- Stocks and bonds fall together over tighter monetary-policy expectations

- Higher rates and global growth concerns boost the dollar

- Portfolio risk drops further, as equity volatility continues to decline

Stocks and bonds fall together over tighter monetary-policy expectations

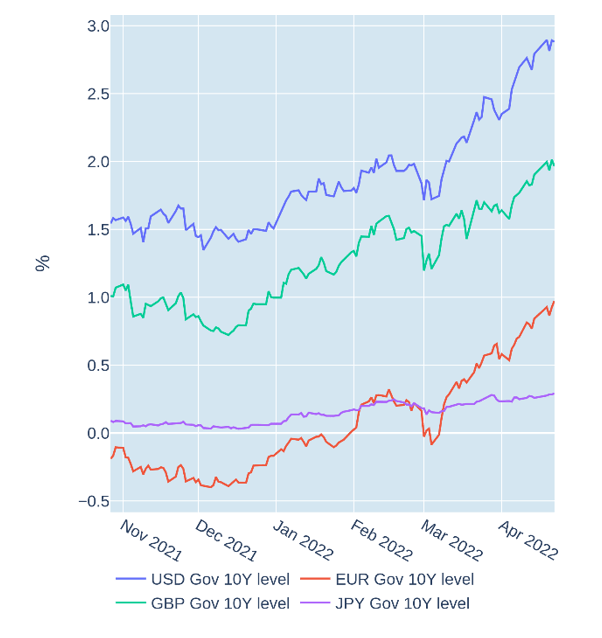

Global stocks and bonds sold off in unison in the week ending April 22, 2022, as investors prepared for yet tighter monetary conditions. Several Federal Reserve officials indicated that the central bank could raise rates even more aggressively than previously anticipated, with at least two back-to-back hikes of 50 basis point each expected at the forthcoming FOMC meetings. St Louis Fed President James Bullard even hinted at a possible “jumbo” increase of 0.75% at some point this year, while Chair Jay Powell noted that it may be appropriate “to be moving a little more quickly” and that 50 basis points were “on the table” for May.

The sentiment was echoed by members of the European Central Bank’s governing council, who hinted at possible a rate rise—the first one since 2011—as soon as July, with short-term interest-rate futures markets now pricing in a positive deposit rate (currently at -0.5%) by the end of the year.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 22, 2022) for further details.

Higher rates and global growth concerns boost the dollar

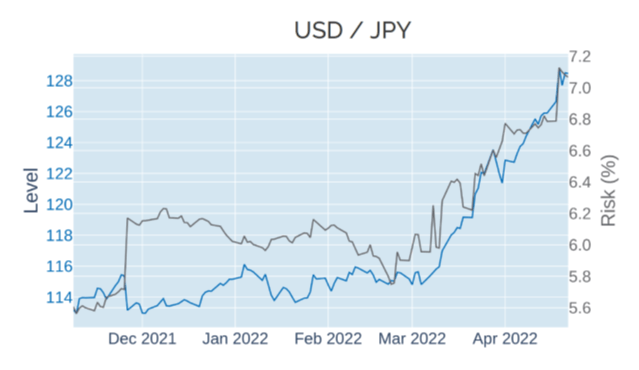

The Dollar Index—a measure of the USD’s value against a basket of major trading partners—soared to its highest level since March 24, 2020, boosted by a combination of higher interest-rate expectations and growing concerns about the impact of the Ukraine war on global economic growth. The International Monetary Fund cut its 2022 growth forecast for the world economy to 3.6%—down 0.8% compared with its January projection—with European countries affected disproportionally relative to the US, because of their proximity to the conflict and their greater reliance on Russian oil and gas. Germany is expected to be hit particularly hard, with the lowest expected growth rate of all G7 countries of just 2.1% (down 1.7% from January).

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 22, 2022) for further details.

Portfolio risk drops further, as equity volatility continues to decline

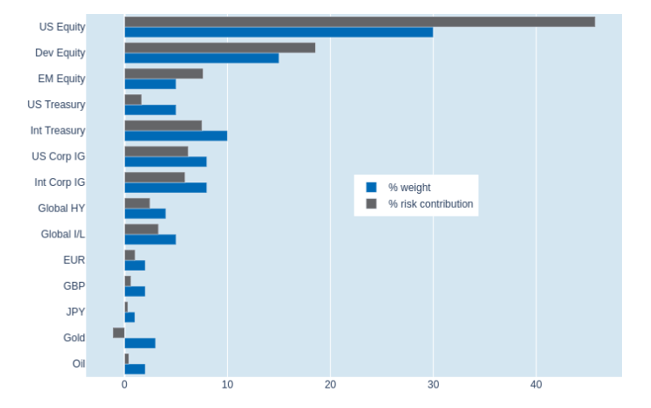

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio plummeted another 1.6 percentage points to 9.7% as of Friday, April 22, 2022, driven once more by a further drop in share-price volatility. The change was most notable for non-US developed equities, which saw their share of overall portfolio risk fall by 1.3% to 18.6%, due to an additional decline in exchange-rate fluctuations against the US dollar. Cross-asset correlations, on the other hand, remained stable once again, so that the risk contributions of most other security types were largely unchanged. Gold seemed to offer the greatest diversification benefit, due to its inverse interaction with both share prices and FX returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 22, 2022) for further details.