Earlier this year, we welcomed ESG data science leader, RepRisk, as a part of our growing sustainability ecosystem, which includes ESG-led partners such as Clarity AI, SDI AOP, ISS and Sustainalytics. We spoke with Jenny M. Nordby, Head of Partnerships and Third Party Distribution at RepRisk, to learn more about the partnership and the data they provide.

RepRisk

Why did you decide to work with Qontigo?

There are two main reasons: First, as a leading provider of innovative risk, analytics, and index solutions, Qontigo’s commitment to providing clients with cutting-edge technologies and solutions aligns perfectly with the way we identify ourselves as an ESG data science company with a clear use case to support companies to make better and more informed decisions. In fact, with over 200,000 companies covered in our database, we have the largest and most comprehensive database on ESG and business conduct risk.

Second, we have a shared commitment to providing clients with useful, actionable data. RepRisk’s mission is to drive positive change via the power of data – and that can only be done if the data is sound. We go to great lengths to ensure our data is actionable and timely for financial decision-making, and aim to partner with companies who do the same.

RepRisk has been in the ESG business for fifteen years, before it was truly headline news. What do you think accelerated the interest in ESG data?

We like to say we’ve been “doing ESG” since before it was cool – it started in 2006 with developing a list of 100 companies flagged as more ESG risky for our first client UBS, who wanted more information on companies’ ESG risk profile than what their existing due diligence and company disclosures could provide. Since then, we’ve grown our database to cover more than 200,000 companies and 50,000 infrastructure projects.

When the pandemic began, it was speculated that ESG might be deprioritized in the time of crisis and disruptions, but the opposite ended up being true. The “uncertainty” people kept alluding to gave rise to a wish to crisis-proof portfolios and have better insight into the true ESG risks of a company as measured by their ongoing performance and business conduct, supply chain exposure, etc., rather than stale backward-looking data and disclosures. Moreover, through focus on stakeholder capitalism, the market has recognized the power of transparency to achieve impact and change in company behavior.

What’s been made clear is that ESG is not just for fair-weather situations, quite the contrary. Much like a seatbelt, crises are when the necessity of ESG data is most evident – and when you want to be sure it’s working. Existing high risk business operations were suddenly illuminated by the pandemic. Unsafe working conditions and unfair treatment of migrant workers were revealed by coronavirus outbreaks in sweatshops, as was the case with Boohoo Group. As a seatbelt, ESG data provided investors with risk signals and allowed opportunities for divestment long before that 2.5 billion dollar crash.

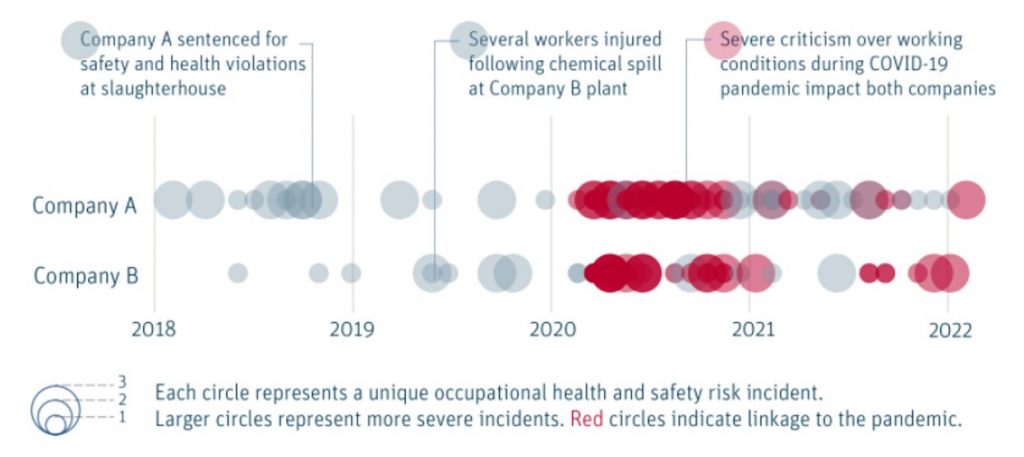

Example of the pandemic highlighting pre-existing risks

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >You don’t provide ESG ratings, but instead you ”systematically identify and assess material ESG risks”. Tell us a bit more about what that means and how you do it.

Our mission is to drive positive change via the power of data, which can be very powerful – so we want to make sure the data we produce is of the highest quality and generated with cutting edge technology.

We believe that the data industry has a responsibility to drive better decision-making for those allocating capital by providing timely and transparent data – allowing for risk detection and mitigation before a risk incident occurs, not after. Multi-dimensional analysis, as opposed to a single rating, and looking beyond self-reported company disclosures leads to a better, comprehensive assessment of material ESG risks – thus more positive outcomes for stakeholders.

In order to provide that kind of multi-dimensional analysis, we combine the best of both worlds: AI and advanced machine learning power the size, scale, and speed of its database; human intelligence delivers curated, relevant data.

Our AI algorithms screen more than 100,000 sources in 23 languages every day, and our analysts curate the results of the daily AI screening using a rigorous methodology – allowing for standardization of curation and results. They then annotate their findings and feed them back to the neural networks, training the algorithms and enhancing prediction quality.The result is the world’s largest and most comprehensive database on ESG risk.

ESG enables investors the flexibility to select investments based on their own objectives which is why we embrace an open architecture approach, working with many different ESG partners. What do you think is your sweet spot in the ESG data space?

Four main differentiators set RepRisk’s dataset apart.

First, our data is risk-focused. We look beyond just controversies, covering the full spectrum of ESG risks, from low-severity adverse incidents to criticism to scandals – and everything in between.

Second, we intentionally exclude company self-disclosures. Nowhere in our daily screening of 100,000 sources do we take into account what companies have said about themselves – as we believe self-disclosures can mask risk.

Third, our aforementioned use of AI, machine learning, and human analyst curation.

And fourth, our data is updated daily and has been generated point-in-time using a consistent methodology for 15 years – no back-engineering involved. That makes it ideal for quantitative analysis and back-testing.

Looking ahead, what are some recent and future developments you have in the works?

We optimize our dataset regularly to ensure that our clients can get as much utility as possible, so we’ve had quite a few developments recently and have even more in the pipeline.

In keeping with our mission to drive positive change via the power of data, we recently made our methodology public in a series of Jupyter Notebooks so that financial decision makers can configure custom ESG scores.

Similarly, in the past year we’ve released a number of different features that allow our clients to more easily comply with and navigate different ESG regulations – like SASB, SFDR, and the UK Modern Slavery Act to name a few – and voluntary ESG frameworks like the UN Sustainable Development Goals.

As for what’s next, we have two particularly exciting developments coming up this year. First, we will build on our existing country risk metric and develop a solution for daily monitoring of material country ESG risks across the globe and sovereign ESG integration. Second, we’ve just beta launched our ESG Spatial Analytics tool, which is already receiving quite a bit of demand and positive feedback. We think it’s a very positive next step in real, on the ground sustainability work. The tool shows a project’s proximity to environmentally sensitive sites – like UNESCO World Heritage sites or endangered species habitats – and links the projects to owner and operator companies.

For more information, contact partnerships@qontigo.com.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.