- Treasury yields hold steady, as Fed reassures markets

- High-yield bonds outperform, as share prices rise

- Decreased cross-asset diversification offsets lower equity risk

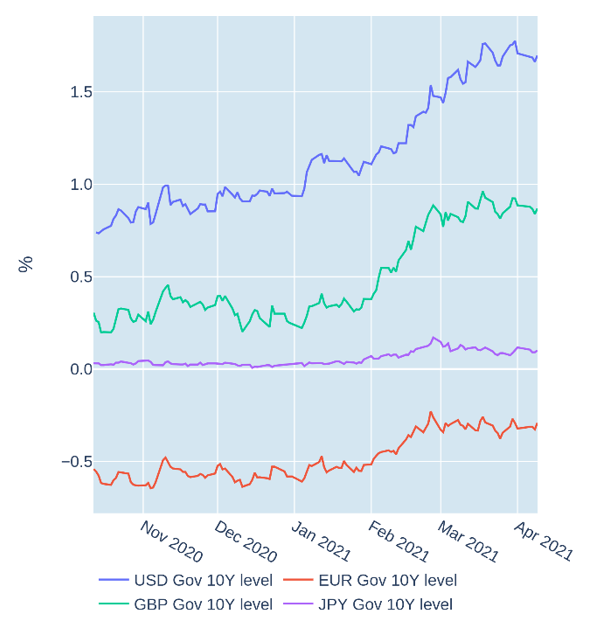

Treasury yields hold steady, as Fed reassures markets

US Treasury yields remained stable in the week ending April 9, 2021, despite a further rise in inflation expectations and another surge in global share prices. The minutes from the latest Federal Open Market Committee meeting in March, released on Wednesday, revealed that rate setters considered inflation risks as “broadly balanced” and that asset purchases would continue at their current pace “until substantial further progress toward the committee’s maximum-employment and price-stability goals would be realised.”

Italy, meanwhile, saw its risk premium over German Bunds increase by 8 basis points to 1.04%, as Prime Minister Mario Draghi brought forward plans to borrow another €40bn to finance additional actions to combat the pandemic.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated April 9, 2021) for further details.

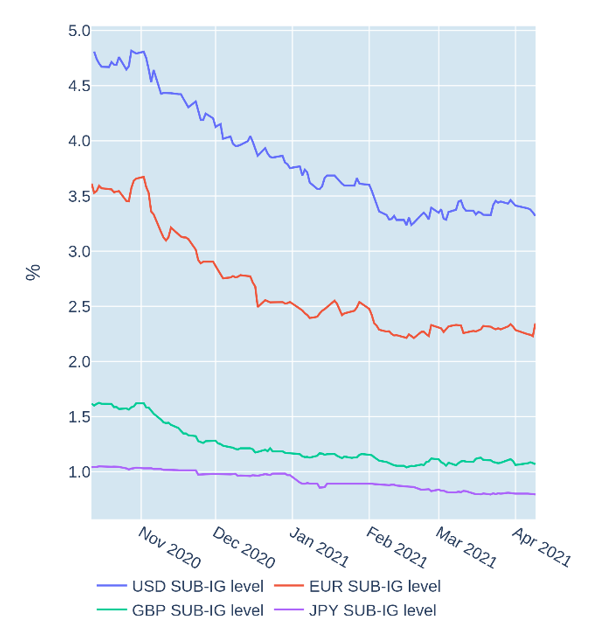

High-yield bonds outperform, as share prices rise

High-yield US corporate bonds outperformed their higher-rated peers in the week ending April 9, 2021, as share prices continued to climb. The average option-adjusted spread of USD-denominated securities with a sub-investment grade rating tightened by around 10 basis points, taking the total year-to-date decline to over 40 basis points. The risk premia on higher quality securities, in contrast, remained around the same levels as in the previous week and only marginally lower than at the start of the year. This meant that the prices of investment-grade bonds were mostly driven by (rising) sovereign yields. For example, the price return (excluding interest) of the ICE BofA US High Yield Index (C0A0) is down 4.8% for the year. The corresponding series for ICE BofA US High Yield Index (H0A0), however, is almost unchanged year-to-date, as the tightening in credit spreads more or less offset the rise in risk-free rates.

Please refer to Figure 5 of the current Multi-Asset Class Risk Monitor (dated April 9, 2021) for further details.

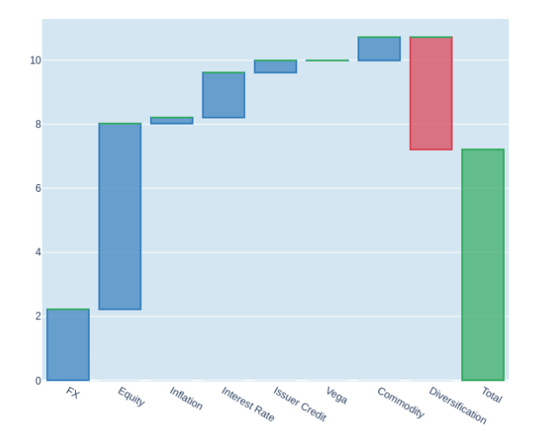

Decreased cross-asset diversification offsets lower equity risk

Short-term risk in Qontigo’s global multi-asset class model portfolio held steady at around 7.2% as of Friday, April 9, 2021, as the beneficial effects of lower stock-market volatility were offset by a renewed co-movement with foreign currencies and a less negative interaction of equity and fixed-income securities. The latter resulted in a significant reduction in diversification benefits, as changes in share prices were no longer dampened by opposing movements in exchange rates or bond prices. That said, investing in US Treasuries still provided the greatest risk reduction, as the complete decoupling from the stock market meant that they neither added to nor subtracted from overall risk. High-yield issues, meanwhile, benefitted from reduced price volatility, as recent increases in risk-free rates had been counterbalanced by a narrowing of credit spreads.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated April 9, 2021) for further details.