The STOXX® Thematic Indices family is expanding to incorporate another technology-based megatrend with a compelling growth profile.

The STOXX® Global Fintech Index tracks companies leading the financial technology revolution, which is transforming the structure and operations of financial services. Fintech is vastly remodeling the transactional and profit landscape for banks, asset managers, brokers, insurers, trading venues and retail.

For example, the megatrend spans the technologies behind the trading of securities, the management of payment, credit and transfer processes, the operation of electronic devices and scanners to complete purchases, and the design of contracts software for the insurance and capital markets industries.

The fintech revolution has been fueled by the rapid penetration and evolution of the Internet, changing consumer expectations, globalization and favorable regulation. All of these have enabled growing and disruptive practices such as online payments, robo advisors and peer-to-peer insurance.

The value of transactions through fintech ventures will climb 24% to $4.5 trillion by the end of 2018 from a year earlier, led by digital payments, according to a recent study.1 Transaction value is expected to almost double in the next four years.

The growth prospects for firms managing those volumes have attracted the attention of both venture capital and established corporate leaders such as banks and insurers. Total global investment in fintech ventures grew at a compound annual rate of 47% between 2010 and 2017, reaching $98 billion in total in the period, according to Accenture.2

Targeting fintech’s winners with precision

The STOXX Global Fintech Index, introduced today, follows the same revenue-based selection methodology applied by other STOXX Thematic Indices. Based on FactSet’s Revere industry hierarchy, the world’s most comprehensive business classification, companies with at least 50% of their sales stemming in aggregate from more than 30 fintech-related sectors are selected for the index.

These sectors are strongly associated with fintech and stand to benefit the most from its increasing prevalence. They include blockchain technology, commodities trading services, payment processing software, retail brokerages, financial and compliance software, money transfer services and trade execution services, to name only a few.

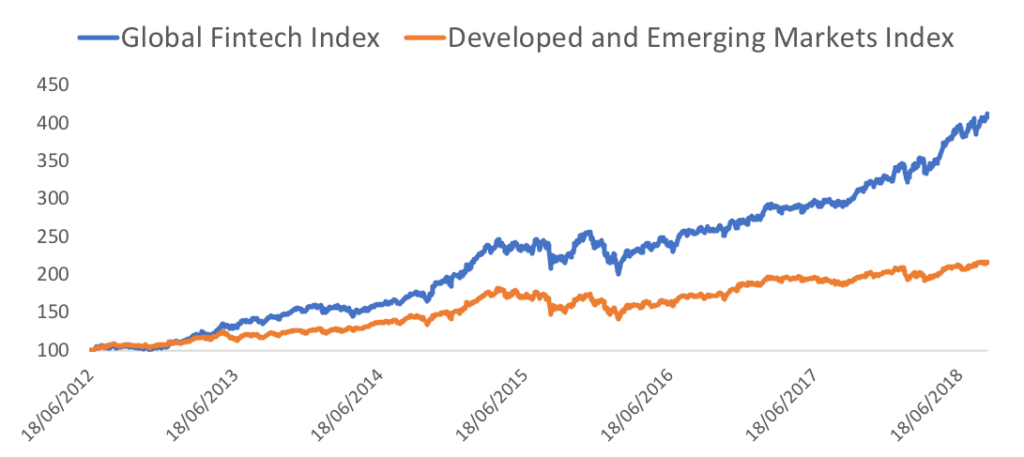

Chart 1 shows the performance of the STOXX Global Fintech Index against its benchmark, the STOXX® Developed and Emerging Markets Total Market Index, since data begins.

Chart 1

Weightings are defined by each stock’s fintech-related sector exposure multiplied by their market capitalization. The granular sector segmentation used in the index composition is constantly updated, making it possible to incorporate new segments as technologies evolve.

A fund tracking the index will be listed by Sumitomo Mitsui Asset Management (SMAM) in coming weeks.

A suite of indices for the world of tomorrow

The STOXX Thematic Indices allow investors to target the most disruptive megatrends of the modern world. They include gauges covering blockchain, artificial intelligence (AI), ageing population, automation and robotics, breakthrough healthcare and digitalization.

A recently launched index combines the themes of biotechnology, robotics, AI and nanotechnology in one strategy.

The indices are designed to offer accurate exposure to the companies reaping the highest benefit and economic growth potential from change. All offerings in the thematic suite are constructed bearing replicability and transparency in mind.

The thematic family will grow in coming months to incorporate more powerful drivers shaping our quickly changing world.

Featured indices

- STOXX® Global Fintech Index

- STOXX® Developed and Emerging Markets Total Market Index

- iSTOXX® FactSet Thematic Indices

1Statista, ‘Digital Market Outlook – Market Report,’ 2018.

2Accenture press release, Feb. 28, 2018.