European yields drop, as new infections accelerate; Gilt curve flattens over Brexit and negative rate concerns; Portfolio risk changes little, as less negative correlation offsets lower equity volatility

European yields drop, as new infections accelerate

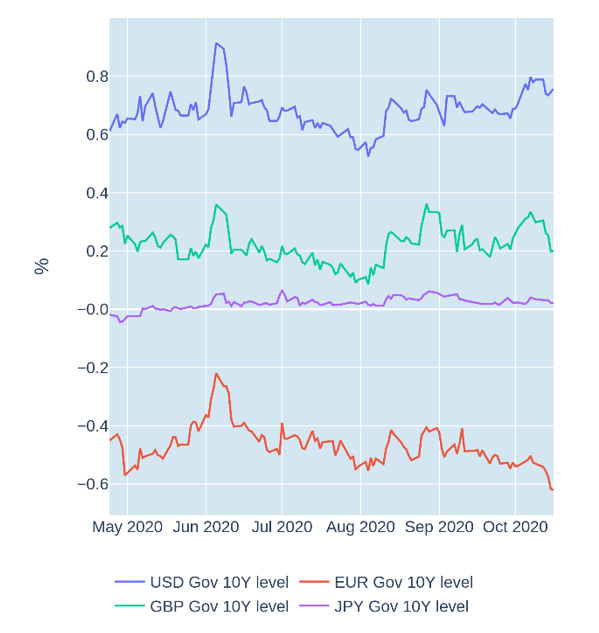

Yields on German government bonds dropped last week to their lowest level since the onset of the COVID crisis, as the rate of new infections in Europe continued to accelerate. For the week ending September 16, 2020, the 10-year Bund rate fell 9 basis points to -0.62%, a level last seen in early March. That said, ongoing support from the European Central Bank meant that risk premia for peripheral issuers also declined, despite waning risk appetites. The Italian BTP-Bund spread fell to its tightest level since April 2018 on Tuesday, when the government in Rome sold its first 3-year bond with a coupon of 0%.

Please refer to Figures 4 of the current Multi-Asset Class Risk Monitor (dated October 16, 2020) for further details.

Gilt curve flattens over Brexit and negative rate concerns

The UK government curve “bull-flattened” in the week ending October 16, 2020, as longer-dated yields fell more than shorter rates. The 10-year Gilt benchmark plummeted 10 basis points to 0.20%, as investors sought safe havens amid concerns over the slow, arduous pace of the Brexit negotiations. The monetary policy sensitive 2-year rate, meanwhile, ventured deeper into negative territory, falling to its lowest level since the end of September, when Bank of England Governor Andrew Bailey had seemingly ruled out the possibility of sub-zero central bank rates. However, in a letter sent Monday, the BoE asked commercial banks about their ability to deal with a negative base rate, seemingly performing another U-turn on the issue.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated October 16, 2020) for further details.

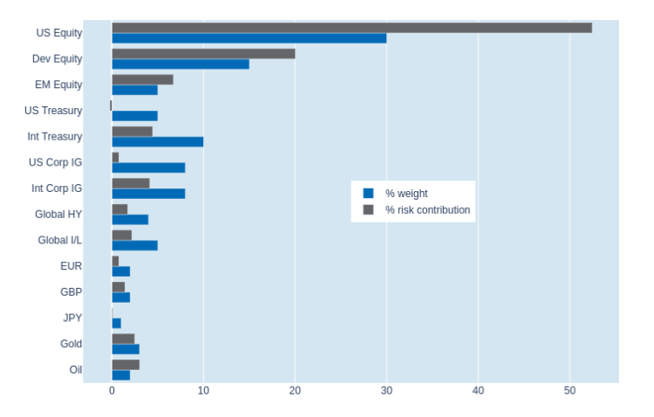

Portfolio risk changes little, as less negative correlation offsets lower equity volatility

Short-term risk in Qontigo’s global multi-asset class model portfolio was marginally lower at 9.2% on Friday, October 16, 2020, as the benefits of lower equity volatility were offset by a less inverse relationship with interest-rate returns. As government-bond yields fell and prices increased—especially in Europe—a late rally on Friday meant that major stock benchmarks ended the week near the closing levels from the previous weekend. Therefore, movements in the two major asset classes no longer offset each other to the same extent as previously. The reduction in stock-market risk was most notable in the US equity category, while for its European counterpart, the effect was counteracted by stronger exchange-rate fluctuations. Non-USD sovereign bonds, on the other hand, saw their share of overall portfolio volatility increase by 0.5% to 4.4%.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 16, 2020) for further details.