- Treasury yields see-saw, as Fed tries to ease inflation concerns

- Euro falls over fears of third COVID wave

- Portfolio risk ebbs on lower equity volatility

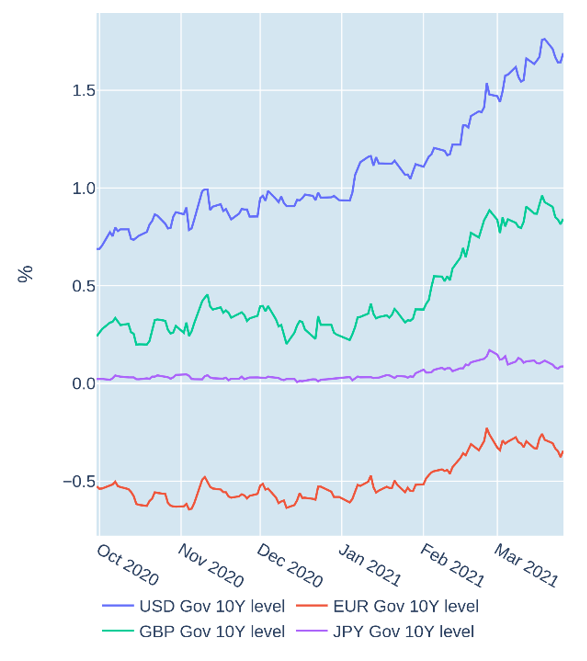

Treasury yields see-saw, as Fed tries to ease inflation concerns

Sovereign yields rollercoasted in the week ending March 26, 2021, as inflation once more occupied investors’ minds. The 10-year US Treasury benchmark plummeted 12 basis points in the first three days, as Federal Reserve Chairman Jay Powell tried to reassure markets that the anticipated uptick in consumer-price growth would be “neither particularly large nor persistent” and that the central bank would maintain its accommodative stance. Treasury Secretary Janet Yellen, Powell’s predecessor, supported his assertions, while also defending the upcoming $1.9tn stimulus package put before the House of Representatives financial services committee on Tuesday. That said, traders appeared only partially convinced, and yields rebounded by 5 basis points on Friday, following a lukewarm reception of the latest auction of 7-year securities the day before.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated March 26, 2021) for further details.

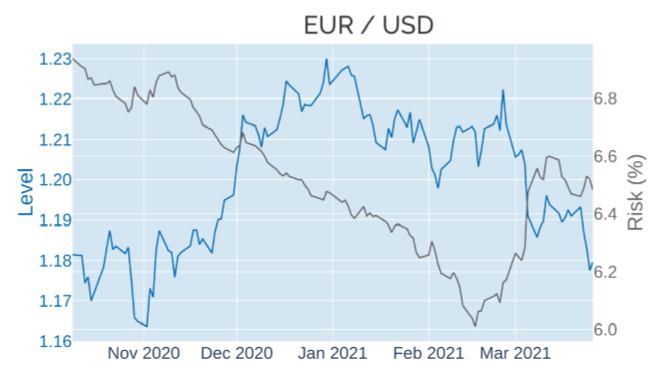

Euro falls over fears of third COVID wave

The euro lost nearly 1% against the US dollar in the week ending March 26, 2021, due to concerns over the relatively slow rollout of COVID vaccinations in the EU. The common currency descended to its lowest level in almost 20 weeks—dropping below $1.18 for the first time since early November—as a third wave of infections swept over the region’s major economies. The surge in cases of the new, more contagious COVID variant prompted Germany to prolong its existing lockdown by another three weeks to April 18, although the government later reversed its controversial decision to extend the Easter holidays from three to five days.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated March 26, 2021) for further details.

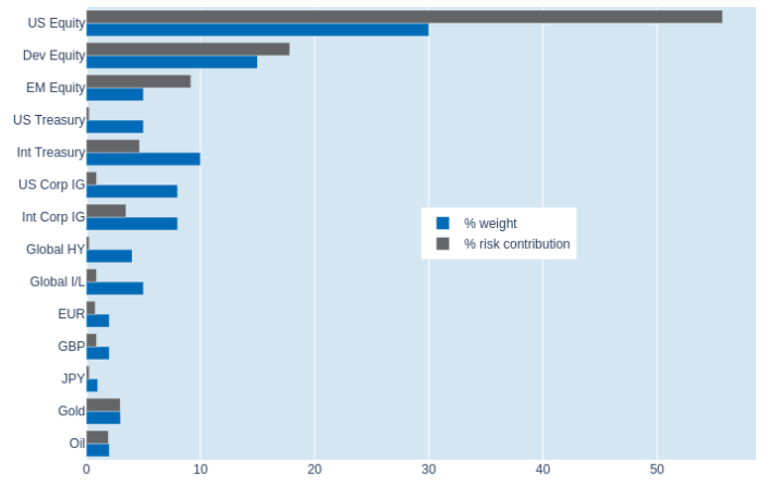

Portfolio risk ebbs on lower equity volatility

Short-term risk in Qontigo’s global multi-asset class model portfolio declined another 0.6% to 7.8% as of Friday, March 26, 2021, thanks to a 1-percentage point decrease in standalone equity volatility. Part of the reduction, however, was offset by stronger exchange-rate fluctuations. As a result, the largest portion of the decline in total portfolio volatility was attributed to US equities. USD-denominated fixed-income assets also saw their share of overall risk shrink, due to a decoupling of both credit spreads and risk-free interest rates from share prices. The latter meant that US Treasuries now neither add to nor subtract from total risk. Non-US equities—developed and emerging market—and corporate bonds, on the other hand, experienced a combined increase of 5 points in their percentage risk contributions.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated March 26, 2021) for further details.