- Hawkish ECB and record inflation turn Bund yield positive

- Higher rates lift the euro

- Stock market jitters continue, pushing portfolio risk higher

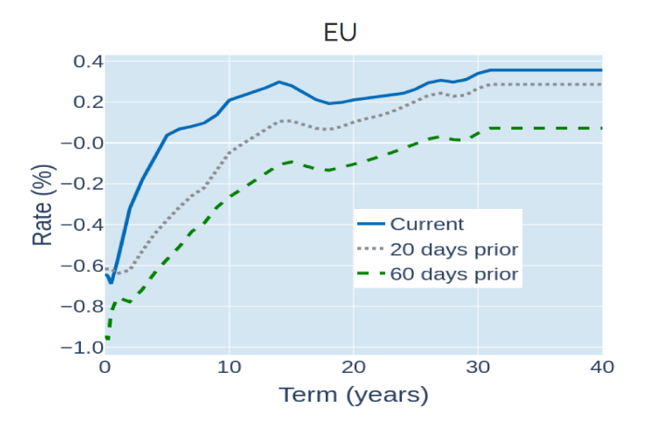

Hawkish ECB and record inflation turn Bund yield positive

The 10-year German Bund yield climbed above zero for the first time since May 2019 in the week ending February 4, 2022, as a steeper-than-expected rise in Eurozone consumer prices increased pressure on the European Central Bank to tighten monetary conditions sooner than intended. The harmonized CPI index for the single-currency zone rose 5.1% in the 12 months ending in January 2022—its strongest growth rate since records began in 1997—exceeding average analyst predictions of 4.4% by a wide margin. German inflation came in at 4.9%, down from 5.3% in the previous month, but still significantly above the consensus forecast of 4.3%. In response, prices on Euribor futures plummeted, with the December 2022 contract closing below 100 on Friday. Short-term interest rate futures are priced such that the corresponding rate can be calculated by subtracting the price from 100. A value below that level, therefore, implies the anticipation of a positive underlying rate. In other words, traders now expect that the European Central Bank will raise its current deposit rate of -0.5% to at least zero before the year is out.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated February 4, 2022) for further details.

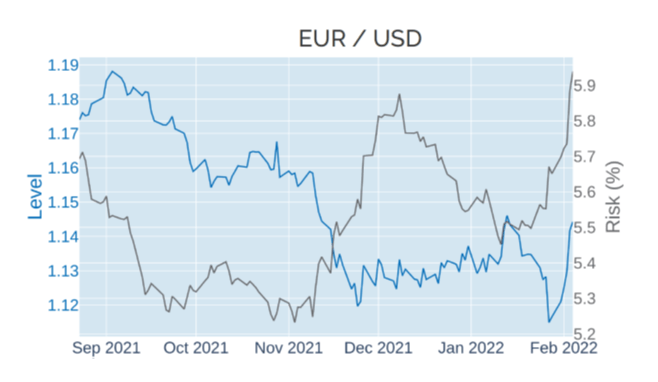

Higher rates lift the euro

The euro rose 2.5% against the US dollar in the week ending February 4, 2022, boosted by the prospect of higher interest rates and bond yields. The common currency outperformed most of its major rivals, as the European Central Bank was expected to emulate both its British counterpart, which has already raised rates for the second time in a row last week, and the Federal Reserve, which is expected to follow suit next month, sooner than previously anticipated. In the press conference following Thursday’s monetary-policy meeting, ECB President Christine Lagarde no longer ruled out raising rates this year, though she reiterated the governing council’s stance that it would only do so once asset buying has come to an end. The current plan calls for a gradual reduction of monthly net purchases from €40bn in the second quarter to €20bn from October onward.

The euro’s move boosted predicted short-horizon volatility for EUR/USD to 5.9%—its highest level since June 2021.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated February 4, 2022) for further details.

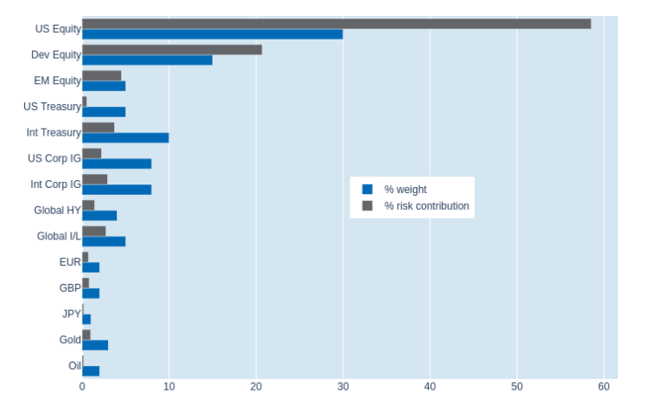

Stock market jitters continue, pushing portfolio risk higher

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio continued to creep up by another 0.4% to 11.3% as of Friday, February 4, 2022, once again fueled by an ongoing surge in equity volatility. The effect was attenuated, however, by a weaker interaction of share prices with both government bonds and exchange rates against the US dollar. This meant that US equities bore the brunt of the increase in overall portfolio volatility, whereas the contributions from non-US stocks remained largely unchanged. Foreign-currency sovereign and investment-grade corporate bonds even saw their share of total risk decline, also benefitting from a weaker interaction with FX returns. Commodity prices, meanwhile, remained uncorrelated with stock markets, resulting in a near-zero risk contribution from the oil position.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated February 4, 2022) for further details.