Some of the publicity surrounding the upcoming changes to GICS sector classifications suggests a degree of market upheaval, but from our risk-oriented perspective we foresee relatively little to worry about. We believe the changes reflect a transformation in the economy that has been building for quite a while—and therefore just create more accurate labels.

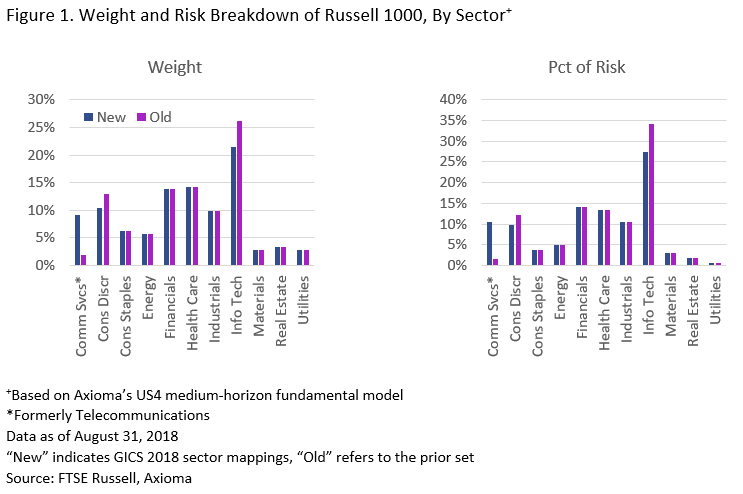

The major change is that several big stocks will be moved from Consumer Discretionary and Information Technology into a newly formed Communication Services sector, where they will join the few remaining stocks that were in the old Telecommunications sector. Those are the only three sectors that will be affected. The risk breakdown for the sectors in the Russell 1000 shows that, unsurprisingly, the weight of and the proportion of risk used by Communications Services (fka Telecommunications) increases substantially, while both Consumer Discretionary and Information Technology see a drop in both (data is as of August 31, 2018, Figure 1). The other sectors do not experience any change. Still, Information Technology remains by far the biggest sector in the index and has the highest proportion of risk, and Consumer Discretionary remains in the middle of the pack.

The new Communication Services sector is also the only one to look substantially different along a number of dimensions. We have created sector portfolios for each of the three affected sectors, filtering Russell 1000 stocks by sector and then rescaling Russell 1000 company weights to add to 100%.

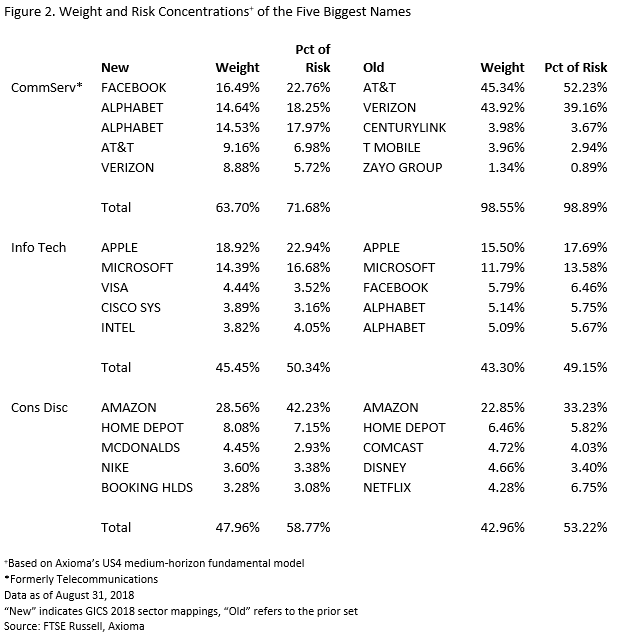

Figure 2 shows the five highest weight stocks in each sector (treating it as a standalone entity) and their contribution to risk, as of August 31, 2018. The new Communications Services sector is less concentrated in weight and risk contribution than the old (although the five biggest names still account for a substantial amount of weight and risk). Because Apple and Microsoft remained in Information Technology the concentration in the top five names did not change substantially. Amazon, already a substantial contributor, became an even bigger part of Consumer Discretionary, and after losing names like Netflix, the sector became somewhat more concentrated as well.

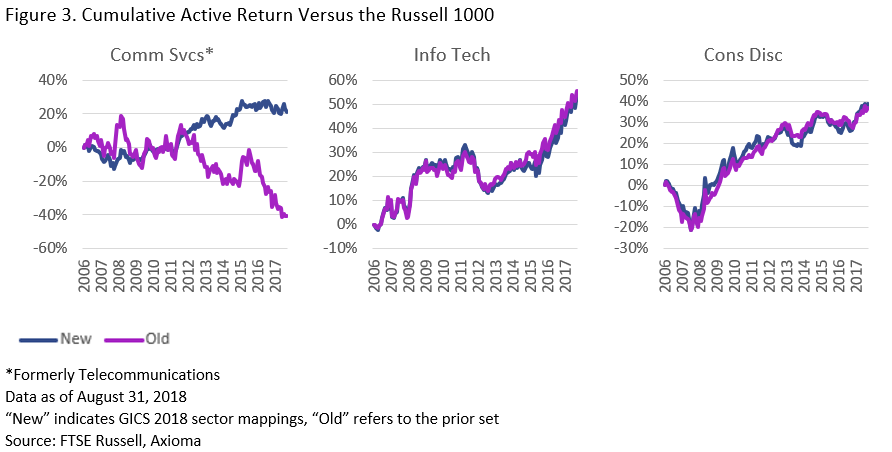

The most remarkable difference between old and new was in historical performance, at least for Communication Services. The old Telecommunications sector had underperformed the Russell 1000 since 2011, while the new sector has outpaced the market for the past 10 years (Figure 3). However, despite losing some big names, the other two sectors saw virtually no performance difference.

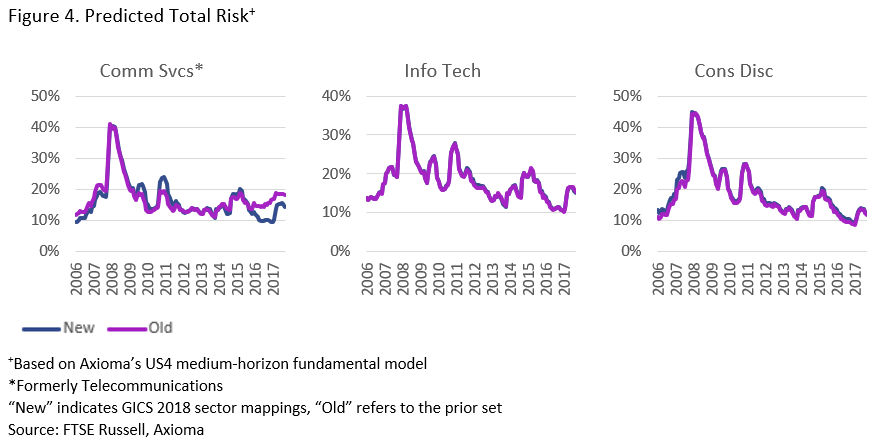

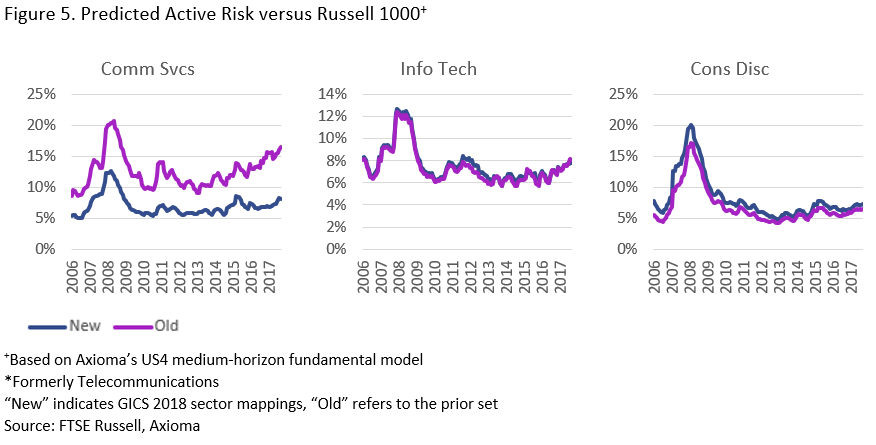

At the same time, total sector risk was largely unchanged, but active risk of Communications Services to the Russell 1000 fell substantially, meaning the sector is now more “like” the index than it used to be.

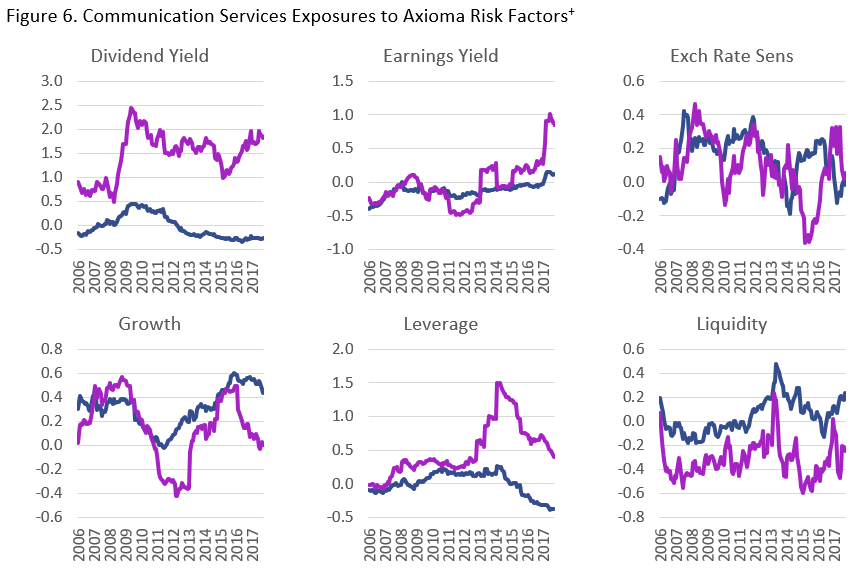

Finally, we looked at the underlying risk exposures of the three sector portfolios to see what may have changed. Once again, the new Communication Services sector saw bigger differences than the other two sectors. Figure 6 details the time series of sector exposures that showed big differences. For Communication Services, the impact of gaining not only bigger names, but also more names, is evident from the increase in stability of the exposures through time.

The most notable difference is the exposure to Dividend Yield, which went from hovering around 2 since 2009 to slightly below zero. The new configuration has typically had lower Leverage, Size and Profitability (although Size reversed and Profitability converged recently), and higher Liquidity, Growth and Market Sensitivity exposures The other factors saw relatively little change.

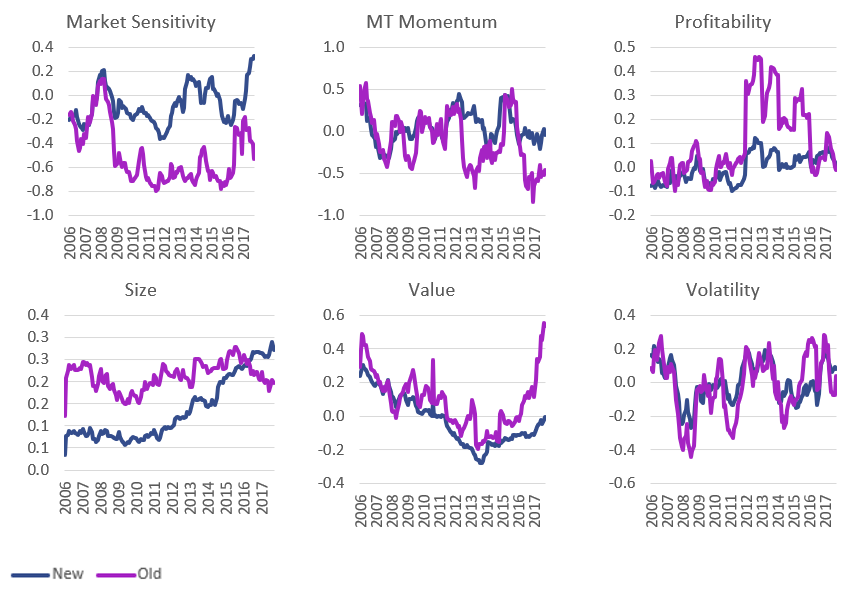

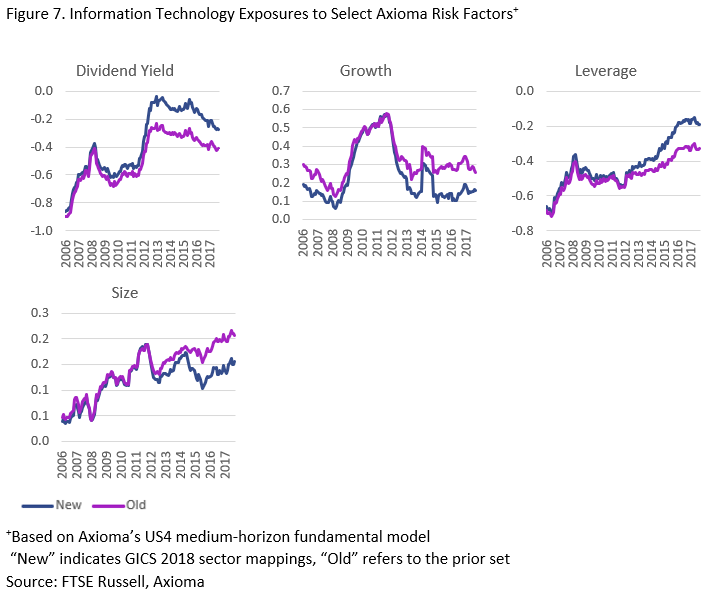

Corresponding to the decrease in Communication Services’ Dividend Yield, Information Technology saw an increase. In the last few years, the new sector’s Leverage exposure also increased as compared with the old one, and Size and Growth decreased. Other factor exposures changed very little (so we excluded them).

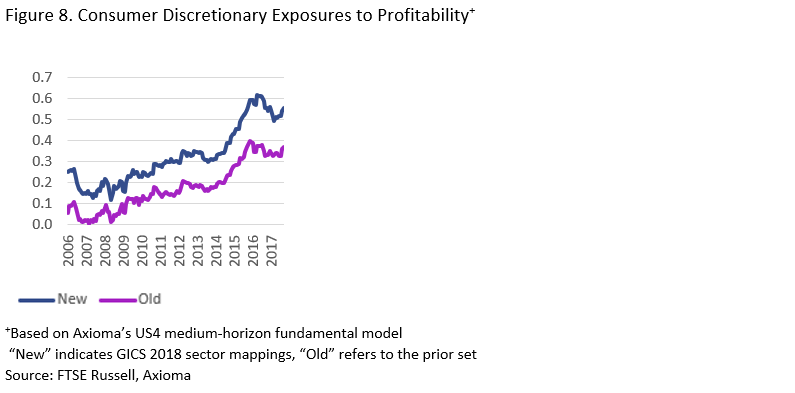

The only notable change in exposure for Consumer Discretionary was an increase in its Profitability exposure.

Conclusion

Portfolio managers should be aware that the upcoming changes in GICS sector classifications will lead to some blips in portfolio risk, but they are likely to be relatively small. A key area to keep an eye on is the new Communication Services sector, which has become more important in the index and will experience a number of changes in characteristics.