- Yields fall after Powell speech—but still end the week higher

- Traders push back rate-hike expectations and the dollar takes a fall

- Closer FX/share-price co-movement continues to raise portfolio risk

Yields fall after Powell speech—but still end the week higher

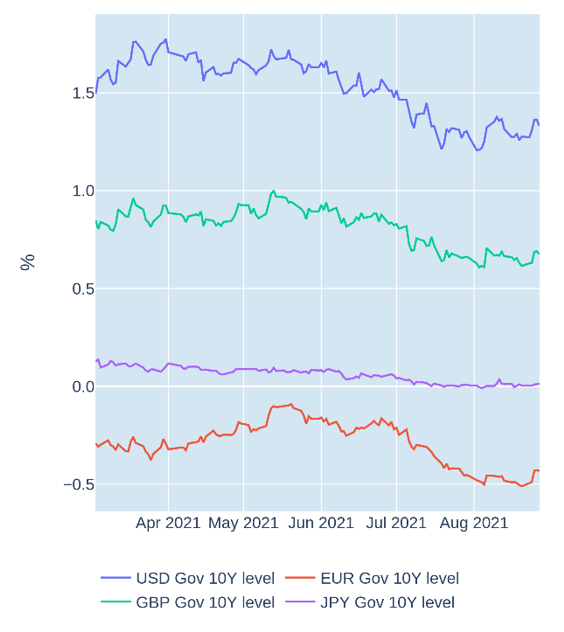

Global sovereign yields fell and share prices rose on Friday, August 27, 2021, following Federal Reserve Chairman Jay Powell’s long-awaited speech at the Jackson Hole Economic Symposium—the annual gathering of central bankers, finance ministers, academics, and financial market participants from around the world. The STOXX® USA 900 blue-chip index posted a fresh high, as Powell stressed that substantial progress had been made against the central bank’s maximum employment and price stability goals. US Treasury prices were also lifted by the announcement, with the 10-year benchmark rate falling 3 basis points. However, the drop in yield was not big enough to offset rises from earlier in the week, so that the bond-market bellwether still closed 5 basis points up from the previous Friday.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated August 27, 2021) for further details.

Traders push back rate-hike expectations and the dollar takes a fall

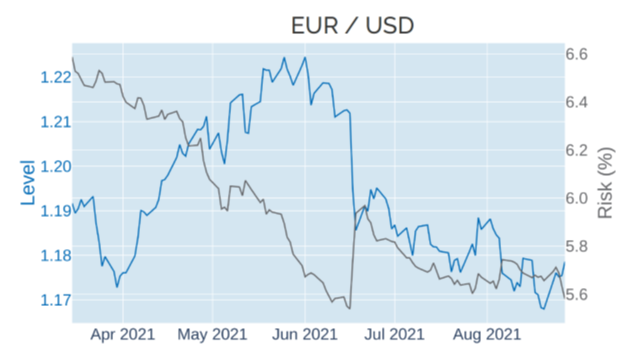

The US dollar lost almost 1% against a basket of foreign currencies in the week ending August 27, 2021, as traders deferred their expectations of a potential hike in the Federal Funds target rate. In his Jackson Hole speech on Friday, Powell clarified that the “timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff.” He further emphasized that despite the recent progress towards the central bank’s main goals, there was still “much ground to cover to reach maximum employment, and time will tell whether we have reached 2 percent inflation on a sustainable basis.” This is the third consecutive week in which the dollar moved in the opposite direction of share prices, once more making foreign currencies appear more strongly correlated with local stock-market returns.

Please refer to Figures 6 of the current Multi-Asset Class Risk Monitor (dated August 27, 2021) for further details.

Closer FX/share-price co-movement continues to raise portfolio risk

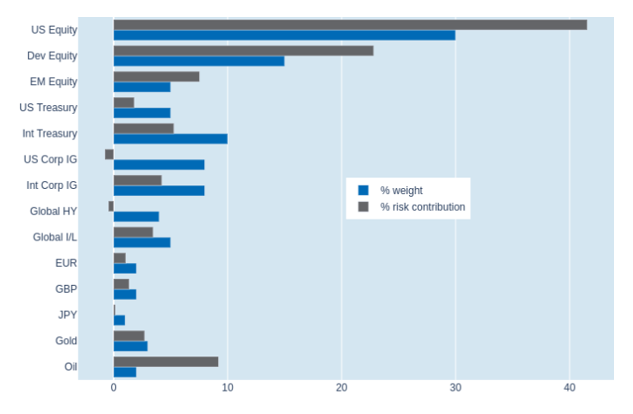

Short-term risk in Qontigo’s global multi-asset class model portfolio climbed another 0.5% to 6.6% as of Friday, August 27, 2021, as the co-movement of share prices and exchange rates against the US dollar intensified further. That said, there was a mixed effect on the different equity holdings in the portfolio. While US stocks saw their share of total risk increase by 3.5 percentage points to 41.6%, weaker local market fluctuations in Europe led to an aggregate decline in the percentage risk contribution of non-US developed equities from 25.6% to 22.7%. Oil remained the biggest contributor relative to its market-value weight of 2%, accounting for almost one tenth of overall portfolio volatility, as crude prices surged 10% last week, making the position appear both more volatile and more closely correlated with share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 27, 2021) for further details.