November 9 was a profoundly bad day for Momentum. In most regions we cover closely, Momentum’s return for the day was between seven and 10 standard deviations below expectations1, and the return was the worst of any day going back to 1999, according to Qontigo’s medium-horizon models. The year-to-date return for Momentum in the US went from positive to negative overnight, but remained positive in other regions, albeit far lower.

In both the US and the Worldwide model, the return on November 9 was about twice as negative as the next-lowest daily return. In Europe it was more than three times worse than the next-lowest day. Interestingly, returns in Japan and Australia were much higher than average, but in most other regions we track closely Momentum’s return was hugely negative—including in our new developed markets ex-US model, which also had its worst day since at least 1999.

And who/what was to blame? While Pfizer’s announcement of a 90%-effective COVID vaccine sent the market soaring, many of Pfizer’s competitors took a stiff hit. Most of those names had been performing well, and therefore had high Momentum scores, presumably in anticipation of one of them making “that” announcement. Similarly, Information Technology names had been expected to continue to prosper—and were all high on the Momentum list—with the likelihood of more lockdowns looming. Granted, investors were already becoming concerned about certain Info Techs, namely Facebook, Alphabet (Google), Amazon and Netflix (i.e., 4/5s of the FAANGs), and their Momentum scores had been slipping.

However, the poor performance of Momentum was largely the result of stocks with poor Momentum that flipped and surged, driven by hopes that the vaccine will finally enable people to safely leave their homes, and perhaps go shopping, to an office, fly somewhere and stay at a hotel, or take a cruise. Names in those industries had been pummeled, meaning their poor Momentum may have been accompanied by looking relatively cheap.

The bottom-line impact of Monday’s news was to send Momentum down, and value-oriented factors up—and not just in the US.

Momentum’s Loss Was Other Factors’ Gain?

The day was not only volatile for Momentum. In the US model, nine of 12 factors produced returns of more than two standard deviations away from their long-term averages. Volatility and Market Sensitivity both produced positive returns that were more than five standard deviations above average, whereas Growth’s negative return was almost five standard deviations below average. Value-oriented factors also had a very good day, with Value and Earnings Yield producing returns two standard deviations above average and Dividend Yield almost five above in the US. All three of those factors have substantial ground to make up, so it seems way too early to herald the end of the value drought. Profitability—mainly in the US—had it tough, as investors appeared to cease viewing those characteristics as scarce resources.

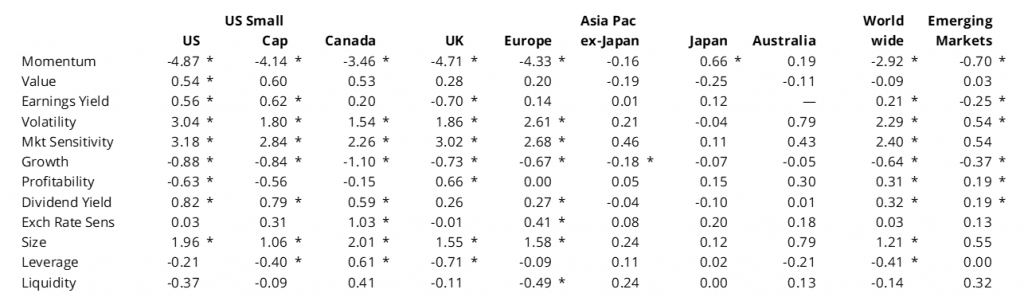

The table below shows returns for Monday, November 9, across most major regions. An asterisk next to the factor return indicates it was at least two standard deviations away from its long-term average.

Factor results were similarly outsized in magnitude and number for US Small Cap, Canada, UK and Europe, as well as in the broad Worldwide and Emerging Markets models. Asian markets were largely spared the drama on Monday, but if history is any guide (as we saw in the Quant meltdown of 2007, for example) they may face a storm today.

Portfolio Impact — Factor Diversification Probably Did Not Help.

We used our US multi-factor “Sample Factor Portfolio” as a proxy for performance of multi-factor strategies, to see if the positives from yesterday outweighed the negatives. Unfortunately, the drag from Momentum was much higher than the benefit of a positive bet on Value and Earnings Yield. The portfolio overall lagged its benchmark by 1.6% in just one day.

Conclusion.

It is, of course, difficult to know if this performance will continue. The nature of our Momentum factor (12-month return excluding the last month) means that it can take a while for factor loadings to change. If the vaccine means all those things mentioned above will actually happen, it may not be reflected in Momentum scores for a while. In the case of Value, yesterday’s storm may provide much-needed rain after a drought, but it is likely to be far more destructive to those who bet on Momentum.

1 Based on predicted volatility of the medium-horizon model as of November 6.