- US curve inversion intensifies after hawkish Fed comments

- UK tax rises and spending cuts prop up Gilts and pound

- Higher equity and FX volatilities boost portfolio risk

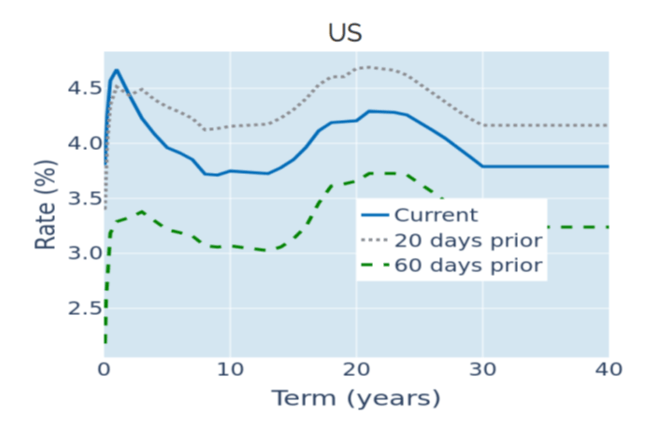

US curve inversion intensifies after hawkish Fed comments

The term spread between long and short-dated US Treasury yields plummeted to its lowest level in more than four decades in the week ending November 18, 2022, following comments from St. Louis Fed President Jim Bullard on Thursday that the current “policy rate is not yet in a zone that may be considered sufficiently restrictive.” Bullard then went on to suggest that even in the best case scenario, the central bank would have to raise its rate target to at least 5% to 5.25%, with a possible peak of 7% under “less-generous” assumptions. The 2-year benchmark yield soared 9 basis points in response, expanding the differential to the 10-year bellwether to -0.69%—the most negative it has been since the onset of the 1981-82 recession. That being said, futures markets still expect the effective fed funds rate to top out just above 5% in Q2 next year, with a 50-basis point hike priced in for the next FOMC meeting in mid-December.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated November 18, 2022) for further details.

UK tax rises and spending cuts prop up Gilts and pound

British sovereign bond prices rallied and the pound appreciated 1.3% against the US dollar in the week ending November 18, 2022, as Chancellor Jeremy Hunt announced £55 billion worth of tax increases and spending cuts over the next six years. However, the package also included cost-of-living support measures and funding for social services and schools over the two upcoming financial years, while most of the proceeds and savings are projected to materialize only after the next general election in late 2024/early 2025. As a consequence, decreases in borrowing costs were limited to maturities greater than four years, whereas short-term interest-rate and yield expectations remained unchanged. The pound, meanwhile, climbed to a 3-month high, surpassing the $1.19 mark for the first time since mid-August, but also saw its predicted short-horizon risk rise to a 2-year high of more than 12%.

Please refer to Figures 3 & 6 of the current Multi-Asset Class Risk Monitor (dated November 18, 2022) for further details.

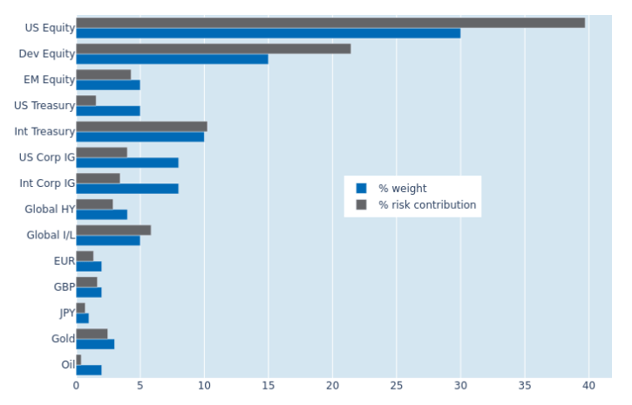

Higher equity and FX volatilities boost portfolio risk

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio soared nearly 4 percentage points to 19.8% as of Friday, November 18, 2022, caused by a 3% surge in both standalone equity and FX volatilities. Emerging-market stocks, in particular, saw their share of overall portfolio risk expand from 3.2% to 4.3%. A stronger correlation of equity and interest-rate returns also meant that the percentage risk contributions from US government and investment-grade corporate bonds increased by 0.7% and 1.1%, respectively. High-yield securities, on the other hand, were almost unaffected, due to a complete decoupling of credit spreads and risk-free rates.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated November 18, 2022) for further details.