- Sovereign yields rocked by geopolitical concerns and monetary-policy expectations

- Dollar soars over widening rates gap

- Soaring FX and equity volatilities boost portfolio risk

Sovereign yields rocked by geopolitical concerns and monetary-policy expectations

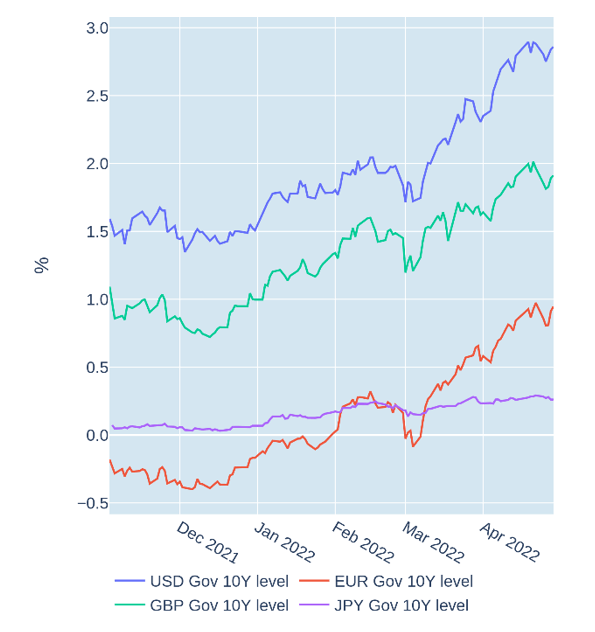

Global government bonds see-sawed in the week ending April 29, 2022, rocked by the opposing forces of geopolitical and economic-growth concerns on one side and the anticipated impact of tighter monetary policy on the other. Long-term yields dropped between 13 and 16 basis points on both sides of the Atlantic in the first two days of the week, as worries about renewed lockdowns in major Chinese cities outweighed any relief that market participants may have felt over Emmanuel Macron’s victory in the second round of the French presidential election on the weekend. News that Russia had halted gas exports for Poland and Bulgaria on Tuesday put further downward pressure on share prices and interest rates alike. That said, the initial declines in sovereign yields were mostly offset in the second half of the week, when the focus once more shifted to the upcoming meetings of the Federal Reserve and Bank of England, both of which are expected to announce a further tightening in monetary conditions.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 29, 2022) for further details.

Dollar soars over widening rates gap

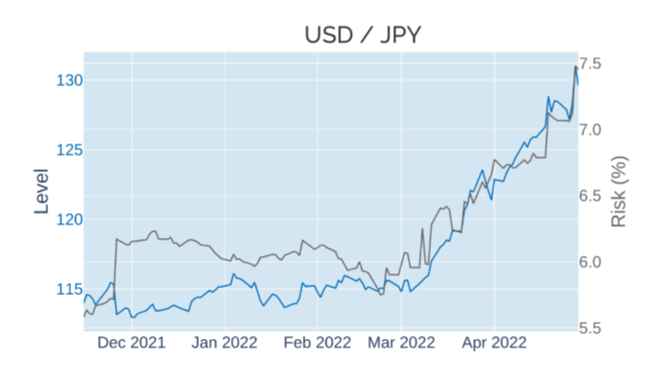

The Dollar Index—a measure of the USD’s value against a basket of major trading partners—closed at its highest level in two decades on Thursday, April 28, 2022, as traders expected rises in US interest rates to outstrip those in most other developed economies. Short-term interest-rate futures now imply a federal funds target corridor of at least 3.25-3.50% by the middle of next year, compared with an anticipated peak of 2.5% in the Bank of England’s base rate and an ECB deposit rate of 1.75%. The Bank of Japan, meanwhile, reiterated is commitment to its zero-yield target, sending the yen to its lowest level against the greenback since April 2002. The dollar appreciation was fairly homogenous against all other G10 currencies, raising predicted short-horizon volatilities for the euro, pound, and yen to around 7.5%.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 29, 2022) for further details.

Soaring FX and equity volatilities boost portfolio risk

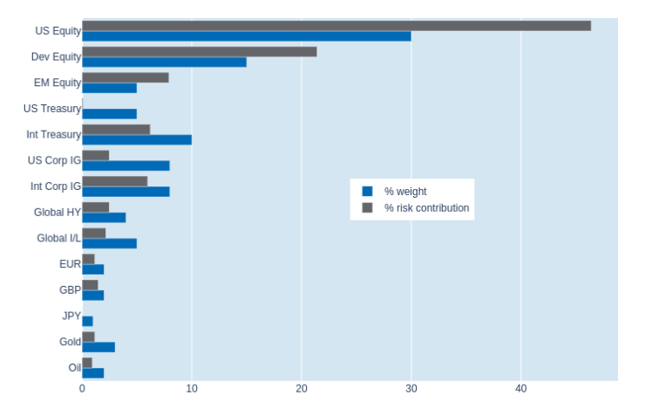

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio soared more than 3 percentage points to 12.9% as of Friday, April 29, 2022, boosted by a combination of stronger share-price and FX-rate fluctuations. The impact was, therefore, felt most by non-US developed equities, which saw their share of overall volatility surge from18.6% to 21.4%, as local stock-market losses were exacerbated by declines in exchange rates against the US dollar. High-quality fixed income assets, in contrast, benefitted from a renewed countermovement of stock and bond prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 29, 2022) for further details.