STOXX has launched an innovative index that allows a systematic investment in the best-performing mutual funds across various asset classes, bringing in a strictly rules-based alternative to active fund selection.

The iSTOXX® Top Citywire Fund Managers Index replicates a portfolio that invests in top-rated funds with the highest risk-adjusted returns in four global categories: equity, high yield, fixed income and mixed allocation. The index distributes the weight according to each category’s momentum, seeking to benefit from performance and flow trends at different points in the market cycle.

The index was designed together with Credit Suisse and Citywire and marks the first time that STOXX employs funds data in the construction of a product. Credit Suisse will issue structured and Delta One products tracking the index.

“With the iSTOXX Top Citywire Fund Managers Index, STOXX is moving into a whole new market where we aim to bring the benefits of indexing seen elsewhere,” said Roberto Lazzarotto, Global Head of Sales at STOXX’s parent Qontigo. “This unique and sophisticated project is the expression of our ability to integrate leading data providers in the manufacturing of innovative strategies for the benefit of the marketplace.”

Background in quantitative investment strategies

Aiming to offer clients exposure to outperforming investment managers in a neutral and cost-effective way, investment banks have for some time created baskets of mutual funds selected by means of passive, quantitative methodologies and rules-based decisions. The iSTOXX Top Citywire Fund Managers Index follows these same strategies but incorporates the independence and objectivity of an impartial portfolio administrator that helps banks strengthen the governance of their investment products.

“This initiative aims to help investors navigate the wide expanse of available mutual funds, fund managers and asset classes in the market,” said Florent Breemeersch from Credit Suisse. “Investors will also benefit from a dynamic universe of top-rated managers and a multi-asset investment approach.”

Historic performance

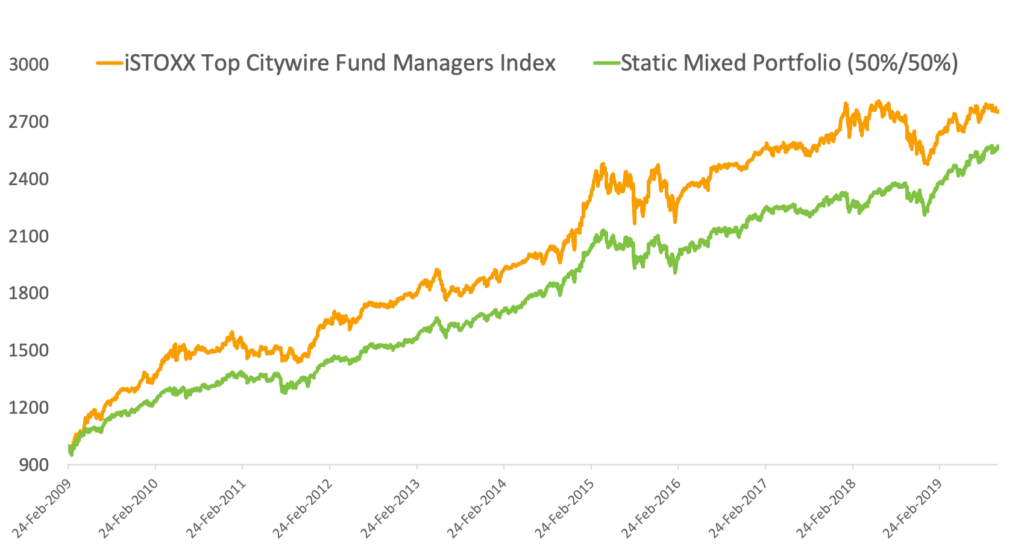

Data show that a combination of the best managers and specific asset allocation delivers alpha. The iSTOXX Top Citywire Fund Managers Index has beaten a static portfolio of 50% equities and 50% bonds since 2009 (Chart 1).

Chart 1

Fund selection and managers’ ratings

The starting universe for the iSTOXX Top Citywire Fund Managers Index is all UCITS-compliant funds rated at least AA by Citywire and that meet certain criteria such as a minimum size and pricing frequency.

It is important to note here that Citywire uniquely rates managers, not funds. This is intended to provide an accurate assessment of the person in charge of the strategy, rather than the fund itself, as fund managers can move about.

Citywire currently tracks more than 15,000 fund managers in 41 countries. In order to be rated, a fund manager will need to have beaten their benchmark over a three-year period. Fewer than 25% of managers tracked by Citywire achieve this, and they will either receive a Citywire+, A, AA, or the top AAA rating, according to their track record.

STOXX ensures that all selected funds meet replicability and investability principles, and monitors for any disruption to their normal trading that would exclude the fund from the index.

Every quarter the index is reviewed to incorporate, for each asset class, the mutual fund with the highest Sharpe ratio, such that it avoids volatile funds with one-off extreme up moves. The selected funds are then ranked in descending order for their momentum factor, assigning a bigger weight to the categories that have performed better. This allows the index, for example, to be tilted towards equities in a bull market.

The top-ranked asset class/fund gets a 50% weight in the index, with the remaining three funds accounting for, respectively, 35%, 10% and 5%.

As of launch, the index had its biggest allocation in Comgest Growth PLC-World (Global Equity), followed by investments in PIMCO GIS Global Bond Ex-US Fund (Global Fixed Income), Amundi Vie (Global Mixed Allocation) and BlueBay Global High Yield Bond Fund (Global High Yield), in the descending weight described earlier.

Control for fees and volatility

The iSTOXX Top Citywire Fund Managers Index includes a daily constant deduction equivalent to 0.5% per year. This so-called decrement allows issuers of products tracking the index to more transparently account for expenses and create more efficient structures.

STOXX is also launching the iSTOXX® Top Citywire Fund Managers Risk Control 8% Index, which replicates the performance of a risk-control overlay applied to the iSTOXX® Top Citywire Fund Managers NF Index that targets a volatility of 8%. In order to realize the targeted risk level, the index shifts between the benchmark and cash. The risk-control version adds an annual decrement of 2.5% to the iSTOXX Top Citywire Fund Managers NF Index.

An addition to the world of index-based investing

The iSTOXX Top Citywire Fund Managers Index breaks new ground in the growing realm of passive investing, opening up new possibilities for investors. With quality data sources and the right applications, even an elaborate selection and methodology process can be attained through a systematic approach that upholds transparency and functionality.