- Bund yields end 2022 on 11-year high as ECB warns rates could stay higher for longer

- Dollar rally fuelled by aggressive Fed hikes cools off

- Lower equity and FX volatilities reduce portfolio risk

Bund yields end 2022 on 11-year high as ECB warns rates could stay higher for longer

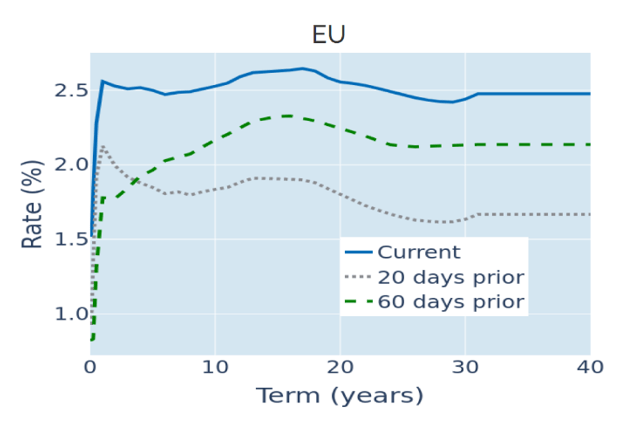

German sovereign yields ended 2022 on an 11-year high, as borrowing costs soared across all maturities in the wake of the European Central Bank (ECB) meeting on December 15. In the adjacent press conference, President Christine Lagarde warned market participants not to expect a pivot in monetary policy anytime soon, adding that the ECB had “more ground to cover” and “longer to go” than, for example, the Federal Reserve.

The Bund curve had started 2022 largely submerged in negative territory, with almost no change in Eurozone monetary policy expected over the course of course of the year. However, as the Russian invasion of Ukraine sparked a surge in energy and living costs, the ECB became more explicit in its forward guidance and its unambiguous prioritisation of fighting inflation over supporting economic growth. In response, traders gradually adjusted their interest-rate expectations upward, now anticipating a peak of 3.5% in the central-bank deposit rate by the middle of this year.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated December 30, 2022) for further details.

Dollar rally fuelled by aggressive Fed hikes cools off

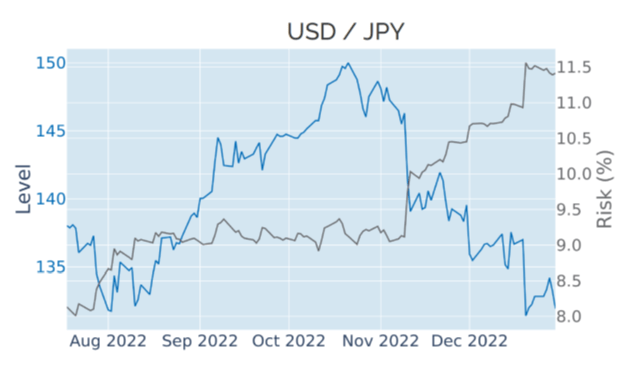

The Dollar Index—a measure of the USD’s value against a basket of major trading partners—declined 1.2% in the three weeks ending December 30, 2022, thereby expanding the drawdown from its 20-year high in late September to more than 9%. Still, the greenback ended 2022 almost 8% stronger than at the start of the year, buoyed by the fastest series of rate increases by the Federal Reserve since the high-inflation environment of the 1970s.

The Japanese yen experienced one of the biggest losses against its American rival, closing 2022 nearly 13% in the red, as the Bank of Japan (BoJ) remained the last major central bank to leave its policy rate at an ultra-low level of -0.1%. That being said, JPY/USD received a 4% boost on December 20, when the BoJ expanded the corridor within which it allows the 10-year JGB yield to fluctuate around its 0% target from 25 to 50 basis points either side.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated December 30, 2022) for further details.

Lower equity and FX volatilities reduce portfolio risk

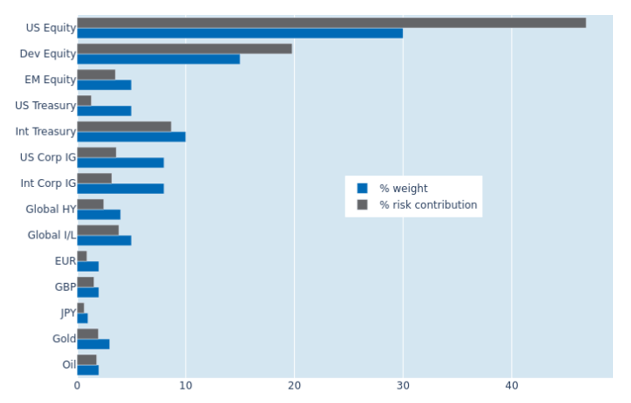

The predicted short-term risk of Qontigo’s global multi-asset class model portfolio plummeted to 12.2% as of Friday, December 30, 2022, compared with 15.2% three weeks earlier. The largest part of the change was due to simultaneous drops in equity and FX volatilities, with non-US developed equities recording the biggest absolute decrease in their risk contribution. Non-USD government bonds also saw their share of total portfolio volatility shrink from 9% to 8.7%, as currency gains against the dollar offset local price losses from higher interest rates. Index-linked securities experienced an even greater decline in their percentage risk contribution of 1.1%, due to a complete decoupling of inflation expectations and share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated December 30, 2022) for further details.