US Treasury curve steepens over inflation concerns; Dollar depreciates further, as equities reach record highs; Equity volatility keeps falling, but correlations remain stable

US Treasury curve steepens over inflation concerns

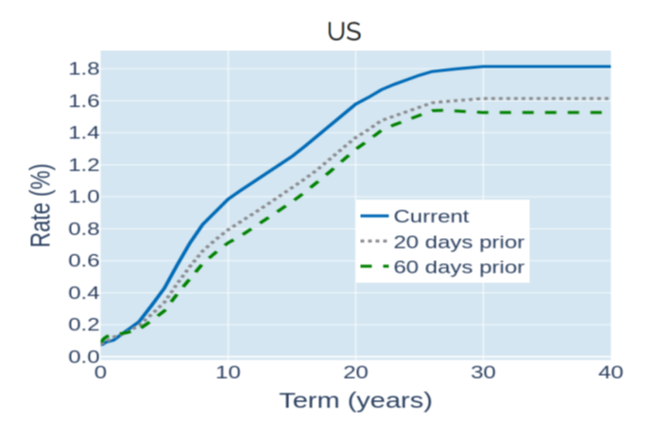

The gap between 10-year and 2-year US Treasury rates grew to its widest margin in more than three years in the week ending December 4, 2020, as long-term yields rose over inflation concerns, while the short end of the curve was held in place by the expectation of low central-bank rates. The 10-year “break-even” rate—the annual rate of inflation implied by prices of Treasury Inflation-Protected Securities (TIPS)—rose to 1.90% (the highest level since May last year), reflecting concerns that the proposed government stimulus package may lead to accelerated consumer-price growth. The front end of the curve, in contrast, remained glued to its current level, indicating that market participants expect the Federal Reserve to keep rates at historic lows for the foreseeable future—especially after the central bank relaxed its inflation target in the summer.

European yields, meanwhile, stayed within their recent tight range, weighed down by ongoing concerns about the persistently high number of COVID cases and the impending Brexit deadline, as well as reports of contracting economic activity.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated December 4, 2020) for further details.

Dollar depreciates further, as equities reach record highs

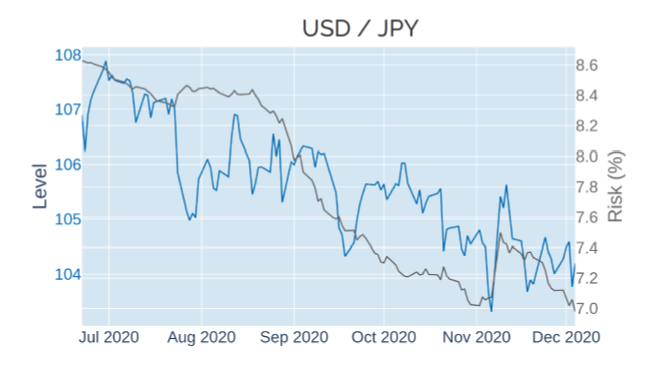

The Dollar Index—a measure of the USD’s value against a basket of major trading partners—fell to its lowest level since April 2018 in the week ending December 4, 2020, as American blue-chip indices climbed to yet higher heights, lifted by soaring energy stocks. The renewed dollar depreciation, alongside rising share and falling government-bond prices, is further evidence of increasing risk appetites. The latter notion was again underscored as the Japanese yen—another indicator of risk aversion—was the only major currency to weaken slightly against its American rival. At the same time, predicted short-horizon volatility for JPY/USD dropped below 7% for the first time since the beginning of March.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated December 4, 2020) for further details.

Equity volatility keeps falling, but correlations remain stable

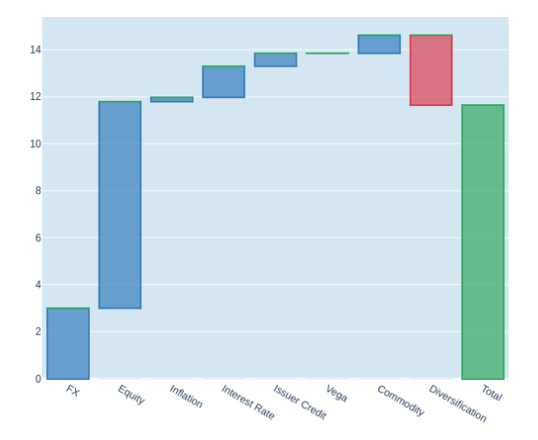

Short-term risk in Qontigo’s global multi-asset class model portfolio dropped 1.2% to 11.6% as of Friday, December 4, mainly due to a further decline in stock-market volatility. Correlations across risk factors and asset classes, on the other hand, remained largely unchanged. Declines in absolute risk contributions were, therefore, mostly limited to the three equity buckets, with US stocks experiencing the biggest decline of 3.2% in their percentage share of overall volatility. Oil was the only other asset class to record a notable decline in risk contribution, due to its close interaction with share prices. That said, equity risk still dominated total portfolio volatility, accounting for 75% of total risk, while diversification remained limited, due to the ongoing decoupling of stock markets and sovereign bonds.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated December 4, 2020) for further details.