Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

News & Research

Most Recent News & Research

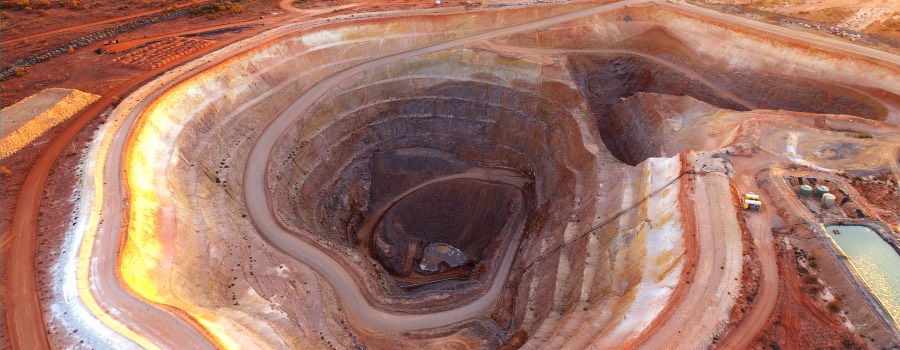

Prices for copper have climbed more than 10% this year as analysts speak of a new “secular bull market.” The positive sentiment has caught on shares of mining companies, with the STOXX® Global Copper Miners Index jumping 16.3% last month.

They have strong profitability, low volatility and have been quietly leading gains in the European equity market. The GRANOLAS – a group of 11 large, international companies – may have the right attributes for the current macro environment, argues Goldman Sachs.

The global benchmark jumped 3.2% last month for a quarterly gain of 9%. All regional indices rose as reports suggested the global economy has avoided a hard landing. Momentum is the best-performing factor for a second straight month.

Stocks gained for a fifth straight month in March, lifting the STOXX® Global 1800 index to a new all-time high, as investors raised their estimates for global economic growth.

Index | Events, Conferences & Webinars

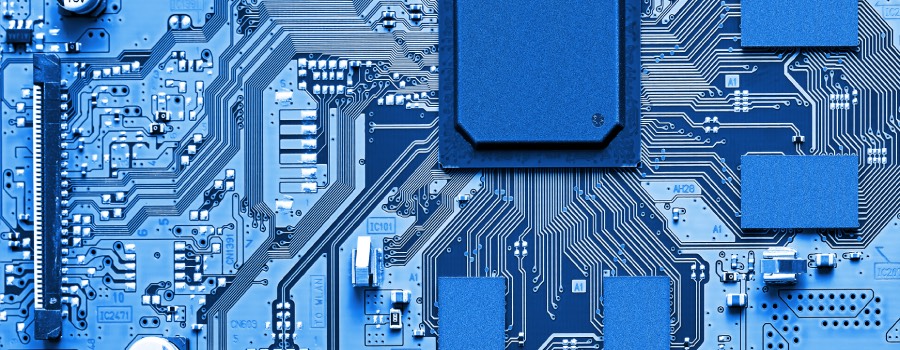

IPE Webinar: Digital Assets – Exploring a new paradigm in investing

The digital assets market is growing strongly, yet it still lacks the maturity of traditional markets. A blue-chip index can bring transparency, help standardize prices and enable institutional-level investment products, a panel of experts argued during the webinar.

A new report delves into the STOXX Digital Asset Blue Chip Index’s construction process to unpick the metrics used to select constituents that, much like in the equities world, stand for high quality and financial strength.

This report delves into the STOXX® Digital Asset Blue Chip Index’s construction process to unpick the crypto-native metrics used in asset selection. It also provides an analysis of what the index offers in terms of risk and returns and its prowess as a barometer of the underlying market.

Index | ESG & Sustainability

Natural capital ‘wake-up call’: Understanding portfolios’ impact and dependencies on biodiversity

As biodiversity garners increased attention and data availability expands, understanding its effect on portfolios becomes paramount. In our first edition of Perspectives, we spotlight how ISS ESG’s innovative methodologies can help assess a portfolio’s impact and natural capital dependencies.

The investment product has been listed on the Frankfurt Stock Exchange. The underlying index follows a best-in-sector selection methodology and has a unique blue-chip focus that selects assets based on specific crypto-market criteria for quality.

Index | New product launches

STOXX Licences First Crypto Blue Chip Index, Co-developed with Bitcoin Suisse, to Valour Inc.

STOXX Ltd., part of the ISS STOXX GmbH group of companies and a leading provider of benchmark and custom index solutions to global institutional investors, has licensed the STOXX Digital Asset Blue Chip Index to Valour Inc. The index, which marks STOXX’s entry into the digital asset space, will serve as an underlying for an exchange traded product (ETP) listed on Xetra, a leading trading venue for ETFs & ETPs in Europe. The index was developed in partnership with crypto-financial services provider Bitcoin Suisse.

The products offer market participants liquid exposure to an industry whose sales are booming on demand from artificial intelligence, mobile gadgets and electronic vehicles.

STOXX is expanding its range of DAX indices with the introduction of UCITS- and 10%-capped indices. The alternative capped indices are tailored to asset managers who must meet strict investment thresholds.