Qontigo has expanded its suite of multifactor indices in collaboration with BlackRock, taking a balanced, modern and well-researched style factor approach to four additional strategies.

The four indices are:

STOXX® Global Equity Factor1

STOXX® Emerging Markets Equity Factor

STOXX® U.S. Small-Cap Equity Factor

STOXX® International Small-Cap Equity Factor2

All four will underlie respective ETFs by BlackRock’s iShares. They complement the existing STOXX® U.S. Equity Factor Index and STOXX® International Equity Factor Index3, which were adopted last June by the US asset manager to revamp its multifactor ETF offering. The STOXX Equity Factor indices were designed as core equity solutions that deliver above-average exposure to five factors: Quality, Value, Momentum, Low Size (small capitalization)4 and Low Volatility, while being mindful of diversification considerations and unintended systematic exposures, and offering low tracking error.

Multifactor investing continues to attract strong interest as a way to distribute allocations across several sources of return premia. Constructing multifactor indices with an optimized approach around exposures and risk targets helps to avoid unintended and uncompensated bets such as a strong overload to one individual factor, and prevents large deviations from the benchmark or excessive transaction costs.

“Built effectively, factor strategies can avoid the inherent pitfalls of style-premia harvesting and cyclical headwinds, leading to long-term outperformance,” said Arun Singhal, Qontigo’s Global Head of Index Product Management. “The STOXX Equity Factor indices can achieve that by combining the indexing expertise of STOXX with Axioma’s leading risk factor models and optimization capabilities. Encouraged by investor response from the first set of products transitioned to STOXX Equity Factor indices, we are pleased to expand the suite and to continue strengthening our partnership with BlackRock.”

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Index overview

The new indices are derived from STOXX’s broadest equity market universe, STOXX® World, a suite that allows investors to slice and dice global markets into flexible and modular investment blocks. From each parent index, constituents are selected and weighted through an optimization process that leverages the Axioma portfolio optimizer and seeks to maximize exposure to a multifactor alpha signal, derived from the combination of the five targeted factors (Exhibit 1).

Each factor follows fundamental metrics and quantifiable indicators that have proved to best capture the targeted style risk premium. These robust and contemporary factor definitions are key to driving returns and reducing risk.

Exhibit 1 – Target factors

During the optimization, the indices embed diversification considerations by applying caps across sectors, countries, individual companies and single-factor exposures. The methodology also controls for turnover and liquidity, and provides beta and tracking error ratios that don’t diverge significantly from the broad market. The optimization enables the balancing of multiple investment objectives, including the desire for above-average exposures to multiple factors, with practical portfolio and trading elements.

Control of systematic exposures

The systematic limits on how much the index can be tilted toward any single factor create diversified factor profiles and prevent the indices from loading too much (or not enough) on one individual factor, which is a common issue faced by many existing multifactor strategies. As individual factors often exhibit market cyclicality, meaning they can be in or out of favor at different points of the market cycle, diversified factor exposures can play an important role in balancing this cyclicality and mitigating prolonged periods of potential underperformance.

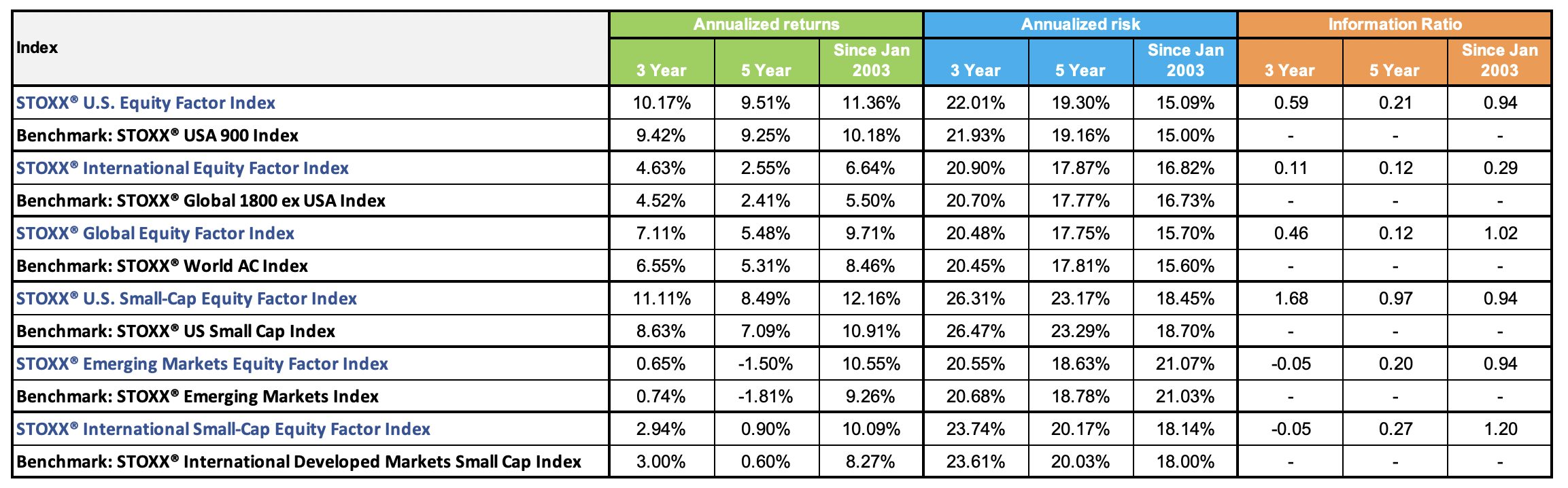

On Qontigo’s backtested analysis, the STOXX Equity Factor indices have exhibited consistent target factor exposures over time. The strategies have also outperformed the market over different periods while showing similar risk (Exhibit 2).

Exhibit 2 – Performance comparison

Factor customization as value proposition

Because of its full-market-cycle performance potential, many investors tend to leverage a multifactor strategy in their core equity allocation. Factors, after all, are the long-term drivers of equity market returns. An efficient factor investing solution can be used in a strategic allocation or even in a dedicated factor investing sleeve.

As investors consider their options in factor strategies, they should thoroughly evaluate the methodology, exposures and characteristics of each solution to ensure an appropriate outcome. The STOXX Equity Factor indices represent a unique, rules-based and transparent offering that has been designed in collaboration with the client to meet their objectives, combine both teams’ know-how and innovation, and deliver a powerful and enhanced value proposition.

1 Index covers developed and emerging markets.

2,3 Indices cover developed markets.

4 The STOXX International Small-Cap Equity Factor Index and the STOXX U.S. Small-Cap Equity Factor Index do not include low size as a target factor.