Since the UK’s decision to leave the European Union, investors have fretted over the impact of Brexit on the UK and European economies. At a high level, the UK and European (EU)[1] financial sectors showed large negative returns before the vote and strong positive returns after. Risk peaked around the referendum date, only to decline abruptly afterwards. The question is, what were the main factors impacting this reversal in performance in each region and what were the contributors that led to the rise and decline in risk?

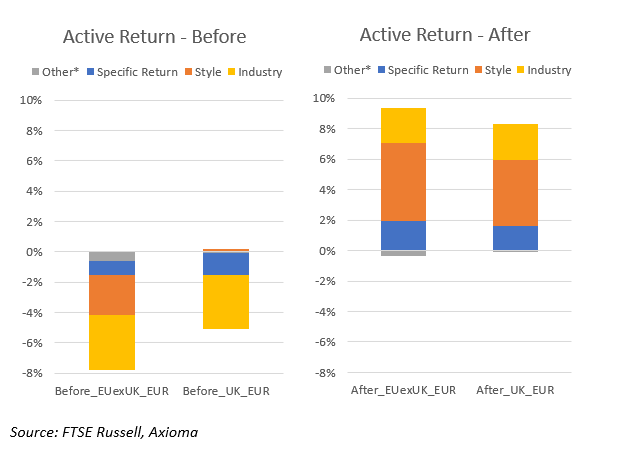

Before the vote, Industry and Style factors were the culprits for Financials’ underperformance in Europe, while in the UK, it was Specific Return and Industry that pulled down Financials’ active return[2]. Style factors drove the post-vote positive returns, while Industry and Specific factors boosted Financials’ returns in both regions[3].

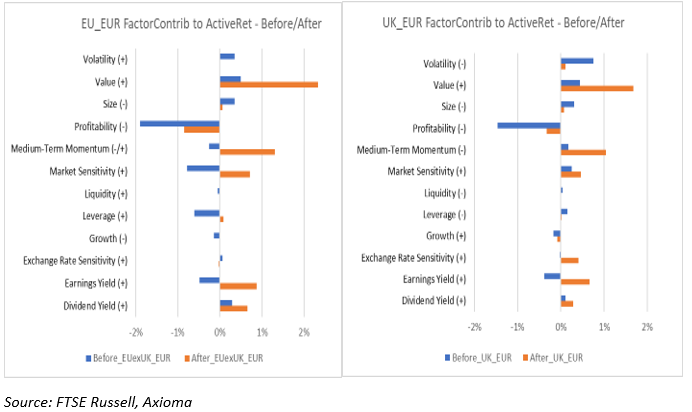

Among style factors, a big negative exposure (-) to Profitability contributed the most to the decrease in returns for UK and EU Financials in the 18-month periods before and after the vote. However, the other main style contributors that added to Financials’ negative return before the vote differed from one region to the other. In contrast, during the post-vote period, it was the same three factors that provided the largest contributions to UK and EU Financials’ strong positive returns: Value (+), Medium-Term Momentum (+ in Europe/ – in UK), and Earnings Yield (+). Interestingly, Momentum’s positive contribution came from a positive average exposure in Europe and a negative average exposure in the UK.

UK Financials’ exposure to Exchange Rate Sensitivity rose significantly post-Brexit, becoming the sector’s largest exposure, although it contributed only slightly to the UK’s positive active return, as the British pound recovered from the tremendous fall right after the vote.

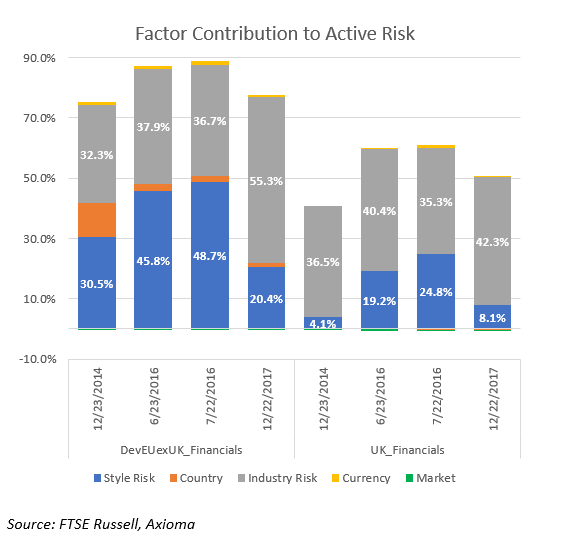

The decomposition of the change in risk revealed an increase in the Industry risk’s contribution to Financials in Europe and the UK, from the pre- to the post-vote era, with Style Risk’s contribution shrinking considerably at the same time. The largest proportion of Style risk on 22 July 2016, when active risk for both sectors was at its peak, came from Volatility, Value and Momentum in both regions. By the end of our analysis period, on 22 December 2017, Market Sensitivity and Value were the main risk contributors to Style risk, while Volatility reduced Style Risk, in both regions.

In conclusion, looking at the before and after picture for EU and UK Financials, we saw changes in exposures to most style factors. EU Financials and UK Financials continued to be Value sectors before and after the vote. UK Financials became much more exposed to Exchange Rate Sensitivity post-vote, remaining a high and ongoing source of risk that was not there before. This means investors in the UK Financials must now incorporate views on currency movements into their return forecast for the sector.

There seemed to be more commonalities at the style-factor level between UK Financials and EU Financials after the vote, with the same Style factors driving the post-vote positive returns (Value, Momentum, and Earnings Yield). Some differences between regions surfaced in the post-vote period as well. While Momentum was a positive contributor in both regions after the vote, the average exposure to the factor flipped sign from one region to the other: positive in Europe and negative in the UK.

In terms of risk, Industry risk rose, while Style risk shrunk, with the same two style factors (Value and Market Sensitivity) as the main contributors to Style risk in both regions, after the vote.

The bottom line is that political events can have a big impact on the risk and return of a sector. In the case of Financials after Brexit, the changes likely had a big impact on the active risk of UK and European portfolios.

Please see the full report on our website for more details.

[1] The UK Financials and EU Financials sector portfolios were constructed by pooling financial stocks from the FTSE 350 and FTSE Developed Europe ex-UK, respectively, and re-weighting the assets using each respective benchmark’s weights.

[2] Based on a daily factor-based attribution using Axioma’s medium-horizon fundamental Worldwide model for the 18 months before and after the Brexit vote.

[3] The analysis was performed in euro for both regions to eliminate the exchange rate impact and make them more comparable.