Credit risk premia have been at pre-crisis levels for a couple of months now, and so has predicted risk for corporate bond portfolios. Low spread volatility and the recent surge in sovereign yields means that risk-free interest rates have once more become the dominant return driver for investment-grade securities. Yet the recent low correlation between rates and spreads could indicate that corporate bonds are now more vulnerable to increases in long-term government yields than they were 15 months ago, as higher rates will no longer be offset by tighter spreads.

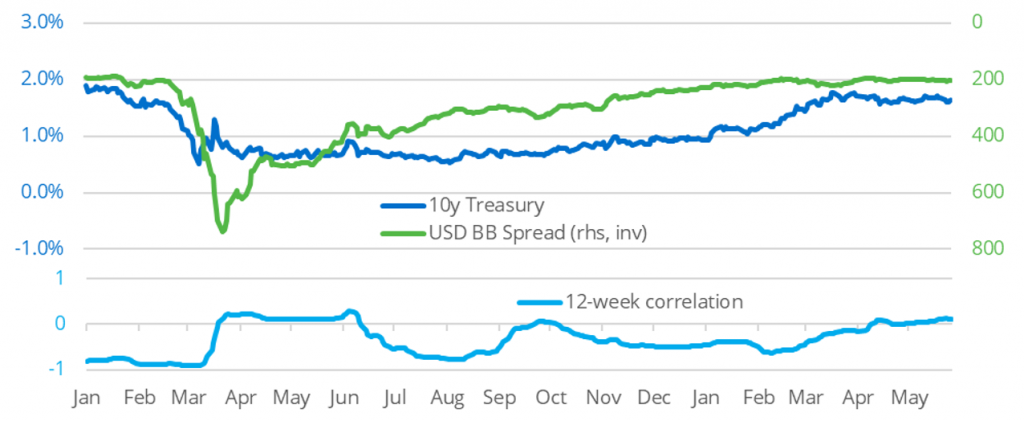

The green line in the chart below shows the average 5-year spread over USD swaps of global issuers with a BB rating—plotted against an inverted scale on the right—together with the 10-year US Treasury yield over the past 18 months. We see that at the start of 2020, the correlation between the two was firmly negative (almost -0.9), meaning that a rise in risk-free rates would have been partly offset by tighter credit premia, and vice versa. However, the relationship broke down in early March, when liquidity concerns led to simultaneous sell-offs in the equity, sovereign, and credit markets. The interaction turned negative again in the summer of 2020 and during the inflation concerns in February this year. But the two timeseries decoupled once more, when reassurances from the world’s major central banks helped stabilize yields again.

USD corporate bond spreads versus US Treasury yields

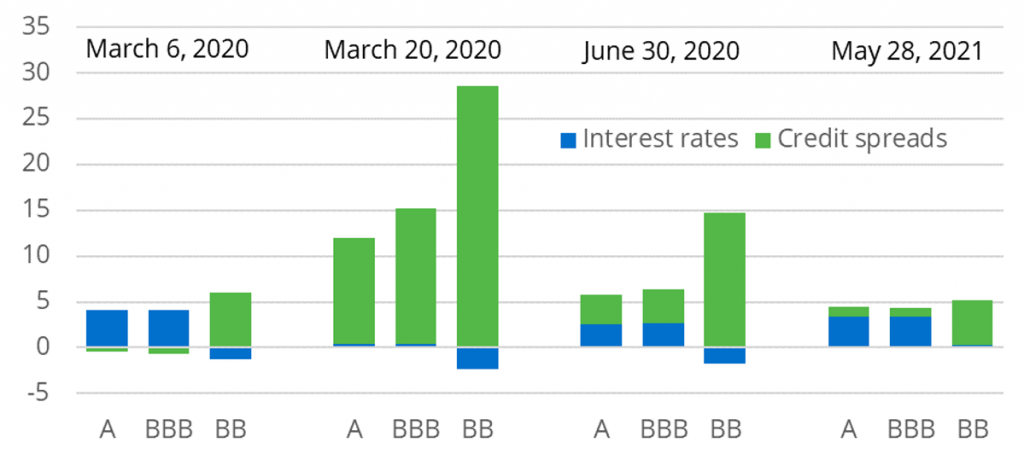

The combination of raised spread volatility and a near-zero correlation with risk-free rates at the height of the COVID outbreak in the spring of 2020 had a profound impact on the predicted risk of corporate bond portfolios. As we noted in our blog post Is BB the new BBB? in April last year, credit spreads became the predominant source of corporate-bond risk across all ratings, which contrasted with pre-crisis behavior, in which the risk and returns of investment-grade securities were primarily driven by changes in interest rates. The bar chart below shows the predicted volatilities for corporate bonds with a duration of seven years and with ratings ranging from single-A to double-B, calibrated on weekly returns over five years and a half-life of one year.

Predicted volatility for USD corporate bonds

The decomposition of the sources of risk highlights the progression during the crisis. Prior to early March 2020, predicted volatility across rating bands was relatively stable and homogenous at around 5%, though there was a clear distinction between investment grade and high yield in terms of what caused the risk. Higher quality securities seemed more sensitive to changes in risk-free rates, while opposing moves in credit spreads even slightly reduced price volatility. Lower rated debt, on the other hand, showed the exact opposite picture. Spreads then took over as the main source of risk for all levels of creditworthiness, when markets went haywire in late March, although high yield securities experienced a much larger surge in predicted volatility. Even when markets began to recover and calm down during the second quarter of 2020, credit risk remained prevalent.

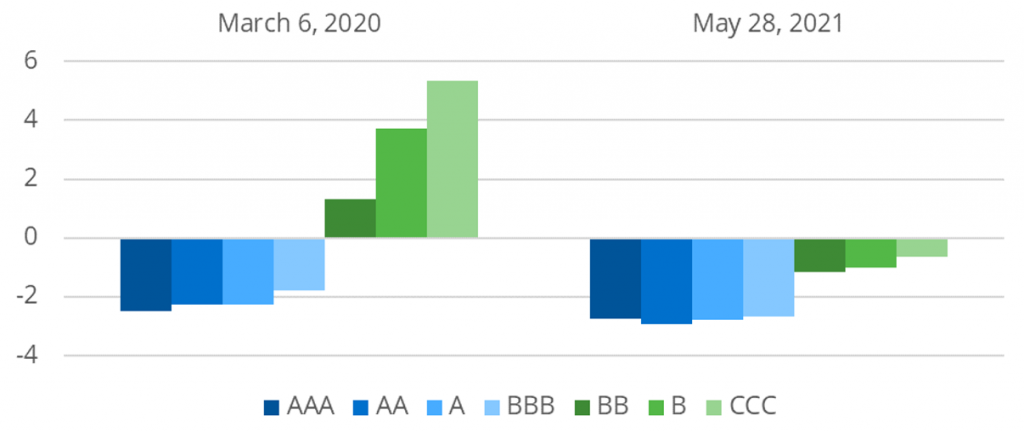

More recently, investment-grade returns have once more been driven by changes in risk-free rates, but it is worth noting that there is no longer a visible risk reduction from opposing rate and spread movements. This means that, if correlations were to remain as they are right now, an increase in sovereign yields could have a bigger negative impact on corporate bond prices than it would have had 15 months ago when the relationship was still inverse. In order to quantify the effect, we performed two stress tests: one based on correlations and betas prevalent over the three months ending March 6, 2020, and one for the current environment. The chart below shows simulated returns of USD-denominated bonds with a duration of seven years for a 50-basis point increase in the 10-year US Treasury yield, broken down by broad rating.

Simulated returns for a 50-basis point rise in the 10-year US Treasury yield

We see that the projected performances of the four investment-grade buckets are very similar in both scenarios—maybe marginally worse in the more recent environment. This confirms the notion that their returns are mostly sensitive to changes in risk-free rates. However, in the pre-COVID environment, the lower-rated securities would have shown a positive total return because of tighter risk premia. But now they also decline in value, as any benefit from lower spreads is predicted to be much lower.

Of course, the validity of this analysis rests on the premise that correlations between credit spreads and risk-free rates remain close to zero. That said, we think this assumption is not too unreasonable. Since the start of the year, spreads have not tightened further, despite a continuing rise in share prices. Plus, as noted above, they are now back to pre-crisis levels and not too far above their all-time lows. So, there is only limited room for them to fall further, while the renewed rise in sovereign yields has only just begun.