- Gilt yields and rate expectations revert to pre-mini-budget levels

- Euro reclaims dollar parity…for a day

- Increased correlations raise portfolio risk

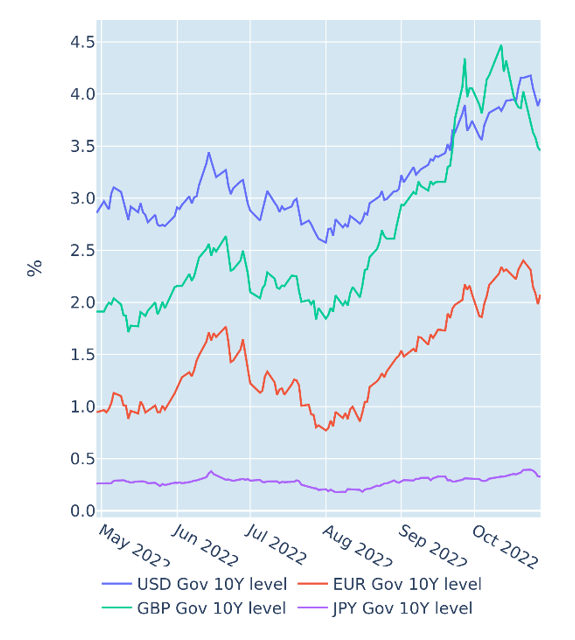

Gilt yields and rate expectations revert to pre-mini-budget levels

Gilt yields dropped to their lowest levels in five weeks in the week ending October 28, 2022, as Rishi Sunak secured a mandate from conservative MPs to become Britain’s third prime minister in less than two months. Borrowing rates dropped between 45 and 60 basis points across all maturities, reverting to levels last seen before the announcement of the “mini” budget on September 23. Expectations of how far the Bank of England is going to raise interest rates were also scaled back, with the base rate once again expected to top out just under 5% in mid-2023—significantly down from the anticipated peak of 6.4% priced in at the end of September. That said, the Monetary Policy Committee is still expected to raise rates by 75 basis points to 3% at its upcoming meeting on November 3.

Please refer to Figures 3 & 4 of the current Multi-Asset Class Risk Monitor (dated October 28, 2022) for further details.

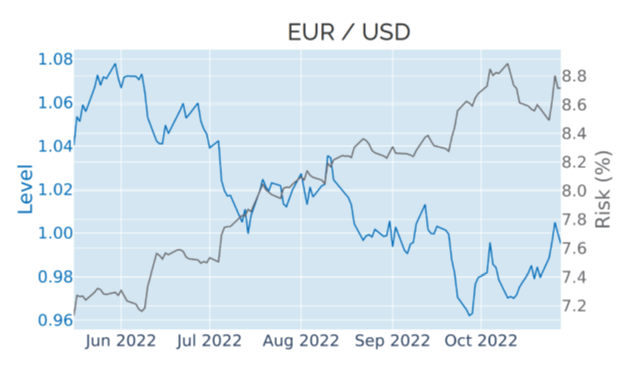

Euro reclaims dollar parity…for a day

The euro temporarily reclaimed parity with the US dollar for the first time in a month in the run up to last week’s European Central Bank meeting, but later relinquished part of its gains, as traders detected a ‘dovish’ tone during the subsequent press conference. The ECB governing council raised its policy rates by 0.75% as expected on Thursday, but when asked about the danger of pushing the economy into recession by tightening monetary conditions too aggressively, President Christine Lagarde conceded that council members were not “oblivious to the risk.” However, she also stressed that people on low incomes were more vulnerable “to the reality of inflation” and that the bank would, therefore, deliver on its mandate of price stability “using all the tools” it has.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated October 28, 2022) for further details.

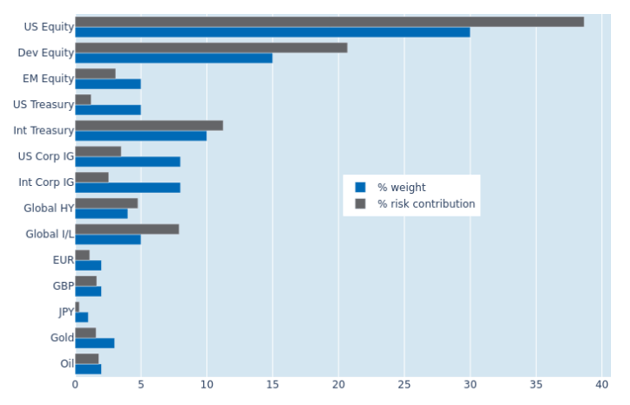

Increased correlations raise portfolio risk

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio rose slightly to 18.9% as of Friday, October 28, 2022, fueled by increased correlations between equity, interest-rate, and FX returns. Non-US government securities saw their share of total portfolio risk climb by 1.5% to 11.2%, as stock and bond prices rose in tandem with exchange rates against the US dollar. The risk contribution of the global high yield bucket more than quadrupled from 1.1% to 4.8%, as gains from lower interest rates and stronger currencies were further amplified by tighter credit spreads.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 28, 2022) for further details.