- Hawkish Fed comments lift Treasury yields to 3-year highs

- Dollar appreciates as traders up interest-rate expectations

- US stock and bond sell-off negates lower equity volatility

Hawkish Fed comments lift Treasury yields to 3-year highs

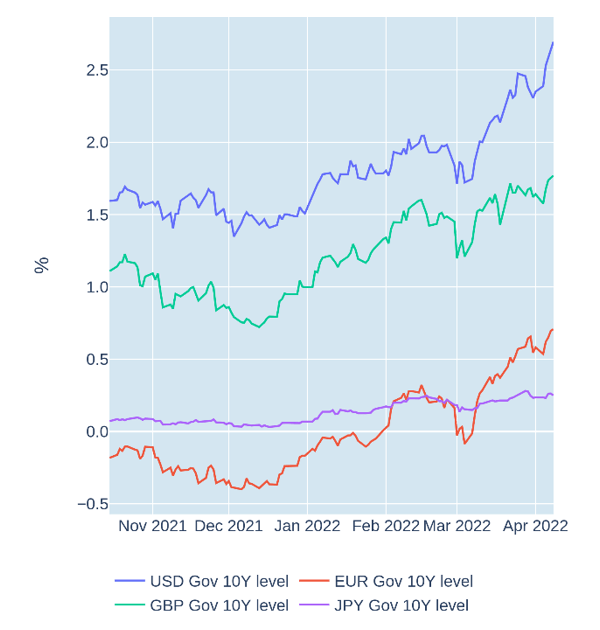

Long-term US Treasury yields climbed to their highest levels since March 2019 in the week ending April 8, 2022, following a flurry of hawkish signals from Federal Reserve officials. Governor Lael Brainard hinted in a speech on Tuesday that the Federal Open Market Committee (FOMC) “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” In response, the 10-year benchmark rate soared 14 basis points. It continued to rise for the remainder of the week—taking the total increase to 0.34%—as the sentiment was echoed by the March FOMC meeting minutes released on Wednesday and by comments from San Francisco Fed President Mary Daly on Friday.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 8, 2022) for further details.

Dollar appreciates as traders up interest-rate expectations

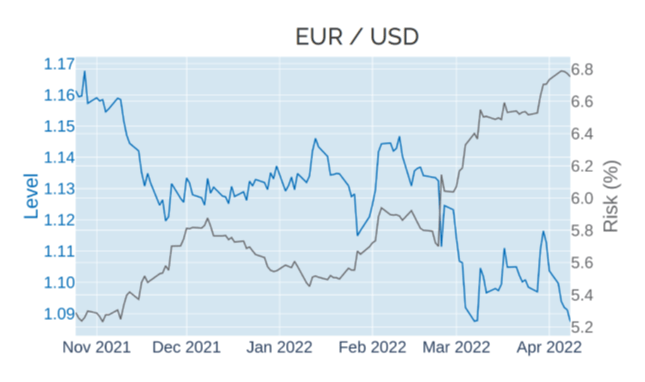

The US dollar gained 1.2% against a basket of foreign currencies in the week ending April 8, 2022, as traders raised the implied probability of a 50-basis point rate hike at the next FOMC meeting in May from 60% to 70%. Higher interest rates and bond yields tend to make a currency more attractive to foreign investors. Accordingly, the Dollar Index—a gauge of the USD’s value relative to its major trading partners—climbed to its highest value since May 2020, when liquidity concerns at the onset of the COVID pandemic had led to a global flight to safety. The euro was among the biggest losers, depreciating 1.5% against its American rival, which reflects the currency bloc’s closer proximity to the conflict in Ukraine.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated April 8, 2022) for further details.

US stock and bond sell-off negates lower equity volatility

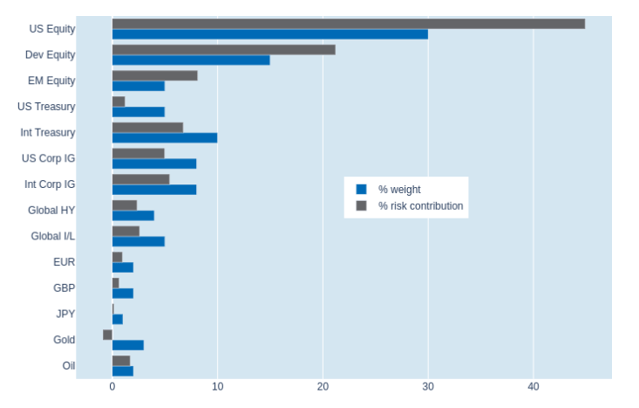

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio fell marginally from 12.6% to 12.3% as of Friday, April 8, 2022, as the benefits from lower equity volatility were mostly canceled out by the simultaneous sell-off in US stocks and bonds. The former was most notable in the US equity bucket, which saw its share of overall portfolio risk drop by almost 7 percentage points to 44.9%. Sovereign and investment-grade corporate bonds, meanwhile, recorded the biggest increases in their percentage risk contributions, whereas the effect was much less pronounced for high-yield debt, due to a near-zero correlation of risk-free interest rates and credit spreads.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 8, 2022) for further details.