- Eurozone inflation drop spurs stocks and bonds alike

- Dollar strengthens as Fed minutes put water on rate-cut hopes

- Falling equity volatility further reduces portfolio risk

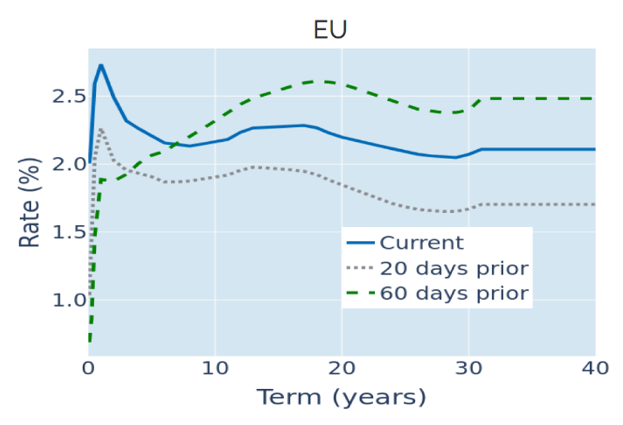

Eurozone inflation drop spurs stocks and bonds alike

European stocks and bonds rallied in tandem in the week ending January 6, 2023, following a bigger-than-expected deceleration in inflation. Preliminary data released on Tuesday showed that consumer prices in Germany and the Eurozone were estimated to have grown by 9.6% and 9.2%, respectively, in the twelve months ending in December—well below corresponding consensus forecasts of 10.7% and 9.7%. Easing inflationary pressures are seen to decrease the urgency for the European Central Bank to tighten monetary conditions, and traders reduced their year-end interest-rate projections accordingly by 25 basis points. Yield declines were even more pronounced for medium and long maturities, with the German 10-year borrowing rate dropping 0.37%. Concurrently, the regionwide STOXX® Europe 600 stock index started the new year with a 4.6% gain.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated January 6, 2023) for further details.

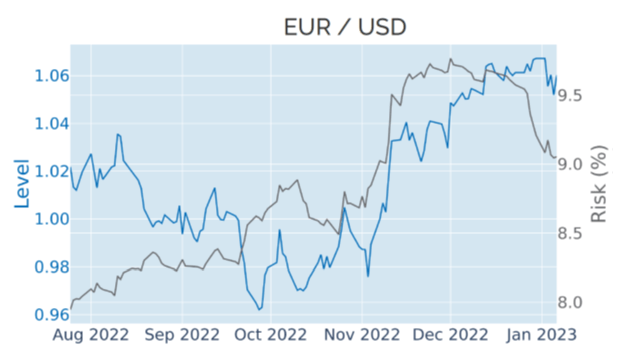

Dollar strengthens as Fed minutes put water on rate-cut hopes

The US dollar appreciated slightly against a basket of major trading partners in the week ending January 6, 2023, as the latest Fed minutes indicated that interest rates may stay higher for longer than previously anticipated by market participants. The minutes published on Wednesday noted that “no participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023.” The so-called ‘dot plot’, which charts FOMC members’ assessments of where they see the federal funds rate at certain points in the future, showed a median projection of 5.13% for the end of this year. This appeared to be in stark contrast to the path implied by short-term interest-rate futures, which anticipate the effective fed funds rate to peak around 5% in the middle of 2023, before descending toward 4.6% by the end of the year.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated January 6, 2023) for further details.

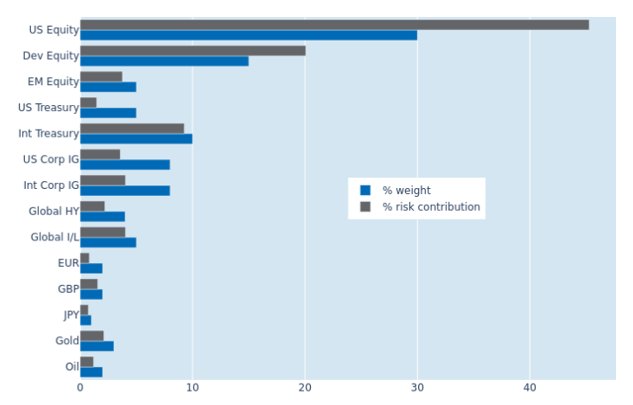

Falling equity volatility further reduces portfolio risk

The predicted short-term risk of Qontigo’s global multi-asset class model portfolio dropped another 1.3 percentage points to 10.9% as of January 6, 2023, driven primarily by a further decline in standalone equity volatility. The risk reduction was most pronounced for US stocks, which saw their share of total portfolio volatility shrink by 1.6% to 45.3%. In contrast, local share-price gains in other parts of the world were offset by weaker foreign-exchange rates, keeping the percentage risk contributions of non-US developed and emerging-market equities almost constant.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 6, 2023) for further details.