- Accelerating inflation boosts Gilt yields

- Pound recovers over higher rates

- Portfolio risk eases as currency gains offset equity losses

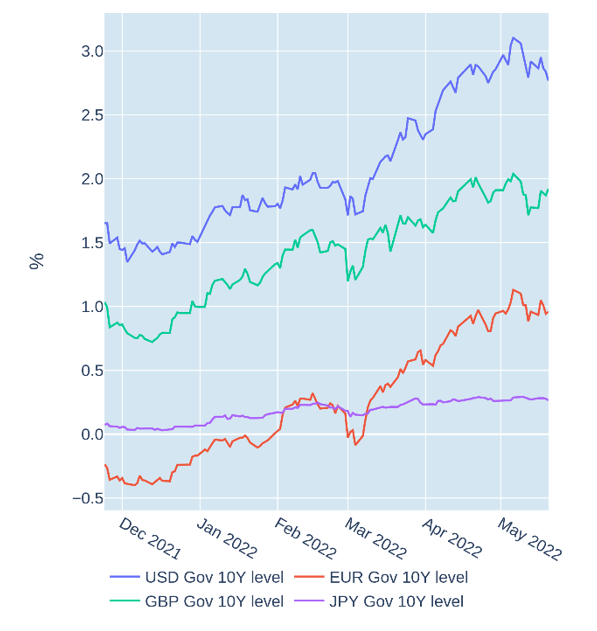

Accelerating inflation boosts Gilt yields

British government yields rose across all maturities in the week ending May 20, 2022, as UK consumer prices grew at their fastest pace in over four decades. The year-on-year growth rate accelerated to 9%—from 7% in the preceding month—driven to the largest part by the 54% raise in the upper limit for household energy bills in April. The price cap will be reviewed again October, and the Bank of England expects inflation to peak around 10% in the final quarter of this year. The yield increase was most pronounced at the monetary policy-sensitive 2-year point, which rose 0.25% basis points, as short-term interest-rate (STIR) traders added another BoE rate hike to their year-end projections.

This was in contrast to the United States, where long Treasury yields contracted 15 basis points amid concerns of potential adverse effects, if the Federal Reserve were to tighten monetary conditions too aggressively.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated May 20, 2022) for further details.

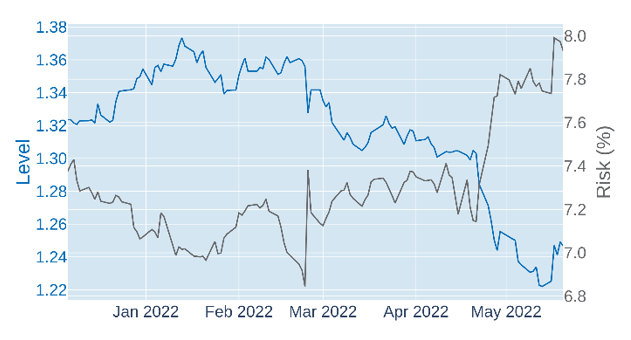

Pound recovers over higher rates

The pound sterling recovered some of its recent losses in the week ending May 20, 2022, buoyed by the surge in Gilt yields and Bank of England rate-hike expectations. Higher expected returns tend to make a currency more attractive to foreign investors. The British currency gained 2% against the US dollar, after having dropped nearly 11% since its most recent peak in January.

The euro received a similar boost from comments by Dutch central bank president Klaas Knot, who openly acknowledged the possibility that the European Central Bank may need to increase its policy by up to half a percentage point at its governing council meeting in July. His comments seemed to slightly contradict ECB President Christine Lagarde’s stance of a more gradual approach of 0.25% increments, though STIR futures markets appear to be siding with Knot.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 20, 2022) for further details.

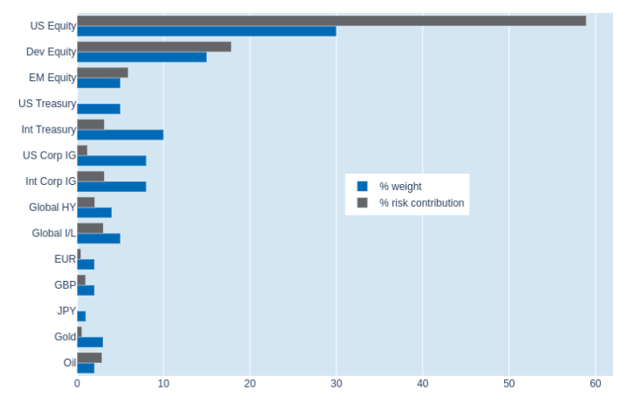

Portfolio risk eases as currency gains offset equity losses

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio eased 0.8% to 13.7% as of Friday, May 20, 2022, as (local) stock-market losses were offset by exchange-rate gains against the US dollar. This meant that US equities saw their share of total portfolio volatility rise by 4 points to 59.1%, whereas the percentage risk contribution of non-US developed remained stable at 18.3%. Most of the overall risk reduction occurred in the non-USD sovereign and investment-grade corporate bond buckets, which benefited from both lower risk-free yields (with the exception of the UK) and strengthening currencies.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 20, 2022) for further details.