- Strong earnings and central-bank support lift European stocks and bonds alike

- Dollar continues to strengthen, as stock market posts record high

- Portfolio risk surges amid stock-market turbulence

Strong earnings and central-bank support lift European stocks and bonds alike

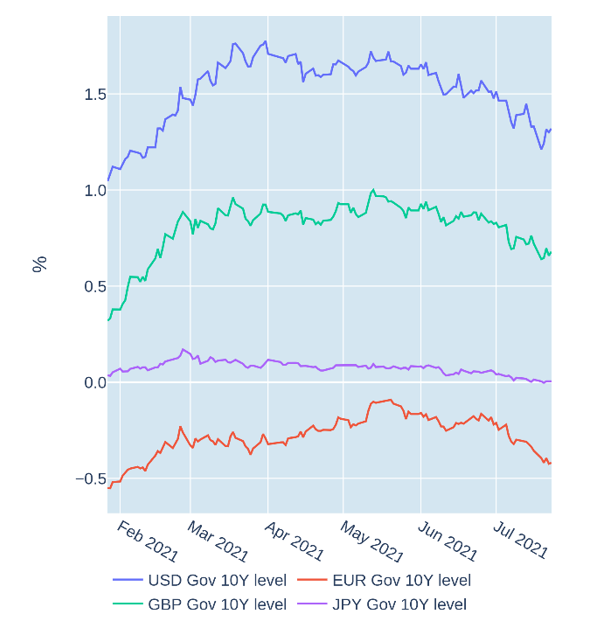

German Bund yields dropped to their lowest level in more than five months in the week ending July 23, 2021, as European blue-chip indices climbed to record highs, along with their American counterparts. The region-wide STOXX® Europe 600 started the week with a 2.3% loss—its biggest daily drawdown of the year so far—amid intensifying concerns over the rapid spread of the Delta COVID variant, but then recovered over the rest of the week, buoyed by encouraging earnings announcements from the other side of the Atlantic. Meanwhile, government-bond prices—which move in the opposite direction of yields—also continued to rise, as the European Central Bank pledged to maintain its asset-purchasing program “until at least the end of March 2022” and to keep interest rates “at their present or lower levels until it sees inflation reaching two per cent well ahead of the end of its projection horizon and durably for the rest of the projection horizon”.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated July 23, 2021) for further details.

Dollar continues to strengthen, as stock market posts record high

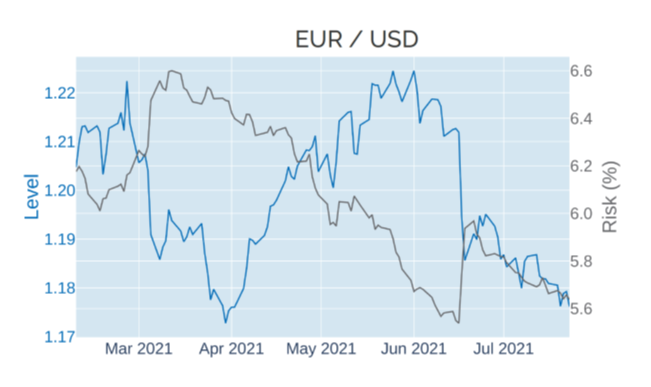

The Dollar Index—a measure of the USD’s value against a basket of major currencies—rose to its highest level since the beginning of April in the week ending July 23, 2021, lifted by a flurry of positive corporate-earnings surprises. The latest appreciation took the total gain since the beginning of June to almost 3.4%, while the STOXX® USA 900 rose 5.3% over the same period (17.3% since the start of the year). On the flipside, the euro was down almost 4%—both since its recent peak on June 1 and year-to-date—reflecting the diverging economic-growth and monetary-policy projections for the Eurozone and the United States.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated July 23, 2021) for further details.

Portfolio risk surges amid stock-market turbulence

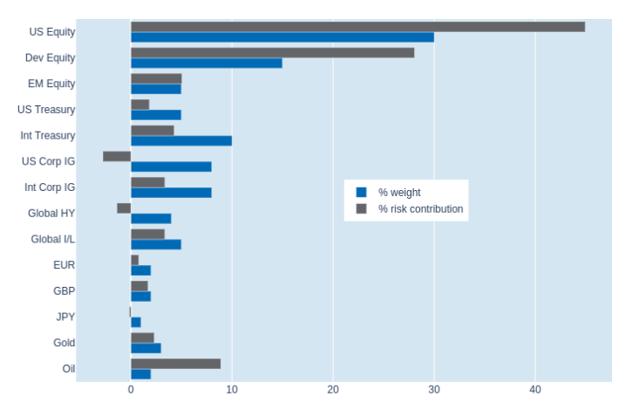

Short-term risk in Qontigo’s global multi-asset class model portfolio surged 1.2 percentage points to 6.5% as of Friday, July 23, 2021. The increase was mostly due to a sharp uptick in equity volatility, as stock markets in Europe and the United States experienced a sharp sell-off on Monday, but then bounced back and rose to new highs over the rest of the week. As a result, the combined share of overall risk of the equities in the portfolio increased by 6% to 78%. However, the biggest week-on-week change was recorded for the oil holding, which saw its percentage risk contribution more than double from 3.5% to 8.8%, due to a combination of higher standalone volatility and a stronger co-movement with the stock market. US Treasuries also continued adding to total portfolio risk, thanks to a sustained positive correlation with share prices.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 23, 2021) for further details.