- Flight-to-safety flows reverse, boosting yields and share prices alike

- As UK tightens COVID restrictions, traders curtail rate-hike expectations

- Increasing risk appetites raise both equity volatility and portfolio risk

Flight-to-safety flows reverse, boosting yields and share prices alike

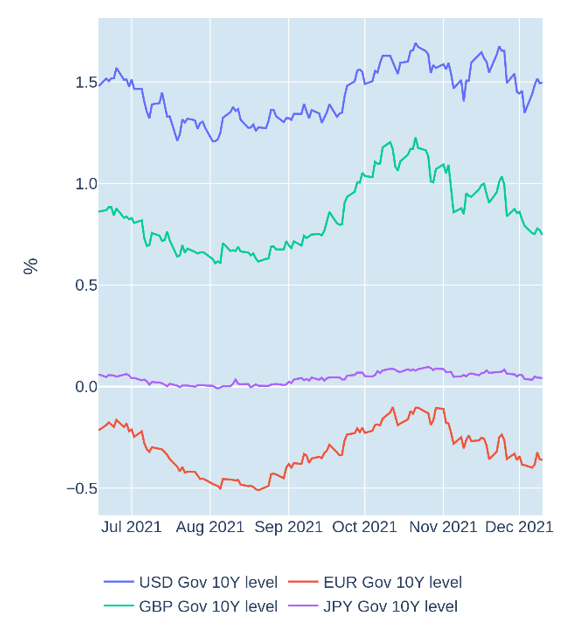

Yields on US government bonds surged in the week ending December 10, 2021, as investors reversed flight-to-safety flows of the preceding fortnight. The 10-year US Treasury benchmark recorded its steepest weekly ascent since early January, when the same-maturity breakeven-inflation rate sparked inflation concerns by surpassing 2% for the first time since mid-2019. This time, however, the move was bolstered by easing concerns regarding the Omicron variant, which also propelled the STOXX® USA 900 to its biggest weekly gain since the first week of February. The latest CPI released on Friday, meanwhile, had very little effect on either asset class, despite posting a 6.8% year-over-year increase to an almost 30-year high.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated December 10, 2021) for further details.

As UK tightens COVID restrictions, traders curtail rate-hike expectations

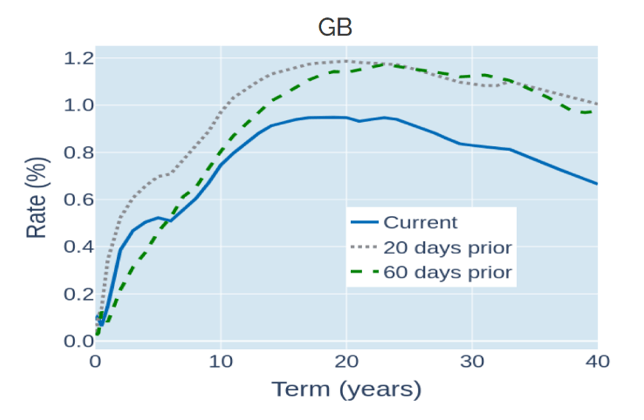

British Gilt yields dropped across all maturities in the week ending December 10, 2021, as the UK government announced a range of new coronavirus restrictions, including recommendations to work from home if possible, plus legal requirements to wear face masks and to provide COVID passports in some public venues. Rate decreases were most pronounced at the short end of the curve, as traders pondered the impact of the latest measures on the Bank of England’s plans for tightening monetary conditions in coming months. The first rate hike is still priced in for February, but the base rate is now expected to peak at 1% in early 2023, down 25 basis points from what was implied by SONIA futures only a month ago.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated December 10, 2021) for further details.

Increasing risk appetites raise both equity volatility and portfolio risk

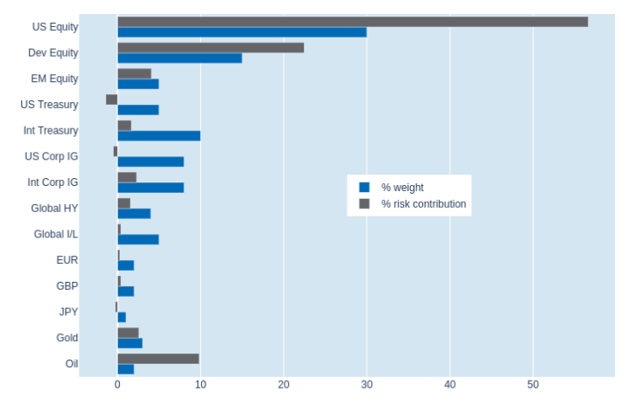

A sharp increase in equity volatility raised predicted short-term risk in Qontigo’s global multi-asset class model portfolio by 0.4% to 7.8% as of Friday, December 10, 2021. However, part of the effect was offset by reduced fluctuations in exchange rates and the ongoing countermovement of stock and bond prices. Holding US Treasuries generated the biggest risk-reducing impact, alongside high quality USD-denominated corporate bonds, which have been almost perfectly correlated with sovereign debt recently, due to the very low volatility of investment-grade credit spreads. Index-linked securities, meanwhile, experienced the biggest drop in their percentage risk contributions, from 1.6% to 0.4%, as breakeven-inflation rates were only marginally higher, despite soaring stock prices and sovereign yields.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated December 10, 2021) for further details.