Funds that align with Article 9 of the European Union (EU)’s Sustainable Finance Disclosure Regulation (SFDR) attracted net inflows of EUR 8.6 billion (USD 9 billion) in the first quarter of 2022, according to a Morningstar analysis released on May 5,1 even as share prices plummeted.

During the same period, SFDR Art. 8 funds, however, registered net outflows of EUR 3.3 billion, mostly due to sales of bond funds, the data show. One year after the introduction of the European legislation, the two categories combined increased their share of total European fund assets to 45.6%, from 42.4% at the end of 2021, the data show. Initial SFDR requirements applied from March 10, 2021.

The SFDR is one of three regulatory pillars in the EU’s Action Plan on sustainable finance, which aims to reorient capital towards more sustainable businesses and has been a driving force in reshaping financial market behavior across the globe.

Art. 9 products are those that specifically seek to achieve an environmental (E) or social (S) objective while doing no significant harm to any other E or S objective and ensuring that investee companies follow good governance practices. Art. 8 funds more generally “promote” E or S characteristics — to use the European Commission’s definition. Because Art. 9 products are more ambitious in their sustainability imprint, they carry more demanding disclosure requirements.

Overall, Art. 8 and 9 funds grew their assets by 8.5% in the quarter to EUR 4.2 trillion, the report showed. There were 6,862 funds classified as Art. 8 and 898 as Art. 9 as of the end of March.

Flows into the most sustainability-focused funds also materialized despite strong outperformance from energy stocks, an industry that may be under-represented in many ‘green’ funds. The STOXX® Europe 600 Energy climbed 13% in the first quarter amid a rally in crude prices, compared with a 7.9% slump for the benchmark STOXX® Europe 600.

Long-term trend

“The move to sustainability-focused strategies is a structural trend among asset managers that will continue independent of the market and cycle backgrounds,” said Markus Zellmann, Senior Director for Legal at Qontigo. “This is true of new investments but also of existing funds that are implementing new responsible policies. In the EU, this trend has gained additional strong momentum through the integration of the clients’ sustainability preferences into the MiFID suitability assessment.”

The suitability assessment within the MiFID framework is a requirement for providers of investment advice and portfolio management to offer suitable personal recommendations to their clients or make appropriate investment decisions on their behalf. The obligation scope was widened by the EU’s Action Plan, which requires those same firms to ask questions to identify clients’ individual sustainability preferences and to be able to recommend products accordingly.

Many European asset managers have switched the strategy of established funds to make them compliant with Arts. 8 and 9 and meet the rising demand for responsible investment strategies. Amundi and Lyxor have replaced the underlying index of two broad-market pan-European ETFs with the STOXX® Europe 600 ESG Broad Market, which removes laggard companies in terms of ESG criteria.

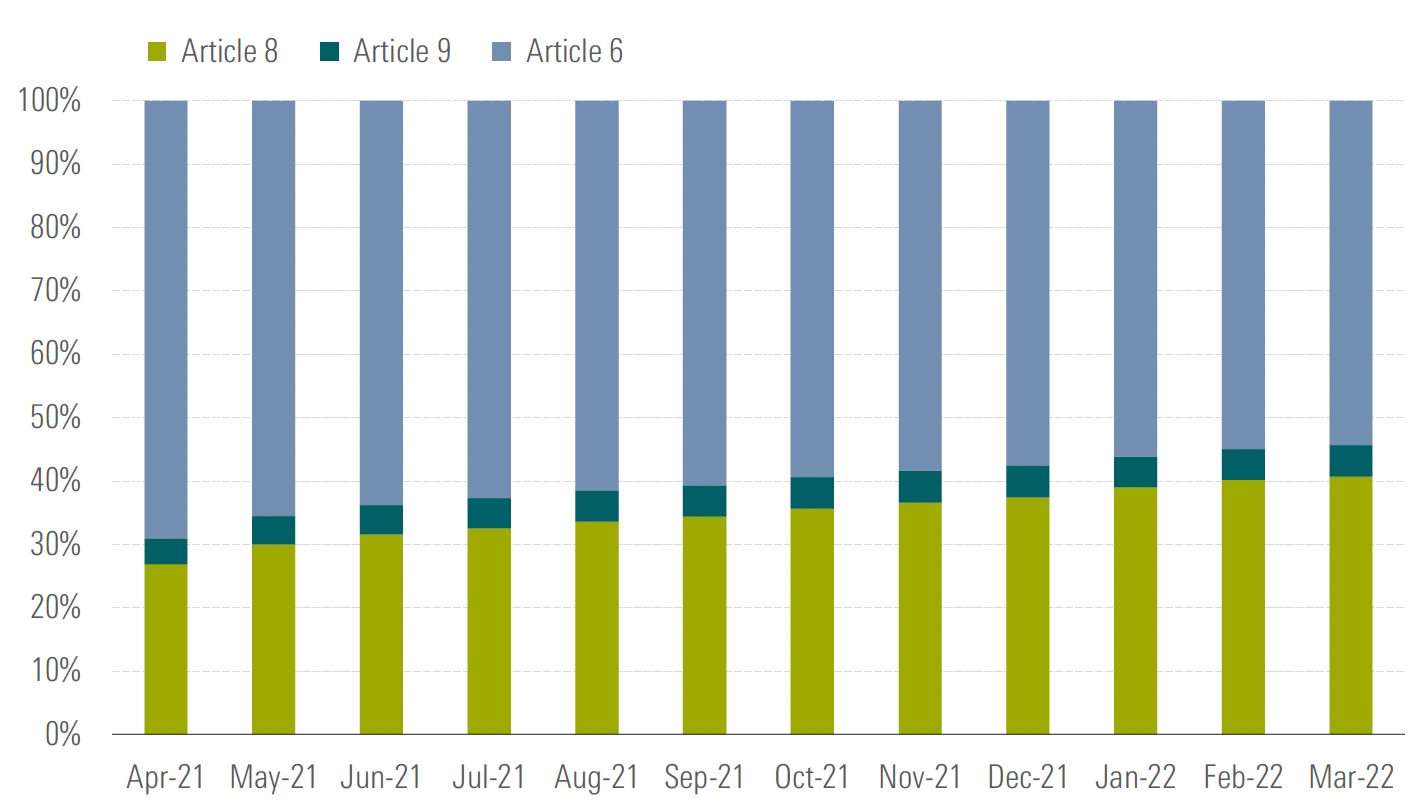

Since SFDR kicked in, assets in Art. 8 and 9 funds have increased as a share of all European fund assets (Figure 1). The remaining funds are aligned with SFDR Art. 6, a regulatory baseline that doesn’t require ESG integration. Art. 6 fund assets have shrunk in relative terms since April 2021.

Figure 1: Monthly assets breakdown by SFDR classification in percentage terms

1 Morningstar, ‘SFDR Article 8 and Article 9 Funds: Q1 2022 in Review,’ May 5, 2022.