- Yields reverse course, rising on stronger-than-expected jobs gain

- Gilt curve flattens, as BoE signals ‘modest tightening’

- Portfolio risk plunges, as equity and FX volatilities both fall

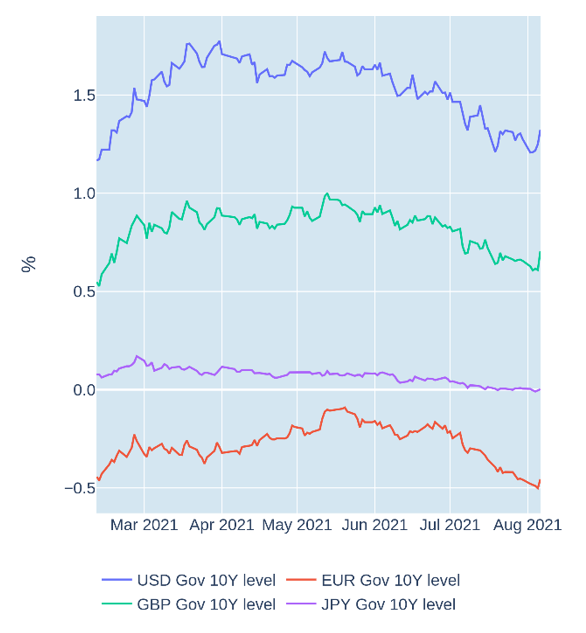

Yields reverse course, rising on stronger-than-expected jobs gain

Long-term US Treasury yields experienced their first weekly rise since late June in the week ending August 6, 2021, as non-farm payroll data released on Friday showed the American economy created almost a million jobs in July, substantially exceeding the consensus forecast of 800,000. The strong reading fueled speculation that the Federal Reserve might taper its $120bn-a-month asset-purchasing program sooner than expected. That said, short-term interest-rate predictions remained mostly stable, with the monetary policy-sensitive 2-year benchmark ending the week a mere 2 basis points higher at 0.21%—still within the Fed Funds target corridor of 0-0.25%.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated August 6, 2021) for further details.

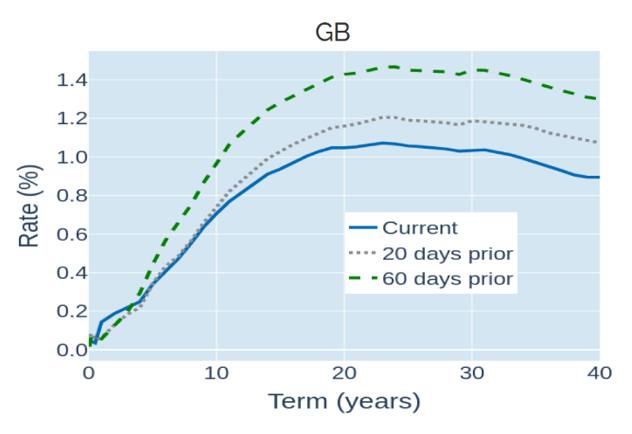

Gilt curve flattens, as BoE signals ‘modest tightening’

The term spread between long and short-dated British Gilt yields declined to its tightest level in six months in the week ending August 6, 2021, after the Bank of England indicated on Thursday that “some modest tightening of monetary policy…is likely to be necessary” in order to meet its “inflation target sustainably in the medium term.” In its quarterly inflation report, the Monetary Policy Committee significantly raised its inflation forecast for the fourth quarter of 2021 to 4%—double the previously assumed growth rate, published in May, when it predicted that “inflation should return to around our 2% target later this year.” As a result, the 2-year benchmark rate surged 8 basis points, while the 10-year yield climbed 5 basis points, narrowing the gap between the two to 0.52%.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated August 6, 2021) for further details.

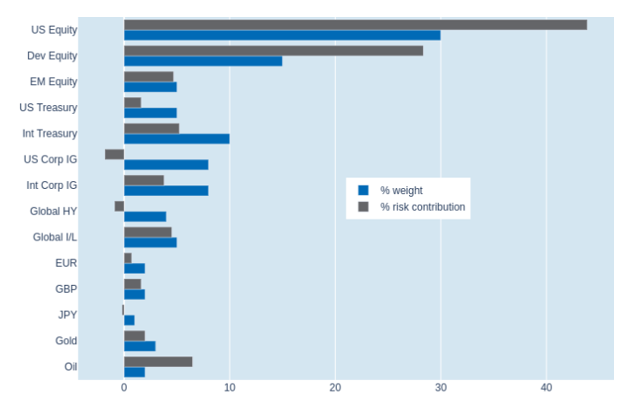

Portfolio risk plunges, as equity and FX volatilities both fall

Short-term risk in Qontigo’s global multi-asset class model portfolio plunged 1.1 percentage points to 5.5% as of Friday, August 6, 2021, due to a simultaneous drop in both FX and stock-market volatilities. The equity portion of the portfolio accounted for nearly two thirds of the overall risk decrease. That said, the biggest reduction in relation to market-value weight occurred in the oil position, which saw its percentage risk contribution drop by 1.5 points to 6.4%. This was due to a sharp decline in the correlation between crude and stock prices, as the former dropped between 6% and 8%, while the latter ended the week at record highs.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated August 6, 2021) for further details.