- ECB emergency meeting supports peripheral Eurozone debt

- Swiss franc takes off after surprise rate hike

- Cross-asset sell-off squeezes diversification opportunities

ECB emergency meeting supports peripheral Eurozone debt

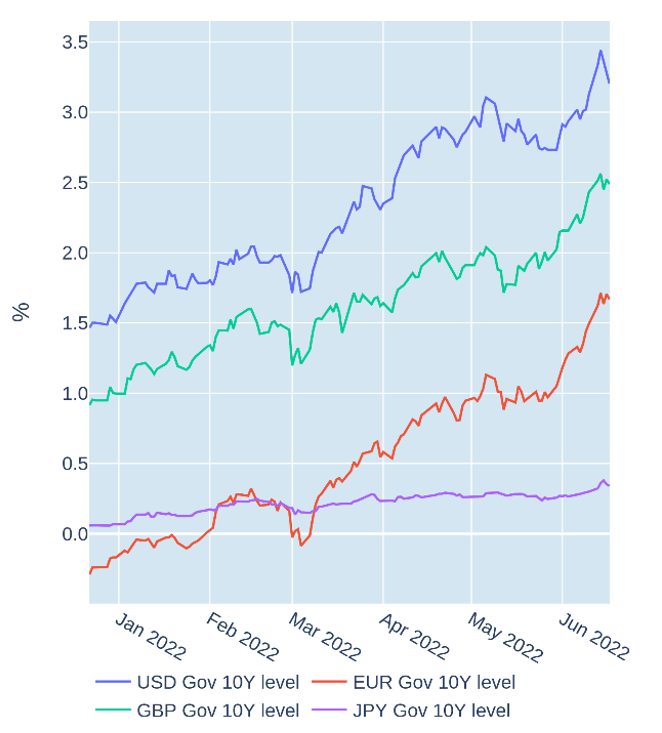

Yields on peripheral Eurozone sovereign debt eased off 8-year highs in the week ending June 17, 2022, as the European Central Bank “pledged to act against resurgent fragmentation” in the single-currency area. The ECB governing council convened an emergency meeting on Wednesday after borrowing costs on Italian and Spanish government bonds had risen to their highest levels since early 2014 in the wake of the previous week’s announcement that the central bank would end net purchases under its pandemic emergency purchase programme (PEPP) from July onward. However, the statement following Wednesday’s ad-hoc seemed to mitigate some of this, noting that “the Governing Council decided that it will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio.”

German Bund yields, in contrast, continued to climb alongside their British, North-American, and Swiss counterparts amid a flurry of monetary tightening from the respective central banks.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated June 17, 2022) for further details.

Swiss franc takes off after surprise rate hike

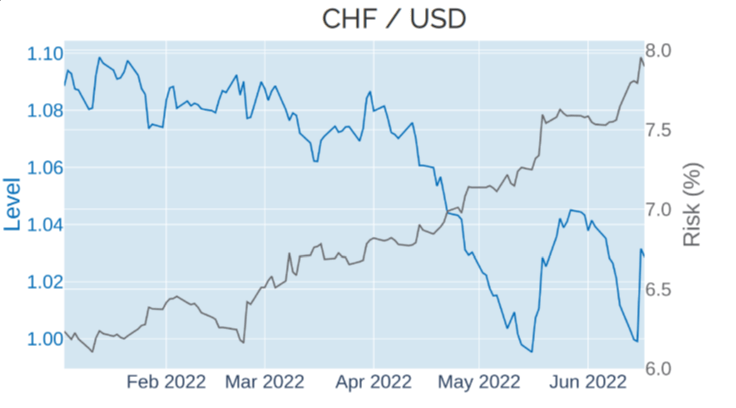

The Swiss franc gained 1.7% against the US dollar in the week ending June 17, 2022, as the country’s central bank raised interest rates for the first time in 15 years. The Swiss National Bank surprised market participants by lifting its benchmark rate from -0.75% to -0.25% in its first upward step since September 2007. The CHF bucked the downward trend of most other major currencies, which depreciated against the greenback in the wake of US Federal Reserve’s decision to raise its target rate by 75 basis points (the first hike of such a magnitude since 1994) in an attempt to curb the latest resurgence in consumer prices.

The British pound also received a boost from the Bank of England’s decision to increase its base rate by 0.25% on Thursday, although the exchange-rate gain was not big enough to offset losses incurred earlier in the week, meaning that GBP/USD ended the week 1.3% in the red.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated June 17, 2022) for further details.

Cross-asset sell-off squeezes diversification opportunities

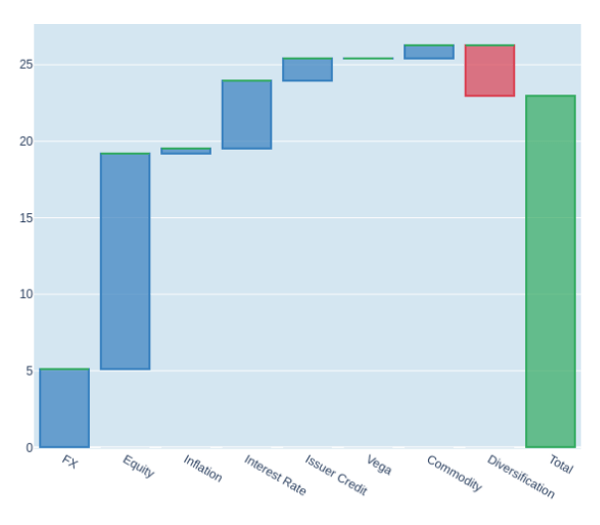

Predicted short-term risk in Qontigo’s global multi-asset class model portfolio soared 10 percentage points to 22.5% as of Friday, June 17, 2022, amid a perfect storm of higher asset-class volatilities and simultaneous sell-offs across almost all markets. As central banks startled investors with the forcefulness with which they hit the monetary brakes, global stocks recorded their worst weekly downturn since the onset of the COVID crisis in March 2020, while most fixed income assets experienced a third week of severe losses. Non-USD corporate bonds were hit hardest by a triple whammy of higher risk-free interest rates, wider credit spreads, and weaker exchange rates against the greenback. Any diversification opportunities were limited to gold and the Japanese yen, which were the only two assets with a relatively low correlation with other parts of the portfolio.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated June 17, 2022) for further details.