Continue active refreshing of this index's data?

Continue active refreshing of this index's data?

Latest Whitepapers

Index | Whitepapers

WORKING PAPER: Understanding Investor Preferences through Passive Investment Flows

In this paper, we use the transparency afforded by ETFs to analyze investor flows, but also look through to the underlying holdings, to understand the time-varying preferences of passive investors. We have found that year on year, there is a great deal of variability in style, industry and regional exposures. However, these exposure preferences tend to be neutral over longer time frames. This is in contrast to a consistent preference for performance, reflected by flows going towards ETFs with strong in-year returns.

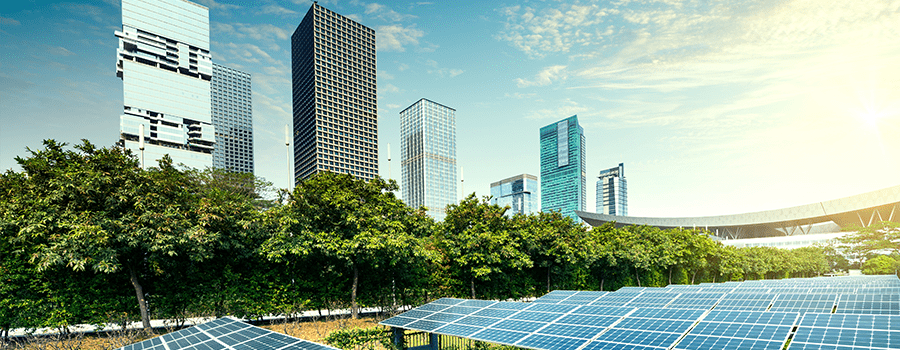

Transaction costs play a crucial role for any investor considering adopting sustainable principles in their investments. This study from ISS LiquidMetrix and STOXX investigates the costs, and cost efficiencies, of shifting a benchmark portfolio of European equities to climate-transition versions.

Index | Whitepapers

ISS STOXX® Biodiversity Indices: How to Incorporate Biodiversity Considerations in Index Construction

Biodiversity is vital for our planet and society. With the emergence of the Kunming-Montreal Global Biodiversity Framework, investors are gaining a better understanding of biodiversity-linked risks and opportunities in their portfolios. This paper begins by exploring the current metrics available for assessing the biodiversity footprints of companies. It then describes the ISS STOXX framework for building biodiversity indices, based on three fundamental steps: “Avoid,” “Minimize,” and “Enable.”

In this paper, we explore the rationale and methodology behind the construction of the index. We start by explaining the concept of megatrends and how they can be captured through thematic indexing, using a multifaceted approach. We look as well at the index performance before concluding with an outlook on the opportunities for the Metaverse in the years to come.

In this paper, our goal is to show how sustainability ETF exposures to a number of sustainability-related factors may vary. It is eminently clear to us that investors with a view about key sustainability features cannot rely on the fund name, but instead need to do more digging into whether their fund meets the required criteria.

The recent launch of the STOXX U.S. Equity Factor Index, which underlies the iShares U.S. Equity Factor ETF (LRGF), highlights the real-world performance benefits of a factor-based approach that seeks to manage risk relative to a capitalization-weighted benchmark.

Index | Thematic Investing

The future of school and play: STOXX Global Digital Entertainment and Education Index

The STOXX Global Digital Entertainment and Education Index captures the global digital transformation of entertainment and education – a long-term structural change. The individual characteristics of the stocks in this index are what set it apart: the Specific Return factor made the largest positive contribution to the seven-year return of all the indices in the study.

Term spreads have risen in multiple regions around the globe, as long-term sovereign yields soared amid rising (expected and actual) inflation but central banks took longer to raise short-term interest rates. The impact of this on international real estate has mostly been positive over the past two-and-a-half years.

Index | ESG & Sustainability

The International Real Estate Index — A hedge against expected inflation

Real estate has long had the reputation of being at least a partial hedge against inflation, since both rental income and property values typically respond positively to inflationary pressures. The iSTOXX Developed and Emerging Markets ex USA PK VN Index has lived up to this reputation historically and is continuing to do so in the current inflationary environment.

Index | ESG & Sustainability

Holding the world in your portfolio and considering climate transition risks

The STOXX WTW Climate Transition Indices are a new approach to managing climate risk that offer investors a systematic and transparent way to incorporate climate transition risk into their investment decisions.

Index | ESG & Sustainability

Want to incorporate SDG exposures into your portfolios? There’s no such thing as a (risk) free lunch, but here’s a way to do it…

This paper focuses on creating SDG portfolios that maximize exposure to one, two or all SDGs. The study shows that it is quite possible to create a portfolio that significantly improves the exposure to SDGs without taking on too much active risk. An optimizer can help manage that active risk.

Index | Thematic Investing

Thematic investing in the current climate – A more focused approach to sustainable and future-proof investing

The Russian invasion of Ukraine spooked equity investors around the world, but losses were not distributed equally across all sectors, with some industries even exhibiting positive returns. This opens up opportunities for more focused strategies such as thematic investing.