Qontigo has introduced the STOXX® Global Fintech 30 Index, a revenue-based thematic index that tracks the biggest companies involved in the financial-technology revolution.

The new index is derived from the STOXX® Global Fintech Index, which has returned more than four times its benchmark’s performance since inception in August 2018, but consists of a narrower number of large companies exposed to a theme that has gained precedence in our fast-digitalizing world and in particular this year.

Disruptive and ubiquitous

Fintech is the disruptive technology changing the way financial transactions are executed, easing the process, lowering costs and giving more autonomy to the end user. Behind its growth lies the rapid penetration of the Internet, increased consumer expectations, globalization, poor reach of traditional banking offerings, and favorable regulation.

The new technology has permeated all financial activities, from payments to stock trading and insurance underwriting, boosting the business of those companies running the backbone of the operations. Fintech is vastly remodeling the landscape for banks, asset managers, brokers, insurers, trading venues and retail.

Double-digit growth

This year, COVID-19 has accelerated the demand for digital financial transactions as consumers interact remotely. While the world’s economy is expected to contract this year, the global digital payments market, for example, is forecast to grow 40% from 2019 to more than $5.4 trillion.1 E*Trade, the leading online brokerage, has this year reported the highest customer trading activity in its 40 years of history. Fiserv Inc., which helps people, businesses and banks move money, has predicted it will have in 2020 its 35th straight year of double-digit growth in profits.

Targeting fintech’s winners with precision

The STOXX Global Fintech 30 Index selects the 30 largest companies by market capitalization within its parent index, comprised of businesses that have at least 50% of sales derived from more than 30 fintech-related sectors in FactSet’s Revere Business Industry Classification System (RBICS). The new index applies a daily trading filter to guarantee liquidity and is weighted by market capitalization. Compositions and weights are reviewed quarterly.

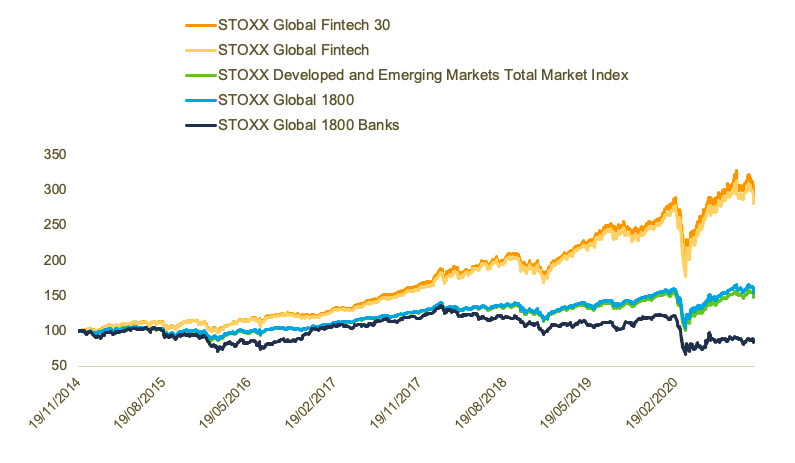

Figure 1 shows the performance of the STOXX Global Fintech 30 Index (in dark orange) since November 2014. Also featured are the STOXX Global Fintech Index (light orange), the benchmark STOXX® Developed and Emerging Markets Total Market Index (green) and the STOXX® Global 1800 Index (light blue). For comparison purposes, the chart also displays the STOXX® Global 1800 Banks Index (dark blue), which has lost 15% in the period.

Figure 1

The STOXX Global Fintech 30 Index nearly trebled in the period considered above and rose four-fold since data begins in June 2013. In February this year the index fell in line with the broader market as the COVID-19 outbreak sent shock waves across the economy and markets. Fintech stocks recovered all of the losses in just over three months, while the STOXX Global 1800 took six months to do so.

The RBICS sectors associated with fintech include blockchain technology, commodities trading, payment processing software, retail brokerages, financial and compliance software, money transfer and trade execution services, to name a few. As of launch, the STOXX Global Fintech 30 Index comprises companies in the Software, Financial Data, Investment Services, Transaction Processing and Professional Business Support ICB business sectors.

A suite of indices for the world of tomorrow

The STOXX Thematic Indices allow investors to target the most disruptive megatrends happening now and altering the outlook of tomorrow. They are designed to offer accurate exposure to the companies reaping the highest benefit and economic growth potential from change.

We are excited to help investors target these megatrends, bearing replicability, a rules-based methodology and transparency in mind.

Featured indices

STOXX® Global Fintech 30 Index

STOXX® Global Fintech Index

1 ResearchAndMarkets.com, “Digital Payments Global Market Report 2020-30: COVID-19 Implications and Growth.”