- Surging oil prices lift both inflation expectations and bond yields

- Dovish ECB keeps the short end of the Bund curve anchored, as long yields rise

- Risk appetites increase, but portfolio risk declines

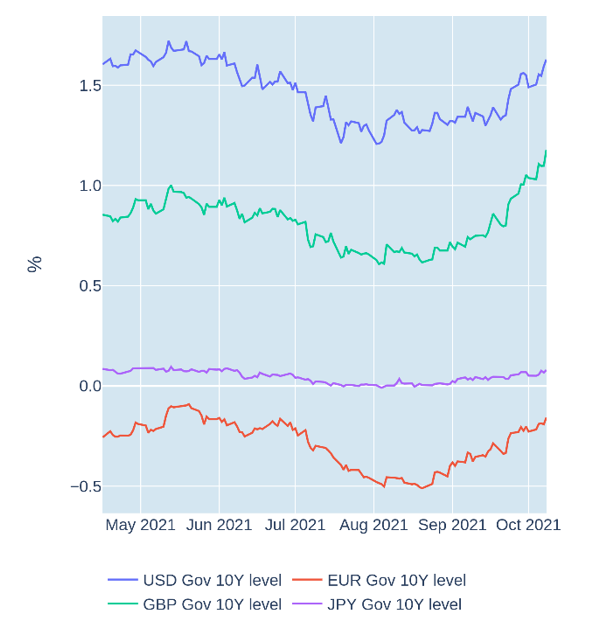

Surging oil prices lift both inflation expectations and bond yields

American and European sovereign yields climbed to their highest levels in over four months in the week ending October 8, 2021, as international oil prices soared to 3-year highs. Long US Treasury rates rose 0.14%, primarily driven by growing inflation expectations. The 10-year breakeven rate increased 12 basis points to 2.5%—a threshold surpassed only 10% of the time in the past 18 years. The moves reinforced analyst expectations that the Federal Reserve will announce a reduction in its $120bn-a-month asset purchase program in November. The weaker-than-anticipated non-farm payroll report released on Friday (194k new jobs, compared with a consensus forecast of 500k) did little to change that view.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated October 8, 2021) for further details.

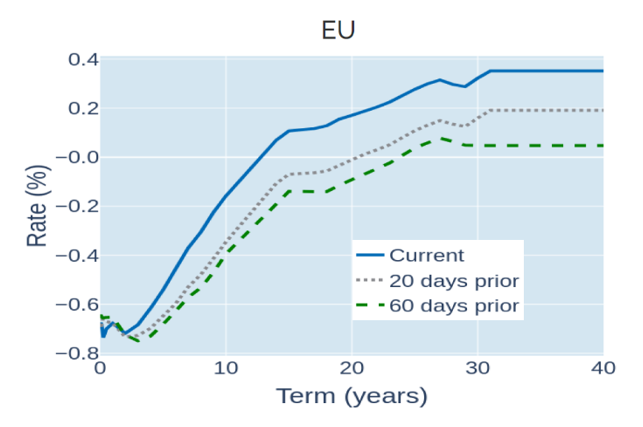

Dovish ECB keeps the short end of the Bund curve anchored, as long yields rise

Long German Bund yields followed their American counterparts higher in a parallel shift of 7 basis points, while the short end of the curve remained anchored at ultra-low levels. Unlike Britain and the US, the European Central Bank is not expected to raise interest rates anytime soon, keeping borrowing costs for maturities up to 5 years below the central-bank deposit rate of -0.5%. With the recent change in its inflation target—from an upper threshold to a medium-term average of 2%—the ECB governing council has given itself a bit more maneuvering room with regards to tightening monetary policy. However, the higher long-term yields do reflect increasing inflation concerns, as well as growing expectations of a cutback in the pandemic emergency purchase program.

Please refer to Figure 3 of the current Multi-Asset Class Risk Monitor (dated October 8, 2021) for further details.

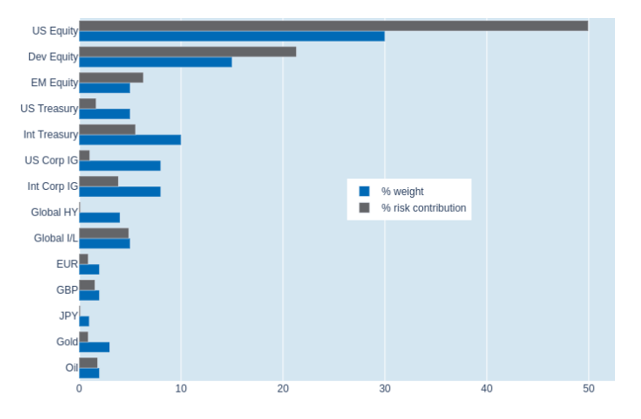

Risk appetites increase, but portfolio risk declines

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio fell one percentage point to 7.8% as of Friday, October 8, 2021, as share prices decoupled from exchange rates, while rising risk appetites meant that stocks and bonds once more moved in opposite directions. Thursday’s decision by the US Senate to temporarily raise the debt ceiling gave equity markets a boost, but the anticipation of increased borrowing also led to higher yields, causing Treasury prices to decline. The resulting diversification effect was notable across all fixed-income securities, which saw their combined share of total portfolio volatility drop by 4 percentage points. Oil, meanwhile, retained its low risk contribution of 1.8%, as crude prices remained largely uncorrelated with stock markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 8, 2021) for further details.