- Stocks and bond rise together, boosted by moderate jobs increase

- Euro drops amid diverging central-bank policies

- Portfolio risk drops on lower FX and equity volatility

Stocks and bond rise together, boosted by moderate jobs increase

Stock and bond prices rose in tandem in the week ending July 2, 2021, as US non-farm payroll data came in slightly higher than expected, but not enough to compel the Federal Reserve to raise interest rates sooner than anticipated. The US Labor Department reported on Friday that 850,000 jobs had been created in June—well above both the consensus forecast of 720,000 and the upwardly revised gain of 583,000 from the month before. The robust reading propelled American blue-chip indices to new all-time highs, but inflation expectations remained unaffected. The 10-year US Treasury breakeven rate held steady around 2.33%, well below the high of 2.55% recorded in mid-May. This indicates that market participants agree with the Fed’s narrative that the current strong consumer-price growth is likely to be temporary.

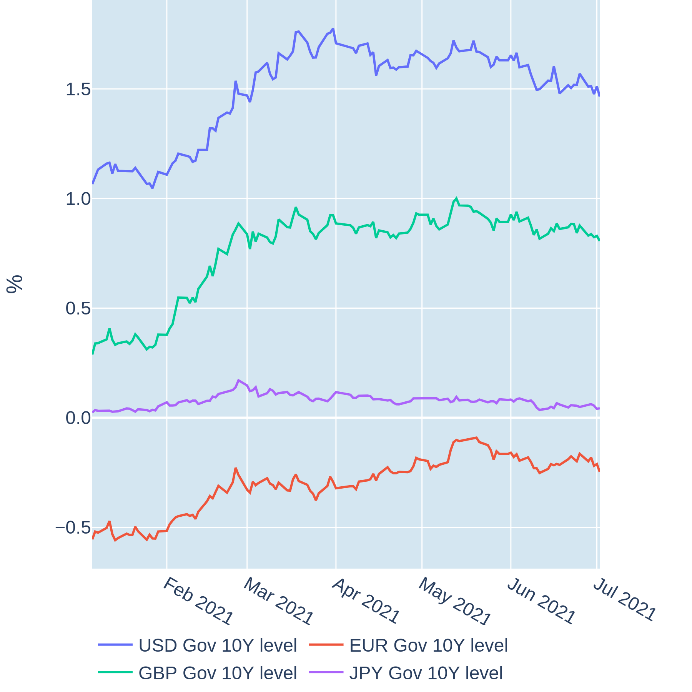

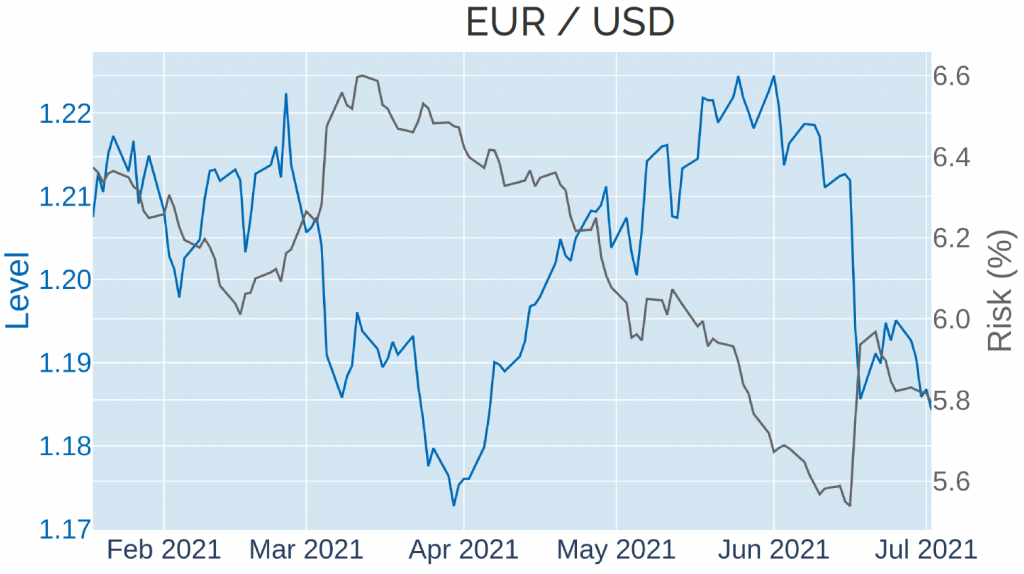

Euro drops amid diverging central-bank policies

The euro fell to its lowest level in nearly three months in the week ending July 2, 2021, amid divergent messaging from the world’s largest central banks. The common currency has lost more than 3% against its American rival since the beginning of June, as the European Central Bank is regarded considerably more ‘dovish’ than its counterpart on the other side of The Pond. ECB officials have repeatedly stressed in the past few weeks that the bank is likely to maintain its €1.85tn pandemic emergency purchase programme until at least March of next year. Decision makers at the Federal Reserve, in contrast, are already openly preparing financial markets for a winding down of its monetary stimulus measures.

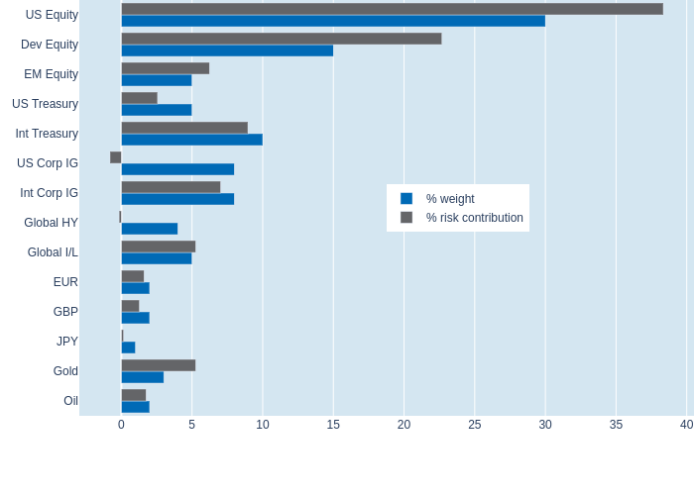

Portfolio risk drops on lower FX and equity volatility

Short-term risk in Qontigo’s global multi-asset class model portfolio dropped 0.9% to 6.3% as of Friday, July 2, 2021, thanks to a combination of lower FX and equity volatility. The decrease in overall risk was most notable in the equity categories, but non-USD fixed-income assets also benefitted from the weaker exchange-rate fluctuations. That said, high-quality international sovereign and corporate debt still showed significant positive contributions, due to the recent simultaneous rise in stock and bond prices. US corporate securities, on the other hand, profited from the low correlation of interest rates and credit spreads, even actively reducing total portfolio volatility.