- Record inflation lifts Eurozone yields to 8-year high

- Solid manufacturing and job-market data boost dollar

- Tighter spreads offset stock-bond sell-off

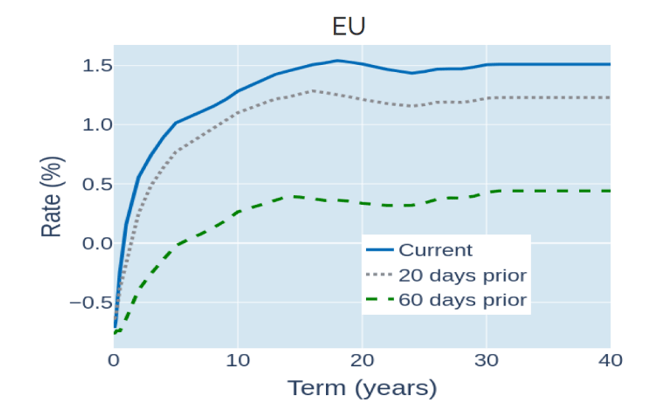

Record inflation lifts Eurozone yields to 8-year high

Eurozone government yields surged to multi-year highs in the week ending June 3, 2022, as consumer prices in the common-currency area were estimated to have risen 8.1% in the 12 months to May, significantly beating the consensus forecast of 7.7%. The monetary policy-sensitive 2-year rate soared 31 basis points to 0.65%—its highest level since 2011—amid growing speculation that the European Central Bank could raise its deposit rate by half a percentage point next month, instead of its official forward guidance of two 0.25% hikes in July and September.

Short-term interest-rate and bond traders on the other side of the Atlantic also raised their predictions for the federal funds target rate, once more expecting it to peak around 3.25% in the middle of next year.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated June 3, 2022) for further details.

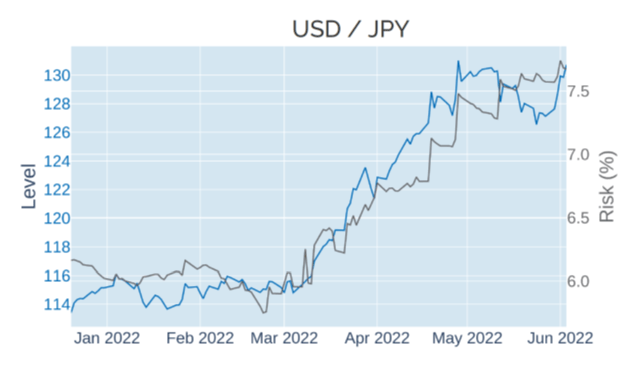

Solid manufacturing and job-market data boost dollar

The US dollar recovered some its losses from the previous two weeks in the week ending June 3, 2022, bolstered by a combination of better-than-expected industrial-output and job-market data. The Institute of Supply Management’s purchasing managers index and the Bureau of Labor Statistics’ non-farm payroll report both beat analyst expectations, providing the Federal Reserve with additional leeway to tighten monetary policy in its fight against surging consumer prices. FX losses were most pronounced for the Japanese yen, raising predicted short-horizon volatility for the JPY/USD exchange rate to its highest level since September 2020.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 3, 2022) for further details.

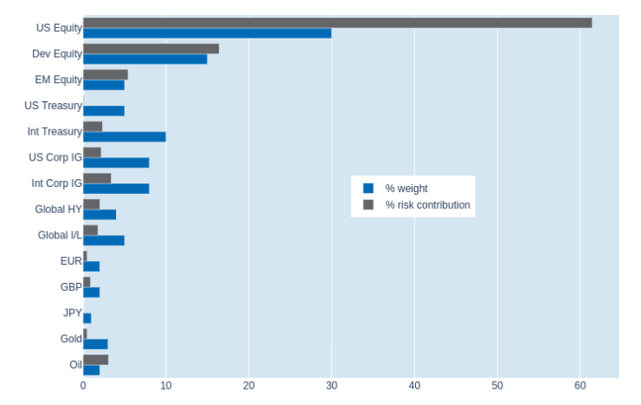

Tighter spreads offset stock-bond sell-off

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio fell 0.7% to 12.4% as of Friday, June 3, 2022, as the adverse effects of a simultaneous sell-off in the stock and bond markets were more than offset by tighter credit-risk premia. The more inverse interaction of interest rates and spreads meant that corporate securities—investment grade and high yield—saw their standalone volatilities decrease, whereas Treasuries experienced stronger price fluctuations. This effect was even more pronounced for non-US government issues, as their losses were amplified by the depreciation of their local currencies against the strengthening US dollar.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 3, 2022) for further details.