- Treasury yields climb to 14-month highs over fiscal funding concerns

- Both the dollar and share prices climb amid rising risk appetites

- Portfolio risk falls, as FX losses offset equity gains

Treasury yields climb to 14-month highs over fiscal funding concerns

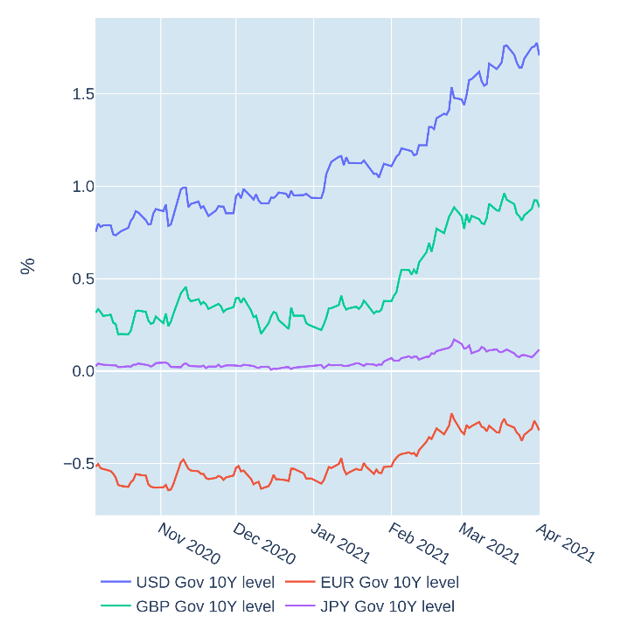

US Treasury yields rose to their highest levels in more than 14 months in the short week ending April 1, 2021, driven by rising concerns over funding of the upcoming $1.9bn fiscal stimulus package. The 10-year benchmark rate surpassed 1.70% for the first time since January 2020, taking the total increase over the first quarter of 2021 to more than 80 basis points. That said, yields eased somewhat on Thursday, after weekly US jobless claims numbers revealed a bigger-than-expected uptick. The accompanying rise in bond prices—which move in the opposite direction to yields—reflected the view that the Federal Reserve will be less likely to tighten monetary conditions, if unemployment remains high.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 1, 2021) for further details.

Both the dollar and share prices climb amid rising risk appetites

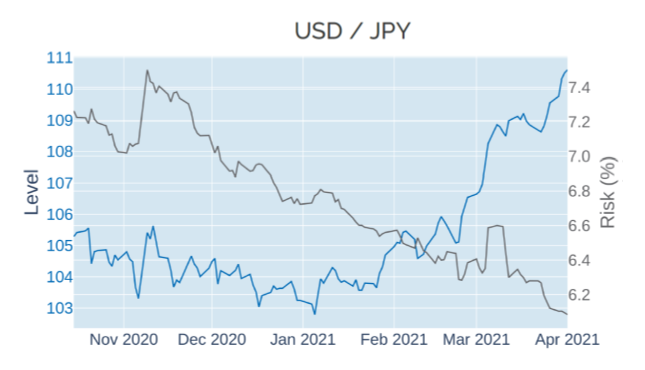

The Dollar Index—a measure of the USD’s value against a basket of foreign currencies—broke above 93 for the first time since mid-November in the week ending April 1, 2021, as the STOXX® USA 900 benchmark index climbed to an all-time high. It was the second week in a row that the two market indicators rose together, after having moved in opposite directions for most of the preceding 12 months. The recent rebound of the greenback, alongside rising share prices, could indicate a reversal of its role from global safe haven at the height of the COVID crisis back to barometer for the state and prospects of the US economy. This notion was also underpinned by the fact that the dollar recorded a year-to-date gain of around 7% against the Japanese yen—the biggest versus any developed currency—after having traded mostly flat vis-à-vis its east Asian rival for most of the previous quarter.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 1, 2021) for further details.

Portfolio risk falls, as FX losses offset equity gains

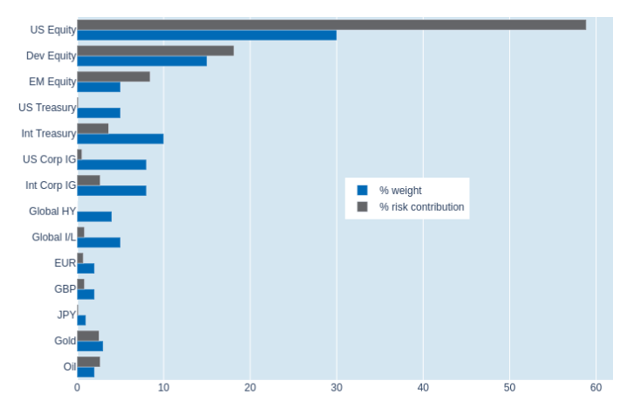

Short-term risk in Qontigo’s global multi-asset class model portfolio fell further to 7.1% as of Thursday, April 1, 2021, compared with 7.8% the week before. Most of the decline was due to the recent countermovement of share prices and foreign-exchange rates against the US dollar, which meant that local gains in non-US equities were offset by a simultaneous weakening of their respective currencies. As a consequence, the largest part of total portfolio risk came from US stocks, whose share of total portfolio risk was nearly twice their market-value weight. The percentage risk contribution of other developed equities, in contrast, was only marginally more than their monetary share (18% versus 15%). Last week’s decline in bond prices over fiscal spending concerns also helped reduce overall portfolio volatility, although stock and bond prices remained mostly uncoupled, with US Treasuries and corporate bonds neither adding to nor subtracting from total predicted risk.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 1, 2021) for further details.