A modern multifactor solution

Factor investing is in Qontigo’s DNA, with over two decades’ work in factor-based indices and analytics. The recent launch of a new multifactor index series — the STOXX Equity Factor Indices — is the latest extension to Qontigo’s robust offering in the factor investing space.

The STOXX® U.S. Equity Factor Index and the STOXX® International Equity Factor Index were designed as core equity solutions that deliver above-average exposure to five factors: Quality, Value, Momentum, Low size and Low volatility. They also include diversification considerations across sector, countries, individual companies and single factor exposures, as well as providing low turnover and tracking error relative to the broad market.

The indices have been chosen by BlackRock to underlie respective iShares ETFs, as the US asset manager revamps its multifactor fund offering.

Multifactor investing continues to attract strong interest as a way to distribute allocations across several sources of return premia. Constructing multifactor indices with an optimized approach around exposures and risk targets helps to avoid unintended and uncompensated bets such as a strong overload to one individual factor, and prevent large deviations from the benchmark or excessive transaction costs.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Index overview

The new indices start with a broad equity market universe: the STOXX® USA 900 for the STOXX U.S. Equity Factor Index and the STOXX® Global 1800 ex USA for the STOXX International Equity Factor Index. From there, constituents are selected and weighted through an optimization process that seeks to maximize exposure to a multifactor alpha signal, derived from the combination of the five targeted factors (Figure 1). Each factor follows fundamental metrics and quantifiable indicators academically proven to drive returns and reduce risk.

Figure 1: Target factors

The optimization enables the balancing of multiple investment objectives, including the desire for above-average exposures to multiple factors, with practical portfolio and trading elements such as diversification, turnover and tracking error considerations. These include market-relative caps on sector and country weights as well as absolute and market-relative limits on individual security weights.

Factor diversification

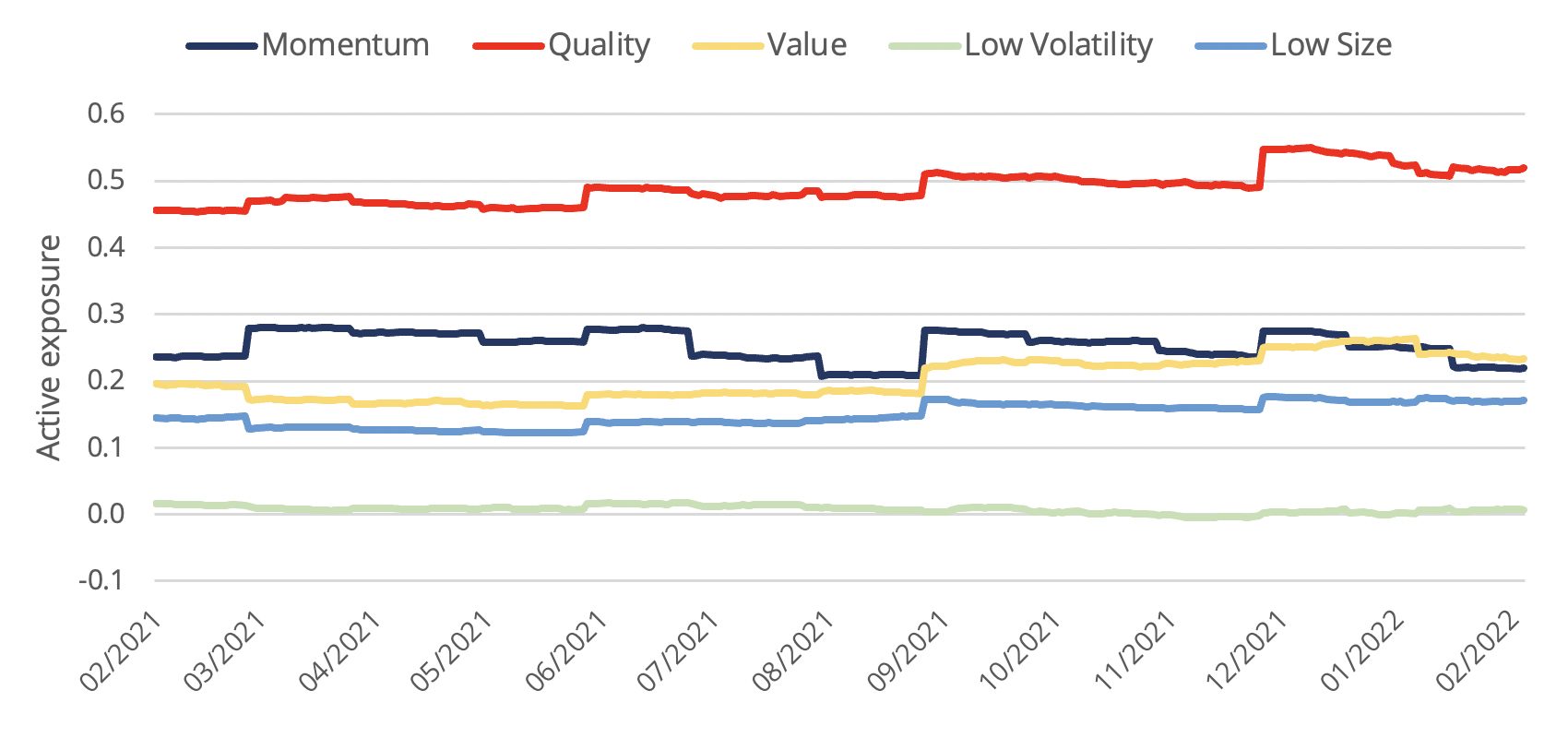

Additional considerations include criteria around systematic exposures, or how much the index can be tilted toward any single factor. These rules create diversified factor profiles and prevent the indices from loading too much (or not enough) on one individual factor, which is a common issue faced by many existing multifactor strategies. As individual factors often exhibit market cyclicality, meaning they can be in or out of favor at different points of the market cycle, diversified factor exposures can play an important role in balancing this cyclicality and mitigating prolonged periods of potential underperformance.

By design, these indices solve for this common problem, and the STOXX Equity Factor Indices have exhibited consistent target factor exposures over time. Figure 2 displays the historical active exposures to the target factors for the STOXX International Equity Factor Index.

Figure 2: Targeted factors – active exposure overtime

Overall, this multifactor approach can be a powerful strategy to target long-term potential outperformance, offering investors an efficient factor investing solution that be used in a strategic allocation or even in a dedicated factor investing sleeve.

Multifactor as a core holding

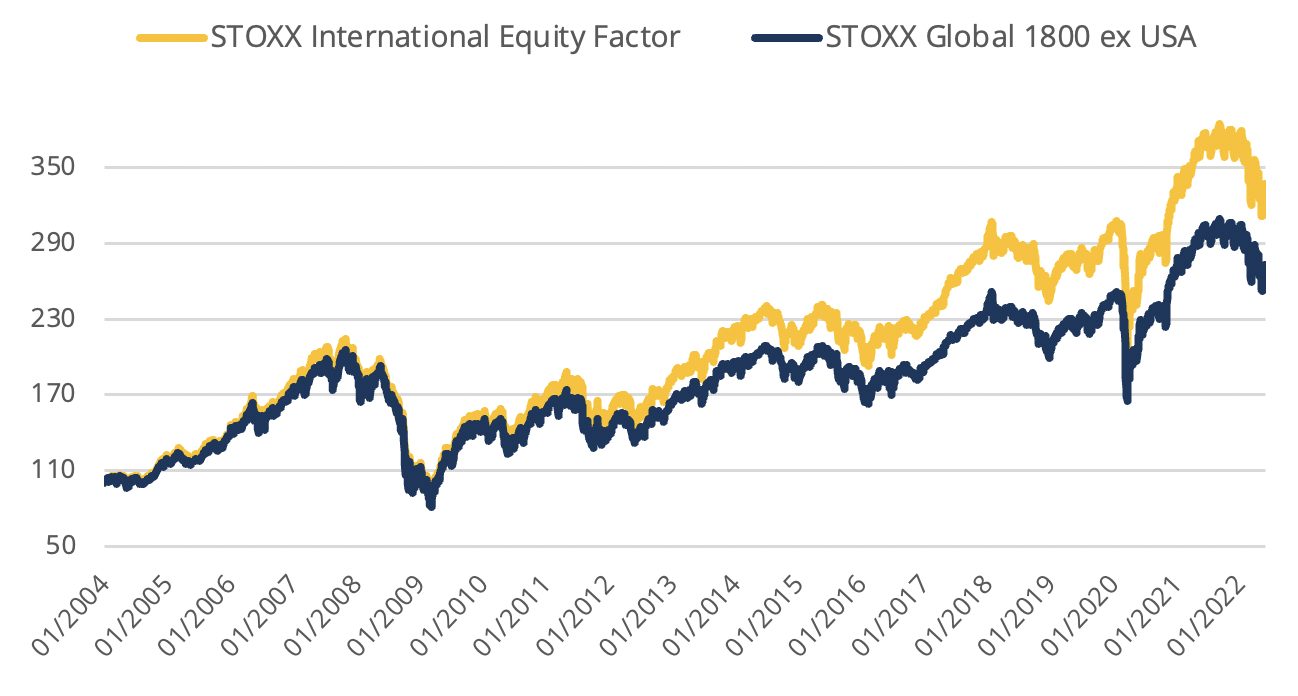

Because of this full-market-cycle performance potential, many investors tend to leverage a multifactor strategy in their core equity allocation. Factors, after all, are the long-term drivers of equity market returns.

Indeed, both the STOXX U.S. Equity Factor and the STOXX International Equity Factor indices have historically delivered outperformance with similar levels of risk compared to their respective benchmarks (Figures 3 and 4).

Figure 3: Index performance

Figure 4: Risk and returns

Innovation in factor investing

Advancements in data and technology have afforded investors greater access to factor-based strategies and offer potential for long-term enhanced returns. As investors consider their options, they should be diligent in evaluating the methodology, exposures and characteristics of each solution to ensure the appropriate fit for their investment objectives.

The new STOXX Equity Factor Indices represent a unique, rules-based and transparent offering with the potential for long-term outperformance via a well-researched, diversified, multifactor equity strategy that was designed to serve as a core equity building block.