A new and intriguing offshoot of the active vs passive debate is emerging. As factor index investing continues to expand the choices available to investors, is it still a truly passive strategy, or is it active?

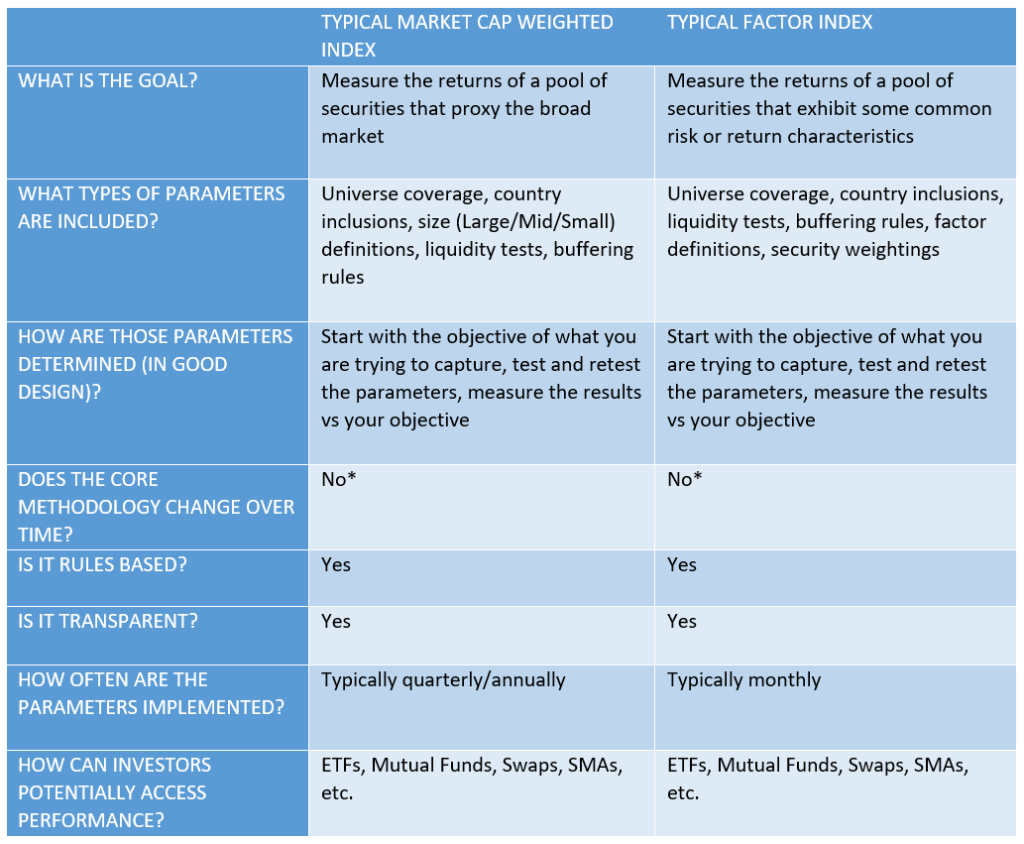

Conventional wisdom says that smart beta strategies are blurring the lines between passive and active. A fund that seeks to replicate the performance of a market cap weighted index would hardly be considered active. But how is that different from a fund that tracks a factor index (such as the ones Axioma helps build and maintain)? Let’s take a closer look.

This is not to underestimate some of the unique challenges of factor indexing, e.g. concerns regarding backtesting bias and unintended factor exposures (which Axioma specializes in helping resolve). The point is, whether you are cooking from a simple recipe or a complex one, it’s still very different from hiring a chef.

Let’s take a look at some the arguments that a factor index is active. Most of these arguments tend to be variations one or more of the following four points: a) it is just a strategy used by portfolio managers, so it is active in ‘disguise’; b) someone designed it with a view towards outperformance; c) it’s not the market; and d) they are black boxes.

a) Active in disguise? A critical differentiator of an actively managed portfolio is ongoing discretion. While decisions need to be taken in designing a factor index, this is the case with any investible index. Once an index is live, however, the discretion levels between an index and an active portfolio, even a systematically driven one, are dramatically different.

b) Designed for outperformance? A factor index seeks to capture the performance of a compensated risk, arising from a behavioral or other market phenomenon. A single factor can either over or underperform the market (often longer than people think) or behave differently in different market environments. While, of course, no one has ever published a bad backtest, good factor strategies can seek purity vs just performance.

c) Not the market? Investors are constantly making ‘active’ decisions on the markets they track – there is no inherent magic in a 60/40 allocation, U.S. large caps or bonds with a specific credit rating. If tracking a factor index is an active strategy, is tracking a small cap index? If you sit in the U.S., is tracking a European index?

d) A black box? A well-designed index goes hand in hand with a well written rulebook, which spells out exactly how future constituents will be determined. It is easy, however, to conflate ease of replication with transparency. While there are certainly advantages to being able to rebuild an index on a single Excel worksheet, there are tradeoffs to make with eschewing tools such as an optimizer, which can help meet specific goals and constraints. In each case, a user equipped with the right data and tools should be able to replicate an index.

So where does this leave us? Andrew Lo’s definition of an index (transparent, investable, rules-based) is a strong one. I would argue any vehicle that tracks such an index is a passive strategy. An active strategy requires meaningful ongoing discretion, either within a portfolio or in determining an allocation across multiple individual strategies.

Wherever one falls on this debate, as we have said in the past, the growth of factor investing, and the unbundling of alpha and beta, has done a great service to investors. Market beta is ‘cheap,’ because it can be easily captured. Factor indices help extend this concept to other betas, that can further explain the returns of securities and capture certain risk premiums in the market. But alpha is still alpha, and that’s still best left to true active management.