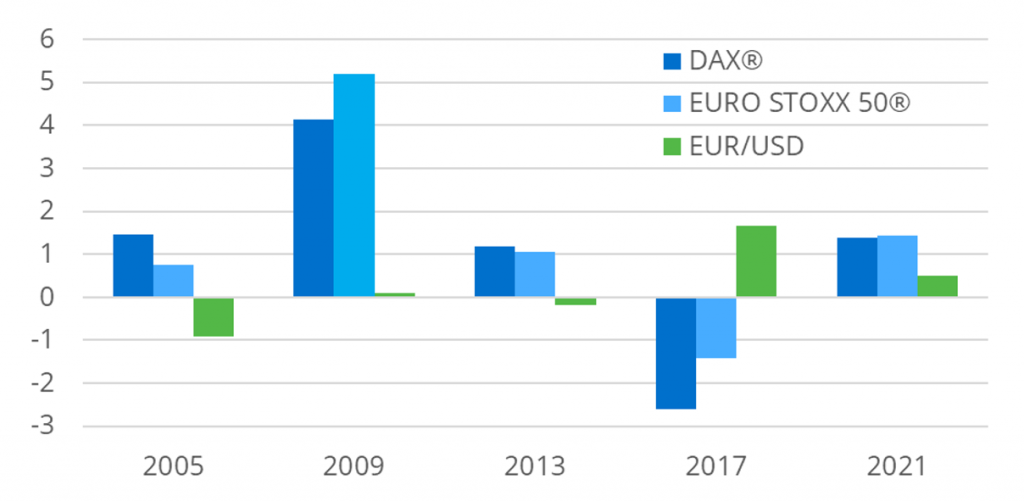

In terms of stock markets, the anticipation of increased fiscal spending would provide a much-needed boost to the German economy, especially in the ongoing recovery from the COVID crisis. The stress test results for the DAX® and EURO STOXX 50® indices in the chart below seem to confirm this notion, with gains predicted in all but the 2017 scenario. It is probably no coincidence that the latter implies lower share prices, as the underlying environment was characterized by increased uncertainty, caused by the prolonged coalition negotiations at the time. It serves as a warning that a repetition of the 2017 coalition quandary could still lead to weaker equity markets after all.

Simulated equity and FX returns for a 30-basis point rise in 10-year Bund yields over six months

Higher bond yields could also result in an appreciation of the euro against the US dollar, as bigger expected returns tend to make a currency more attractive to foreign investors. The current correlation regime would certainly support a stronger exchange rate, although the evidence from the historical scenarios is less conclusive. That said, EUR/USD did climb higher in first six, following each of the three most recent German elections (2009, 2013, and 2017).

[1] The so-called ‘debt brake’—temporarily suspended in response to the COVID crisis—was introduced into the German constitution in 2009 to limit the federal structural deficit to no more than 0.35% of GDP.