The countdown has begun. The Securities and Exchange Commission (SEC) adopted the 18f-4 Derivatives Rule in October last year, which means most SEC-registered companies will now have to make sure they don’t fall foul of the rule by August 19, 2022. While it seems a long time away, it’ll be here before you know it. To that end, we’ve put together a few questions you should ask your existing – or potential – risk solutions provider.

1. What is your approach when calculating VaR, running VaR backtests and stress testing?

Flexibility and choice are key. You want to be able to run various VaR methodologies like historical and Monte Carlo simulations all on one system. The system should be able to perform absolute VaR, relative VaR vs. benchmark, relative VaR vs. portfolio ex- derivatives, and relative VaR vs. a client customized benchmark calculations at any level, for example, fund, position, sector or any client specified tag. A VaR statistic that utilizes a weighting (be it Exponentially Weighted Moving Average or a decay) is typically more responsive to changing market conditions performs better in backtests vs. a flat weighting especially in periods of high volatility. Having a provider who can work with you to set up the appropriate risk settings helps. On the stress tests front, the system should allow you to run your portfolio through events as well as correlated, macroeconomic stress tests.

2. How broad is your derivatives coverage and how do you capture the risk of the derivatives?

Clearly, you need to ensure that your active derivative positions in your portfolios are actually handled by the risk management system. Given the non-linearity of most derivatives, your system needs to be able to handle both full-repricing in both VaR and stress testing to get accurate results.

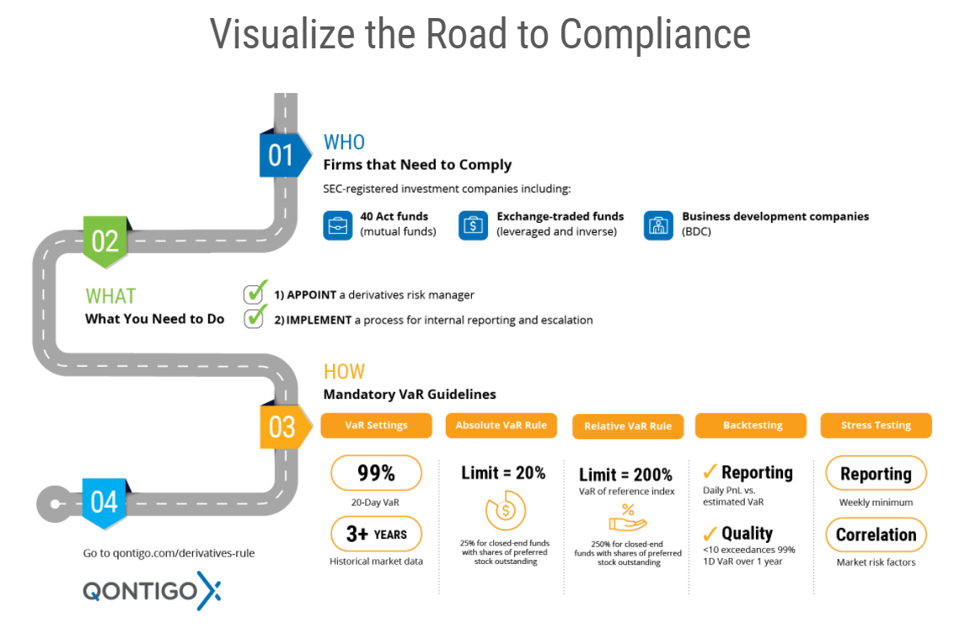

INFOGRAPHIC:

What, where, when, why, how? The SEC Derivatives Rule explained

3. How will you source the holdings of the fund, including the terms of the OTC derivatives?

Here, you don’t want a one size fits all solution, but a provider willing to help you operationally so you needn’t worry about how your data gets into your risk system. For example, it could be from your own portfolio management system, your fund custodian, your provider’s internal holding database – or a combination of any of those. This way you can focus your efforts on what’s important: the reports and the analytics.

4. Do you have the historical market data, and the terms and conditions data for listed securities?

The answer to this needs to be yes. If you’re thinking about longer-term and scalability, you should be reviewing providers that have a process that covers new companies’ listings and new securities issuance and have at least 3 years of market data.

5. What type of tools do you provide for deep-dive risk analysis and pre-trade analysis?

As far as technology goes, you should opt for an intuitive web-based user interface combined with a risk management provider that has an API-first philosophy. This will help you create efficiencies by allowing you to easily plug-and-play into various pre-trade, at-trade or post-trade tools.

For deep-dive risk analysis, being able to decompose your risk not only at the fund or tag level but also by factors is an added bonus.

Before rebalancing your portfolio or hedging, you want to determine what the impact will be – how effective it will be, so a flexible what-if functionality embedded into this system will help in your portfolio research, rebalance and hedging strategy.

Have questions? Learn more about our risk management system, Axioma RiskTM and the turnkey reporting package we have to help you comply with the SEC derivatives rule. For a no obligation consultation, visit our dedicated resource center.