The market volatility and macroeconomic disruptions of 2022 have raised a challenge to the thematic investing boom, but also offer a chance to reappraise the benefits of the investment approach.

As markets have tumbled this year amid interest rate concerns and Russia’s invasion of Ukraine, some thematic indices have managed to outperform, and the segment overall is still attracting money inflows.

In this market environment, it is important to remember that thematic investing is for the long term. Moreover, investing along themes appears to be more fitting for our era of technological advances and macro shocks than is implementing the traditional sector-focused approach.

Before April’s across-the-board selling sent all equities plunging in tandem, some thematic indices were outperforming and even posting positive returns in the wake of the invasion of Ukraine on February 24. These included the STOXX® Global Broad Infrastructure, STOXX® Global Digital Security, STOXX® Global Smart Cities and STOXX® Global Smart City Infrastructure indices.

What those indices reflect are trends that have gained precedence this year: investments in renewable energy sources, protection against cyber-attacks, and a scarcity of semiconductors due to disruptions in the global supply chain. Some themes have also attracted flows as a hedge against inflation, which has accelerated as a result of spiking commodity prices. Such is the case with infrastructure.

And that’s just this year. Big macro drivers from recent years include lockdowns, the move to remote working and the race to net-zero, all of which have driven demand for investable themes.

These trends would be harder to invest in with traditional sector portfolios. Take, for example, Technology. In it co-exist chipmakers that have profited from supply shortages, with manufacturers further down the value chain that have fallen on concern that skyrocketing prices for those same components will squeeze their margins. Economic sectors are too broad and diverse to accurately capture the peculiarities of a world in flux.

A theme-based approach, on the contrary, provides a more targeted investment tactic that is designed to tap the beneficiaries of specific long-term trends. A winning theme can generate alpha from its sector allocation, as we detailed in a whitepaper1 published in March.

Years of growth

Thematic indices have garnered much interest as a way to harness powerful and structural megatrends transforming our modern economies and societies. Over the two years through 2021, assets invested in thematic funds worldwide nearly tripled to USD 806 billion, according to Morningstar.2 In 2021 alone, global net inflows into the funds totaled USD 188 billion. The funds now represent 2.7% of all assets under management in equity funds globally, up from 0.8% ten years ago.

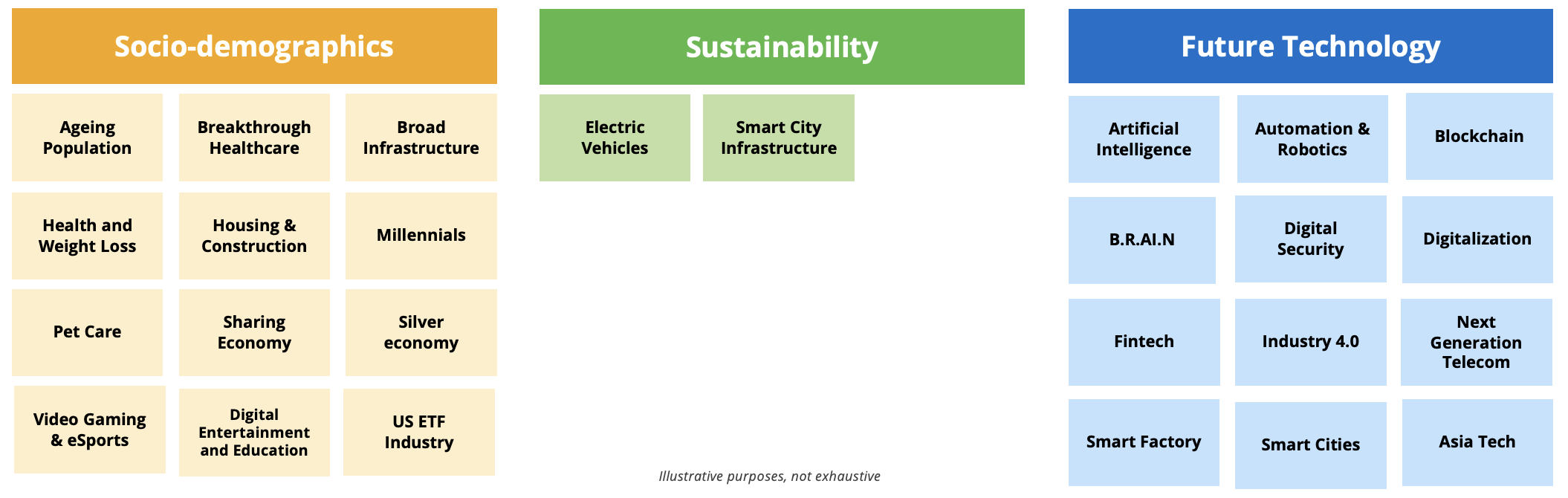

Qontigo’s STOXX® Thematics suite includes over two dozen indices targeting themes such as ageing population, digitalization, smart cities, automation and robotics, and video gaming & eSports (Figure 1).

Figure 1: Qontigo’s STOXX thematic indices

Breadth of options

While flows have slowed down this year, thematic investing has still lured new capital despite the negative market backdrop. Through April, ETFs that invest in themes have received net inflows of USD 38.6 billion in 2022.3 The STOXX Global 1800 Index fell 13.2% in the same period.

As Rob Powell, Head of Thematic & Sector Product Strategy at BlackRock, explained at the recent Qontigo Investment Intelligence Summit, while investors have sold the more growth-style themes, such as technological breakthrough, they have added to funds tracking themes such as climate change. In Rob’s words, the industry has shown itself to be more resilient than some people would have imagined.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >A different investment profile

Thematic investing is forward-looking and daring, it relies on a predictive assessment of future growth as opposed to past reports. It provides diversification from the traditional sector- and country-based portfolio, and extends its duration and time horizon by investing in trends that outpace the annual, or even quarterly, earnings calendar that dominates equity markets. As such, thematic funds are typically less dependent on the cyclicality of the global economy.

Multi-year (or -decade) trends such as urbanization in developing nations, the digitalization of entertainment and education, or the automation of factories will not falter due to temporary market snags.

In the short term, economic swings will alter investors’ risk appetite. If markets regain some stability in coming weeks and share prices start reflecting again more fundamental drivers, thematic indices should recover their standing. Meanwhile, these testing times of financial and economic volatility should be used to reappraise the advantages of the investment strategy.

* Christoph Schon is Senior Principal at Qontigo’s Applied Research team.

1 Schon, C., ‘Thematic investing in the current climate – A more focused approach to sustainable and future-proof investing,’ Qontigo, March 2022.

2 Morningstar, ‘Global Thematic Funds Landscape Report,’ March 24, 2022.

3 Data from ETFGI, covering all funds worldwide.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.