- Stocks and bonds rise together, as traders ignore Fed’s key inflation measure

- Strong inflation and low rates push dollar to 5-month low

- Portfolio risk keeps falling, but diversification remains limited

Stocks and bonds rise together, as traders ignore Fed’s key inflation measure

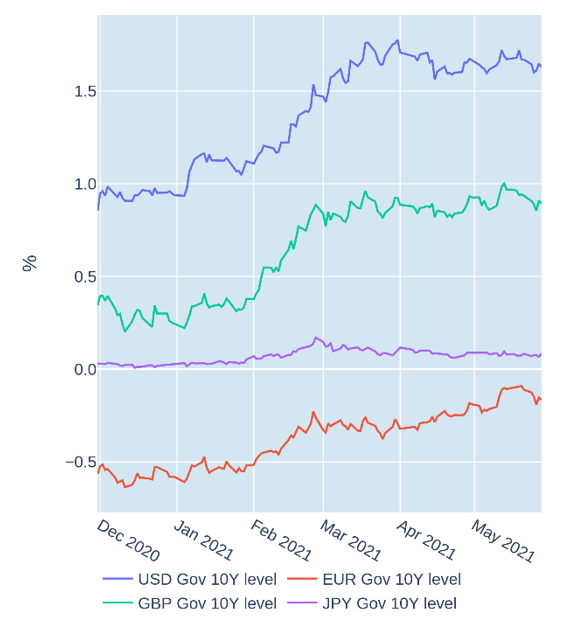

Stock and sovereign-bond prices rose in tandem in the week ending May 28, 2021, despite a sharp uptick in the Federal Reserve Bank’s preferred inflation measure. The core Personal Consumption Expenditures Price Index Excluding Food and Energy rose 3.1% in April, compared with a year ago, up significantly from the 1.9% increase recorded in March. It was also the biggest year-on-year increase since 1992. While a co-movement of equities and bonds is common in times of inflation concerns—either both falling when the economy is about to overheat or rising when consumer-price growth is slow—the direction seems unusual. Normally, an inflation reading substantially above the central bank’s stated target would prompt expectations of tighter monetary policy. Yet, with the Federal Reserve still stressing its plans to keep buying securities, it appears no one wants to bet against that purchasing power.

Please refer to Figure 4 of the current Multi-Asset Class Risk Monitor (dated May 28, 2021) for further details.

Strong inflation and low rates push dollar to 5-month low

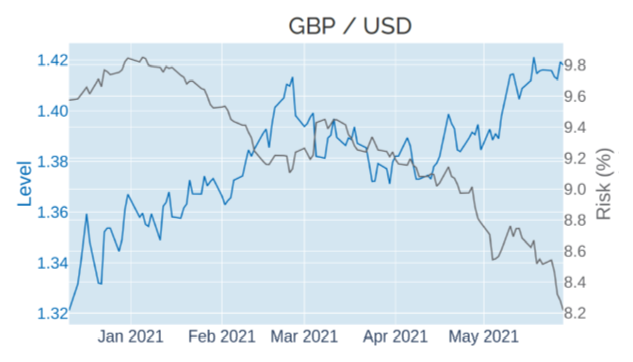

The US dollar briefly dipped to its lowest level since the start of the year against a basket of foreign currencies in the week ending May 28, 2021, as persistently high consumer-price growth and the ongoing expectation of low interest rates and loose monetary conditions continued to take their toll. The economic concept of relative purchasing power parity (RPPP) states that the currency exchange rate between two countries should be inversely related to the difference in their respective inflation rates. If prices in country A have grown more than in country B, country A’s currency needs to depreciate, so that a consumer from country B pays the same amount of money for a comparable basket at home and abroad. Given that inflation—both realized and expected—is currently much higher in the United States than in many European countries, RPPP suggests that the dollar should weaken further against, for instance, the euro and the pound. The latter derived additional support from several Bank of England rate-setters, who hinted that a base-rate hike could be in the cards as early as next year. Higher interest rates can also make a currency more attractive to foreign investors.

Please refer to Figure 6 of the current Multi-Asset Class Risk Monitor (dated May 28, 2021) for further details.

Portfolio risk keeps falling, but diversification remains limited

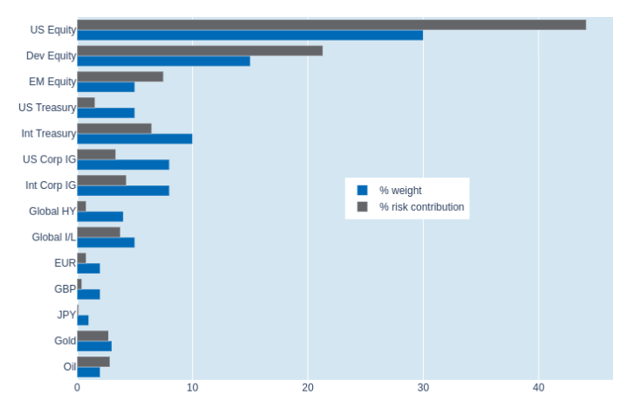

Short-term risk in Qontigo’s global multi-asset class model portfolio was once again slightly lower at 7.8% as of Friday, May 28, 2021, thanks to a further decline in both stock-market and exchange-rate volatilities. Accordingly, non-US developed equities experienced the biggest drop in their percentage risk contribution, from 23.3% to 21.3%. However, much of these benefits was offset by the ongoing co-movement of stock and bond prices. But it was the oil holding that saw the biggest surge in its share of overall portfolio volatility—at 2.2%—after a renewed uptick in its correlation with global stock markets.

Please refer to Figures 7-10 of the current Multi-Asset Class Risk Monitor (dated May 28, 2021) for further details.