Qontigo is introducing a new family of indices that allows investors to take a comprehensive approach to biodiversity challenges.

Antonio Celeste is Director for Sustainability Product Management at Qontigo.

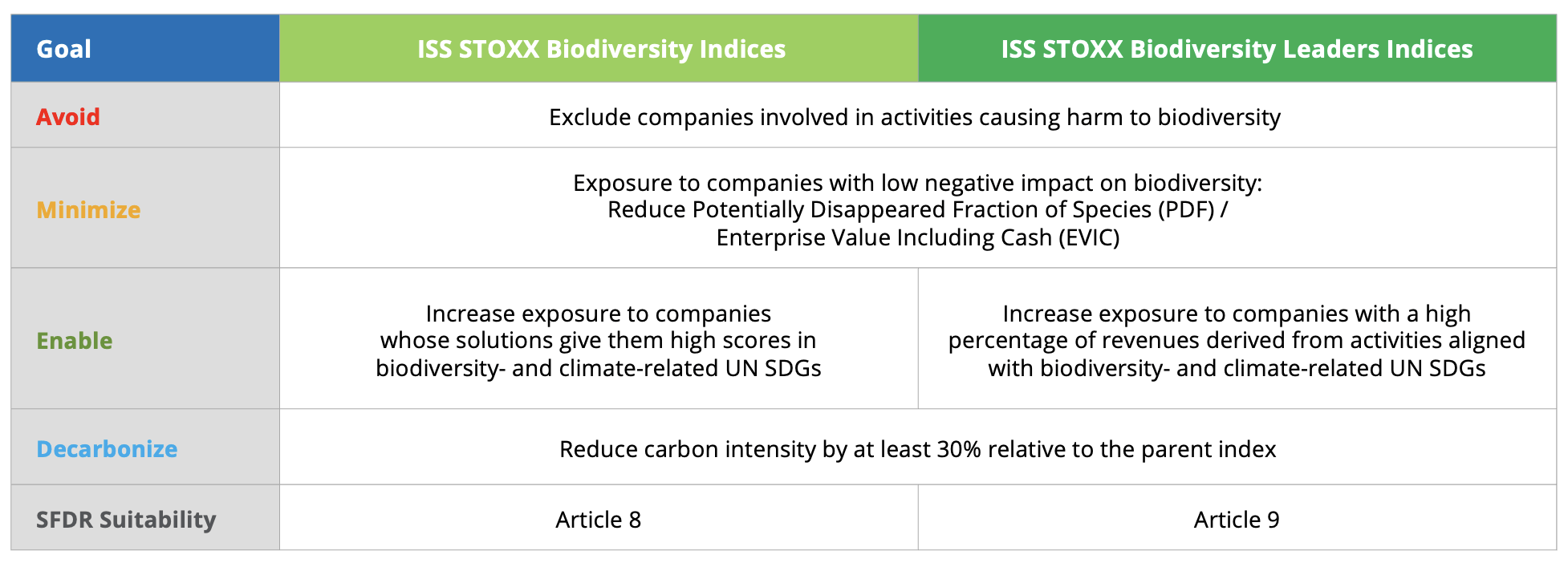

The new ISS STOXX® Biodiversity indices exclude companies involved in activities causing harm to biodiversity, select securities that have a positive impact on ecosystems and those enabling exposure to relevant UN Sustainable Development Goals (SDGs), and, finally reduce the portfolio’s carbon emissions. The overall objective of the indices is to allocate capital to companies that minimize their biodiversity footprint and help our world’s natural capital.

The background, COP15, implication for investors

COVID-19 highlighted the interconnection between species and crystalized the deep linkage between the environment and our lives.[1] Resource exploitation, climate change, pollution and the introduction of invasive species are among the main drivers behind the rapid degradation of the world’s land and water — and an average 69% decline in wildlife population since 1970.[2] One sole industry, food production, is estimated to have caused 70% of biodiversity loss.[3]

While ecosystems are essential for the wellbeing of humans and all living organisms, only 3% of global climate finance is currently spent on nature-based solutions.[4] Luckily, politicians and regulators are turning their focus to reverse this. At the 15th conference of the UN Convention on Biological Diversity (COP15) in Montreal last December, 196 states reached a landmark agreement to protect and restore 30% of the world’s land and water by 2030. For many observers, the Kunming-Montreal Global Biodiversity Framework (GBF)[5] accord could do for biodiversity what the Paris Agreement did for climate: become a tipping point for targeted investment flows.

In a 2021 blog post, we discussed biodiversity’s relationship with climate change, the related regulatory landscape and challenges with data, and why investors should care. In a follow-up article last December, we provided an update on the extreme deterioration of our nature systems. As example, the ecological footprint (the demand put on biocapacity) exceeds Earth’s biocapacity by at least 75% — the equivalent to living off 1.75 Earths.

In our second article we also argued that the need for investors to step up action is unequivocal. Those at the forefront of responsible investing are increasingly looking to integrate biodiversity considerations in portfolios, both as a risk-management exercise but also to tap opportunities with companies that are best positioned in biodiversity action through operations, products and services. The move to protect our habitats raises the regulatory liabilities for corporates and investors, already facing biodiversity-related physical, transition and systemic risks.[6]

It is within these considerations that Qontigo has introduced the ISS STOXX Biodiversity indices.

A thorough Biodiversity framework

The ISS STOXX Biodiversity indices address three different biodiversity goals and incorporate an additional climate objective (Figure 1). The indices are classified into two categories: “Biodiversity” and “Biodiversity Leaders.”[7] The former tilt exposure to companies with high scores in seven biodiversity- and climate-related SDG objectives, while the latter include companies with high revenues from products and services that restore climate or biodiversity.[8]

Indices in the first category comply with current Article 8 requirements of the Sustainable Finance Disclosure Regulation (SFDR), while those in the Leaders cluster are, as per present regulation, aligned with SFDR’s more ambitious Art. 9.

Figure 1: ISS STOXX Biodiversity indices framework

Four-step stock selection process

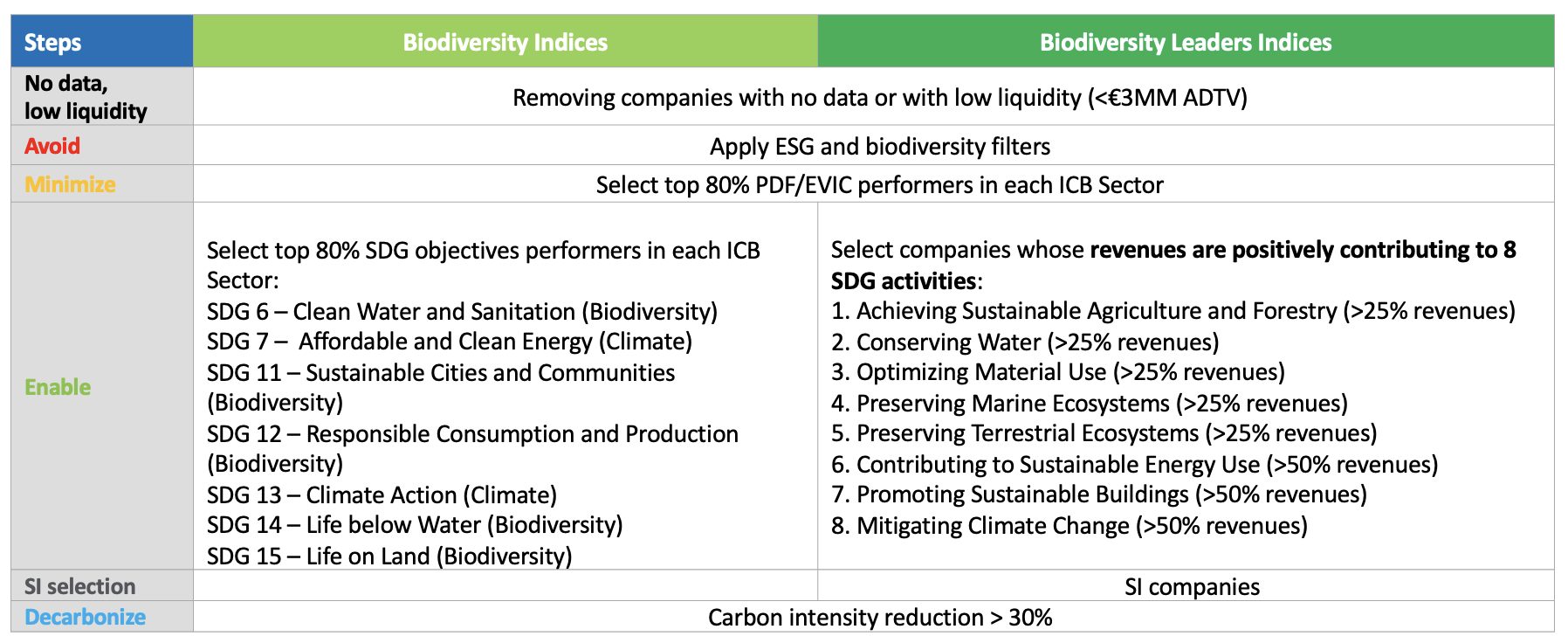

Figures 1 and 2 lay out the ISS STOXX Biodiversity indices’ building process. Its four main steps are described below.

1. Avoid

The indices exclude companies that are:

- in breach of the United Nations’ Global Compact and OECD Guidelines.

- involved in controversial weapons, tobacco, thermal coal, unconventional oil & gas, civilian firearms and military contracting.

- involved in specific biodiversity-related products and activities: palm oil, GMO agriculture, hazardous pesticides, animal testing for non-pharmaceutical purposes, fur & exotic leather production.

2. Minimize

Our partners at ISS ESG have developed the Biodiversity Impact Assessment Tool metric. The measure quantifies each company’s impact on biodiversity in great detail through a Potentially Disappeared Fraction of species (PDF) ratio. PDF represents — from a total preservation ratio of 0% to full destruction at 100% — the potential decline in species richness in an area over a period due to unfavorable conditions associated with environmental pressures.

PDF is then divided by each company’s EVIC[9] to get a more accurate and comparable picture of the real biodiversity impact of corporates. The indices select the top 80% companies in each ICB Sector by PDF/EVIC.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >3. Enable

In a third step, the indices select companies with the highest exposure to SDGs chosen for their impact on biodiversity and climate.[10] Here, the methodology differentiates between the Biodiversity and Biodiversity Leaders indices. In the former, we calculate each stock’s total SDG exposure score among seven SDGs and select the top 80% into the index. The latter adopt a more stringent approach by selecting only companies with high revenues (between 25% and 50%) in eight biodiversity- and climate-related SDGs activities. This screen creates a more focused SDG exposure for the Leaders indices.

4. Decarbonize

If the resulting portfolio doesn’t achieve a 30% carbon footprint reduction relative to the starting universe, companies are excluded by descending order of their carbon intensity until that target is met.

Sustainable investment alignment

Finally, only sustainable investment (SI) companies, defined by Qontigo as those that derive at least 20% of their revenues from products and services that make a positive net contribution to all 17 SDGs, are selected in the Biodiversity Leaders indices. The standard Biodiversity indices do not include this step.

Figure 2: Biodiversity indices’ methodology steps

The results

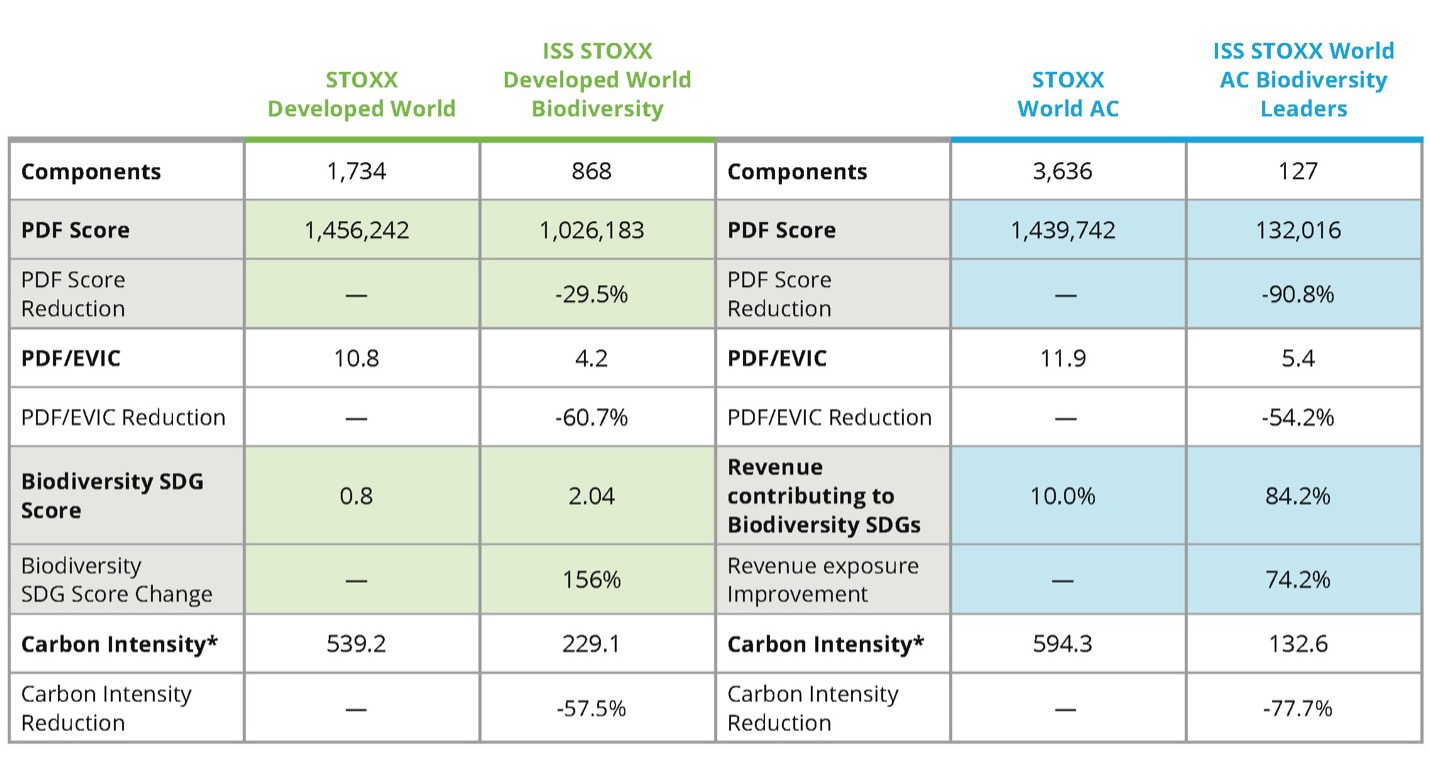

Our analysis shows that the ISS STOXX Biodiversity indices significantly improve both the overall PDF and SDG scores, and surpass the 30% carbon footprint reduction objective (Figure 3).

Figure 3: Results

Reversing the world’s fortunes

The fight to preserve our biodiversity is in essence addressing the survival of our civilization. As we have seen with climate action, investment flows can help turn the tide in the fortunes of our environment and species.

The ISS STOXX Biodiversity framework offers a complete toolkit for investors to customize existing indices incorporating additional objectives and constraints, in a transparent way and employing novel and sophisticated data. The customization possibilities can be further expanded by changing screens or thresholds, or using Qontigo’s Axioma optimization capabilities, with which investors can calibrate their desired results with heightened specificity.

On top of managing biodiversity risk and impact, the ISS STOXX Biodiversity indices can also help asset managers meet reporting obligations and channel sustainability engagement. All and all, facilitating the investment community’s journey as it does its part in an increasingly important topic.

To find out more about the ISS STOXX Biodiversity index suite, please visit our product page or schedule a meeting with our Sales team.

Request Info >

[1] The link is related to the fact that biodiversity loss reduces the natural barriers that prevent pathogens from moving from animals to humans as it forces wildlife populations into closer contact with human settlements. COVID-19 is not the first disease outbreak to be linked to biodiversity loss. Many other diseases, such as Ebola and SARS, have also been traced back to human activities that impact biodiversity.

[2] See “Living Planet Report 2022,” World Wide Fund for Nature (WWF).

[3] WWF, 2020.

[4] Source: “Nature Based Solutions Essential For Climate Mitigation,” National Geographic, 2020.

[5] The GFB features 23 targets to be achieved by 2030, also including the goal to reduce to near zero the loss of areas of high biodiversity importance and high ecological integrity, the phasing out or reformation of subsidies that harm biodiversity by at least USD 500 billion per year, and the mobilization of at least USD 200 billion per year from public and private sources for biodiversity-related funding. The accord also calls for requiring transnational companies and financial institutions to assess and disclose risks and impacts on biodiversity.

[6] Physical risks include the loss of raw materials and disruption of operating environments. Transition risks include policy shifts, change in market preferences and voluntary commitments. Systemic risks include global pandemics. Regulatory or litigation risks include increasing legislation.

[7] The standard Biodiversity category includes indices that cover the World All Countries, Developed World, Europe 600, Developed Europe, US, Asia-Pacific and Emerging Markets regions. The Biodiversity Leaders category indices cover the World All Countries region.

[8] ISS ESG’s SDG Impact Rating provides a holistic measurement of a company’s positive or negative impact on the 17 SDGs across more than 100 data factors. Companies are rated on a scale of -10 (significant negative impact) to +10 (significant positive impact).

[9] EVIC: Enterprise Value Including Cash.

[10] Selected SDGS are SDG 6 – Clean Water and Sanitation (Biodiversity); SDG 7 – Affordable and Clean Energy (Climate); SDG 11 – Sustainable Cities and Communities (Biodiversity); SDG 12 – Responsible Consumption and Production (Biodiversity); SDG 13 – Climate Action (Climate); SDG 14 – Life below Water (Biodiversity); SDG 15 – Life on Land (Biodiversity).