Stimulus or lockdowns? US and European yields diverge accordingly; Dollar falls as risk appetites rise; Portfolio risk falls despite higher equity volatility

Stimulus or lockdowns? US and European yields diverge accordingly

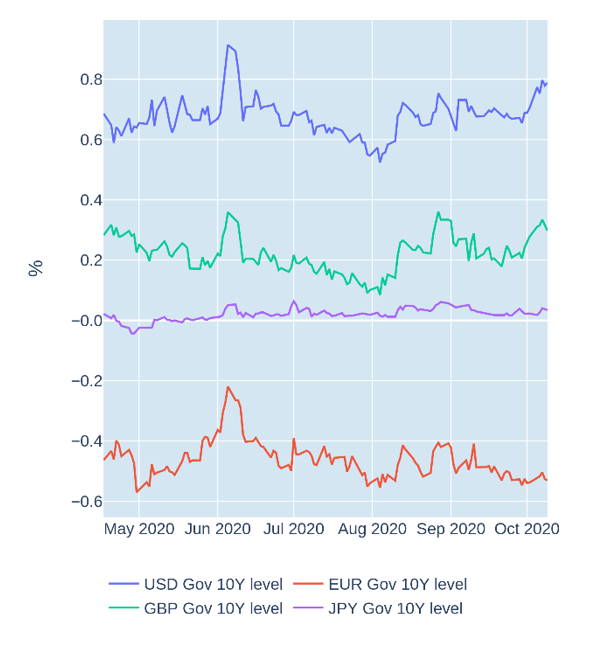

US Treasury yields rose to their highest levels since early June in the week ending October 9, 2020, as American blue-chip indices posted their strongest weekly gains in three months, propelled by renewed optimism about forthcoming fiscal support. Share prices in the United States rose to within 2.5% of their late-August peaks, after President Trump upped his proposed stimulus package to $1.8tn, following his return to the White House on Monday. German Bund yields, meanwhile, continued their sideways movement, as European investors remained considerably more cautious over a resurgence of COVID-19 cases and the potential reintroduction of lockdown measures. Though both Bund and Treasury yields remained within their respective six-month ranges, the gap between the two is now at its widest since the spikes at the height of the liquidity crisis in late March.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated October 9, 2020) for further details.

Dollar falls as risk appetites rise

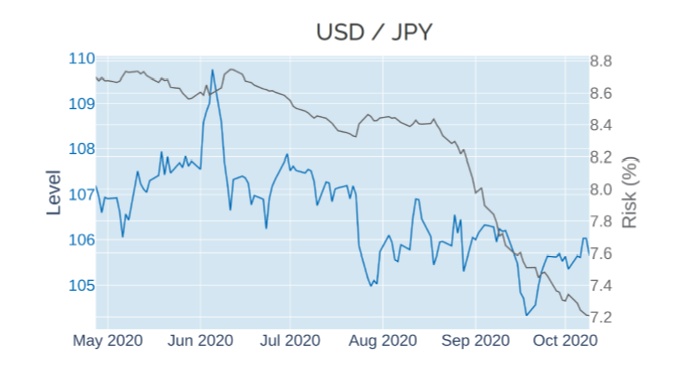

The US dollar depreciated 0.8% against a basket of foreign currencies in the week ending October 9, 2020, continuing the predominant pattern of rising share prices and weakening currency (and vice versa), which we have been observing over the past seven months. The losses were spread across a wide range of major trading partners, indicating they were driven by the dollar itself. The only notable exception was the Japanese yen, which devalued another 0.3% against its American rival. The latter underpins the notion that these exchange-rate movements were motivated by increasing risk appetites, as investors may have closed previous safe-haven positions. It was also accompanied by a further decline in predicted volatility for JPY/USD to levels last observed in mid-March.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated October 9, 2020) for further details.

Portfolio risk falls despite higher equity volatility

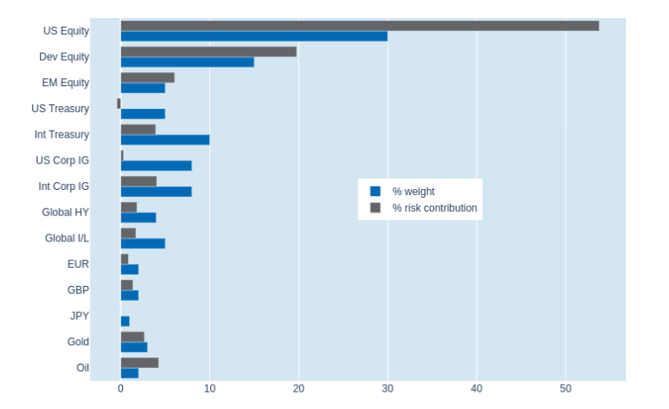

Short-term risk in Qontigo’s global multi-asset class model portfolio fell marginally to 9.4% as of October 9, 2020, as a slight increase in share-price volatility was offset by lower exchange-rate fluctuations and a weaker interaction of equity and FX returns. The risk reduction from the latter was most notable in the non-US sovereign and corporate-bond categories, where returns had been dominated by changes of local currencies against the USD. US stocks, meanwhile, were affected most by the rise in equity volatility, while the effect was more muted for their foreign counterparts, thanks to their reduced co-movement with FX rates.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated October 9, 2020) for further details.