- Yields drop amid concerns over Delta variant and economic growth

- Bund curve flattens, as ECB vows to keep rates low

- Portfolio risk falls, as strengthening dollar dampens local returns

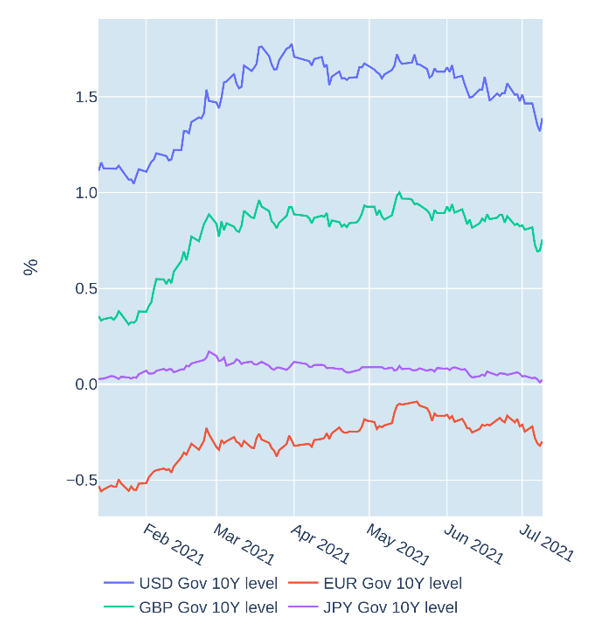

Yields drop amid concerns over Delta variant and economic growth

Global sovereign yields continued to fall in the week ending July 9, 2021, amid rising concerns over the Covid Delta variant and signs of a slowdown in economic growth. The 10-year US Treasury benchmark declined 15 basis points between Tuesday and Thursday, dropping below 1.3% for the first time since mid-February, but then recouped half of the losses on Friday, when share prices rebounded to another all-time high. On the other side of the Atlantic, German Bunds and British Gilts followed a similar path, falling in the middle of the week, before recovering on Friday, each closing 5 basis points in the red.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated July 9, 2021) for further details.

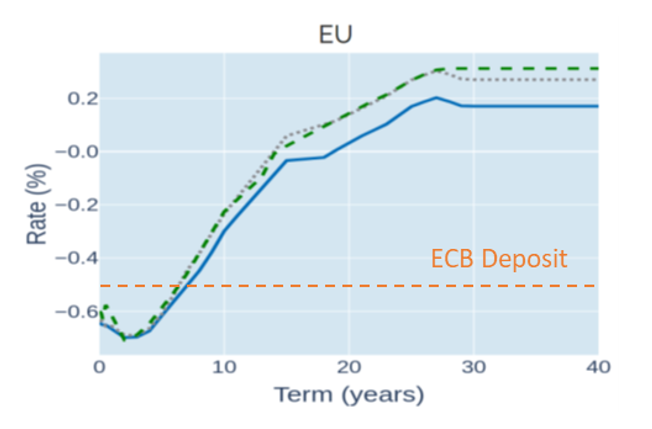

Bund curve flattens, as ECB vows to keep rates low

The Eurozone yield curve ‘bull’-flattened in the week ending July 9, 2021, as the 10-year Bund benchmark fell to its lowest level in three months, while the term spread over the 2-year point tightened to just under 40 basis points for the first time since late March. The shape of the curve indicates that traders do not expect any rate hikes for several years, with maturities up to 8 years yielding less than a central-bank deposit. This contrasts with the United States, where market players are tentatively pricing in the first short-term rate increases for 2023. The European Central Bank also gave itself more flexibility regarding potential future rate rises by changing its price-stability mandate from “below, but close to, 2% over the medium term” to a “symmetric 2% inflation target”—more in line with its British and American counterparts.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated July 9, 2021) for further details.

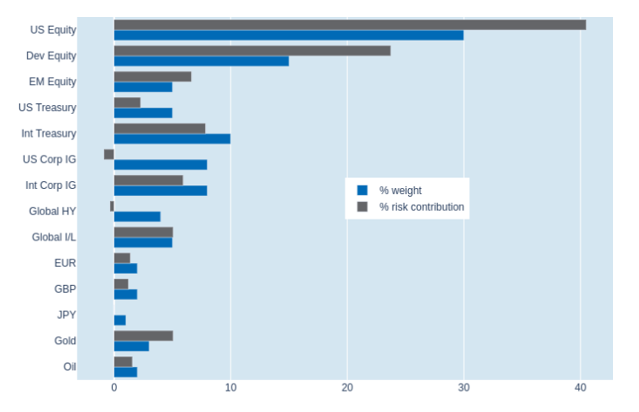

Portfolio risk falls, as strengthening dollar dampens local returns

Short-term risk in Qontigo’s global multi-asset class model portfolio fell by half a percentage point to 5.7% as of Friday, July 9, 2021, as the benefits of a lower equity-FX correlation were partly offset by marginally stronger share-price fluctuations. Since the beginning of June, the STOXX® USA 900 has gained 4.4%, while the dollar appreciated 2.6% against a basket of foreign currencies. This meant that gains in non-US securities were dampened by exchange-rate losses, reducing their perceived volatility in USD terms. That said, the biggest reductions in overall risk contributions—both in absolute and percentage terms—were recorded in the non-USD sovereign and corporate-bond categories.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated July 9, 2021) for further details.