- Speculations on ‘technical’ default persist, boosting short-term borrowing costs

- Bank of England raises rates…and the pound drops

- Lower equity volatility reduces portfolio risk

Speculations on ‘technical’ default persist, boosting short-term borrowing costs

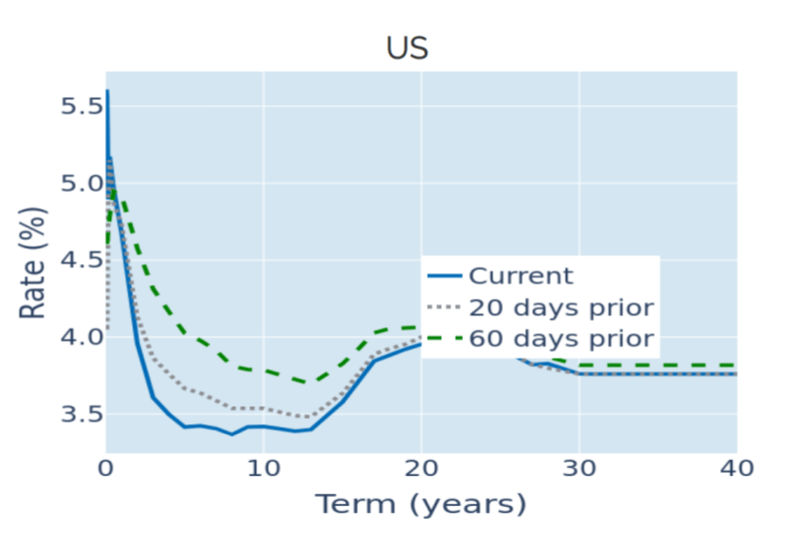

Short-term borrowing costs for the US government continued to rise in the week ending May 12, 2023, amid increasing worries that it may run out of the cash to service its obligations in early June. The 1-month T-Bill rate climbed another 20 basis points to just above 5.8% on Thursday, as Treasury Secretary Janet Yellen warned Congress about a potential “economic and financial catastrophe” if lawmakers do not raise the debt ceiling. However, the rest of the yield curve implies that any insolvency will be of a ‘technical’ nature, meaning that the government will resume payments relatively quickly. In fact, the 2-month rate dropped 36 basis points to 4.8% last week, extending the differential to the 4-week point to an entire percentage point. Medium to long yields remained even lower, reflecting greater ongoing concerns about long-term economic growth and the stability of the banking system.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated May 12, 2023) for further details.

Bank of England raises rates…and the pound drops

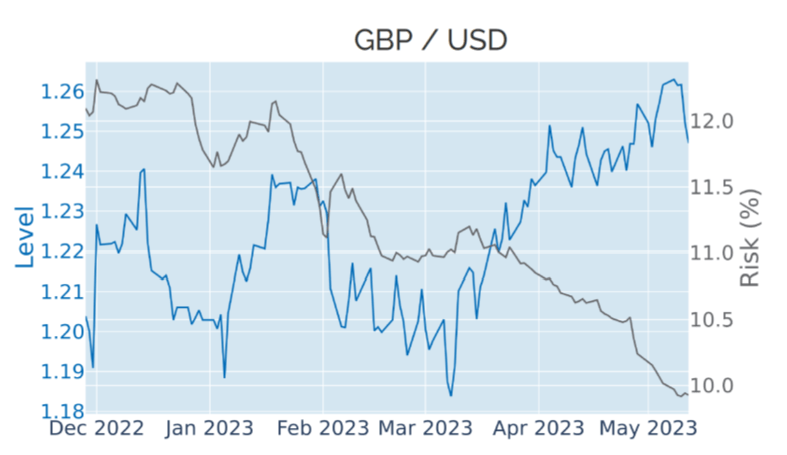

The Bank of England raised its base rates for the 12th consecutive time to 4.5% in the week ending May 12, 2023, in an effort “to address the risk of more persistent strength in domestic price and wage setting.” The Bank expects CPI inflation to fall sharply over the next few months, though, as the large price rises from one year ago drop out of the calculation and energy prices continue to decline. Yet, it still raised its inflation projection for the second quarter of 2024 from 1% to 3.4% in its latest Monetary Policy Report, as “the second-round effects of external cost shocks on inflation in wages and domestic prices may take longer to unwind than they did to emerge.”

The rate hike did little to support the pound, which dropped 1.2% against the US dollar, once again defying the conventional wisdom that higher expected yields make a currency more attractive to foreign investors (or more expensive to sell short for that matter).

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 12, 2023) for further details.

Lower equity volatility reduces portfolio risk

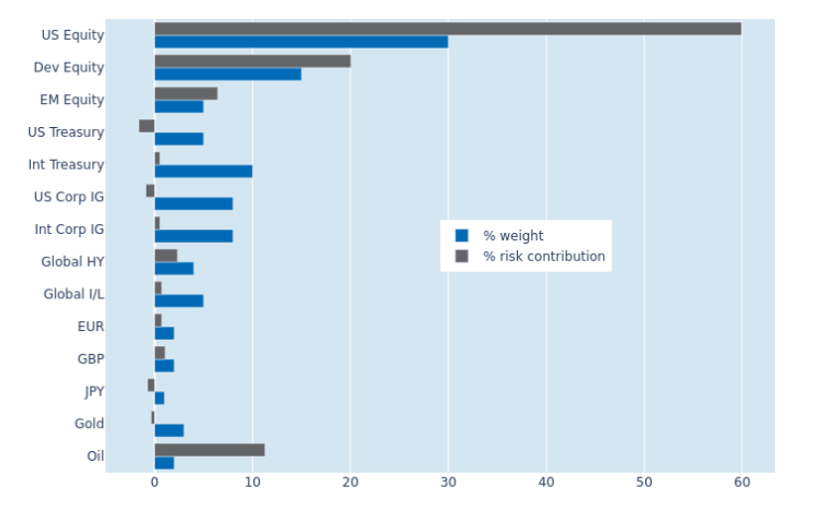

The predicted short-term risk of Qontigo’s global multi-asset class model portfolio declined from 6.2% to 5.6% as of Friday, May 12, 2023, primarily due to a drop in standalone equity volatility. Most of the absolute risk reduction was recorded in the US equity category, while the contribution from non-US stocks rose by 1.6 percentage points to 20.1%, as local losses were amplified by weaker exchange rates against the dollar. USD-denominated investment-grade corporate bonds joined US Treasury securities in actively reducing overall portfolio volatility, helped by a slightly weaker correlation between share-price and credit-spread returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 12, 2023) for further details.