Italian risk premium continues to rise, as political uncertainty persists; Gilt yields and pound rise on higher inflation; Portfolio risk falls on lower equity volatility

Italian risk premium continues to rise, as political uncertainty persists

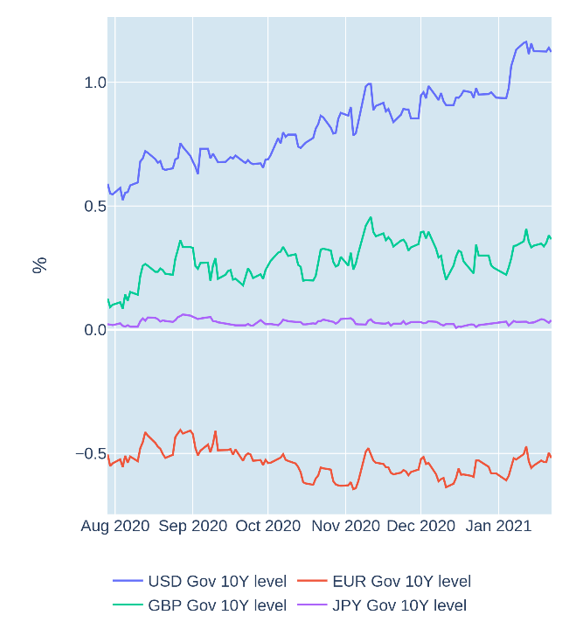

The risk premium of Italian sovereign bonds over their German equivalents continued to rise in the week ending January 22, 2021, driven by ongoing uncertainty over the stability of the governing coalition. The spread between 10-year BTPs and same-maturity Bunds rose to 127 basis points—its widest in 11 weeks—after Prime Minister Giuseppe Conti narrowly survived a confidence vote in the Senate but was still left without a majority in the upper house. The latter severely restricts the government’s ability to pass meaningful legislation, leaving it vulnerable and handicapped in a national emergency. Italy has the second-highest death toll in Europe with more than 85,000 dead—second only to the United Kingdom at 98,000 casualties.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated January 22, 2021) for further details.

Gilt yields and pound rise on higher inflation

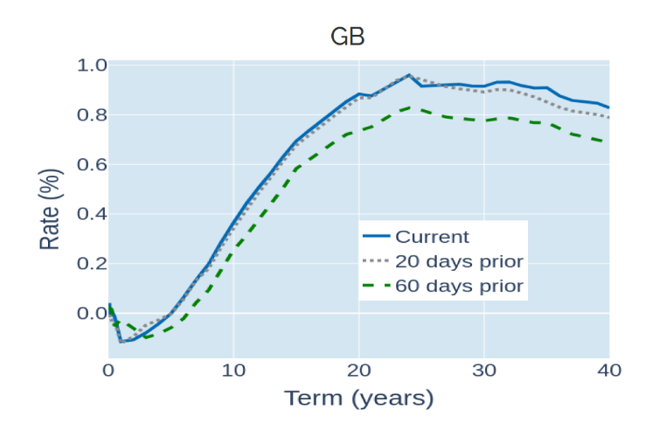

Yields on British Gilts rose across all maturities in the week ending January 22, 2021, as rising consumer prices in December slightly exceeded analysts’ expectations. Short-term interest rate futures ended the week marginally lower, implying a reduced probability of another rate cut from the Bank of England. That said, both futures markets and short government-bond yields still indicate the possibility of negative central-bank rates, albeit with a decreasing likelihood.

The pound reacted positively to the news, climbing above $1.37 on Thursday—its highest level since April 2018—as higher interest rates tend to make a currency more attractive. This was also reflected in its value against its continental European rival, which rose to an 8-month high of around €1.13.

Please refer to Figures 3 & 6 of the current Multi-Asset Class Risk Monitor (dated January 22, 2021) for further details.

Portfolio risk falls on lower equity volatility

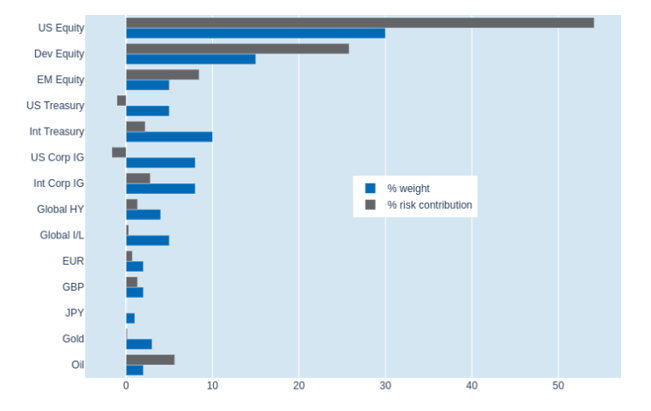

Short-term risk in Qontigo’s global multi-asset class model portfolio fell another 0.3% to 6.7% as of Friday, January 22, 2021, as the benefits of lower equity volatility were offset by a slightly stronger interaction with FX rates. The increased co-movement of share prices and exchange rates against the US dollar meant that the returns of non-US stocks appeared to be more volatile than those of their American counterparts. As a result, the decline in percentage risk for US equities of -2.2% was substantially higher than the -0.5% decrease for non-US developed markets—even when accounting for their relative market-value weights of 30% and 15%, respectively. Higher-rated corporate bonds, in contrast, saw their risk contributions increase, due to the ongoing strong relationship of share-price and credit-spread returns.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated January 22, 2021) for further details.