Potential triggers this week: Covid-19 developments globally and flash PMI surveys for the US, UK, Eurozone, Japan, and Australia will provide an insight into whether these economies continued to recover amid a resurgence in COVID-19 infections. Other key data to follow include: US housing data; UK retail trade and inflation; Eurozone consumer confidence; Japan Q2 GDP and trade balance.

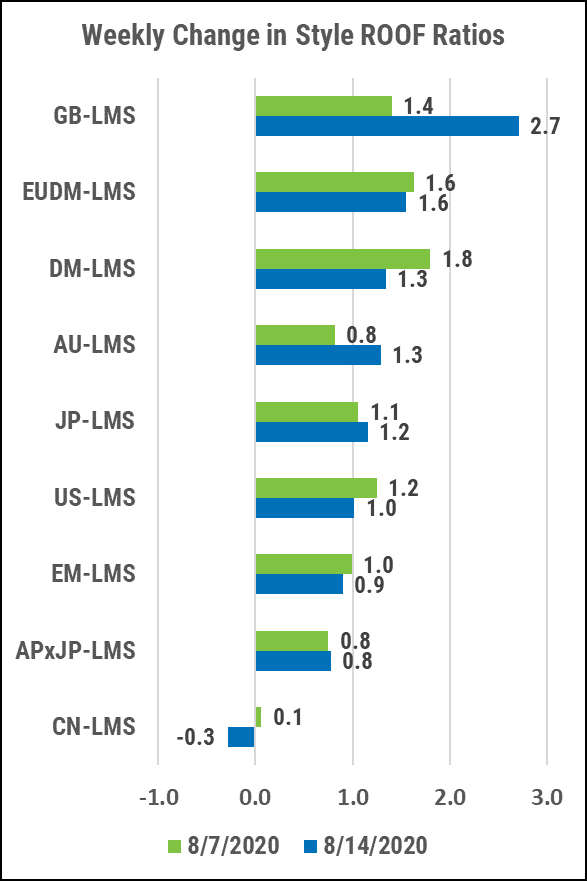

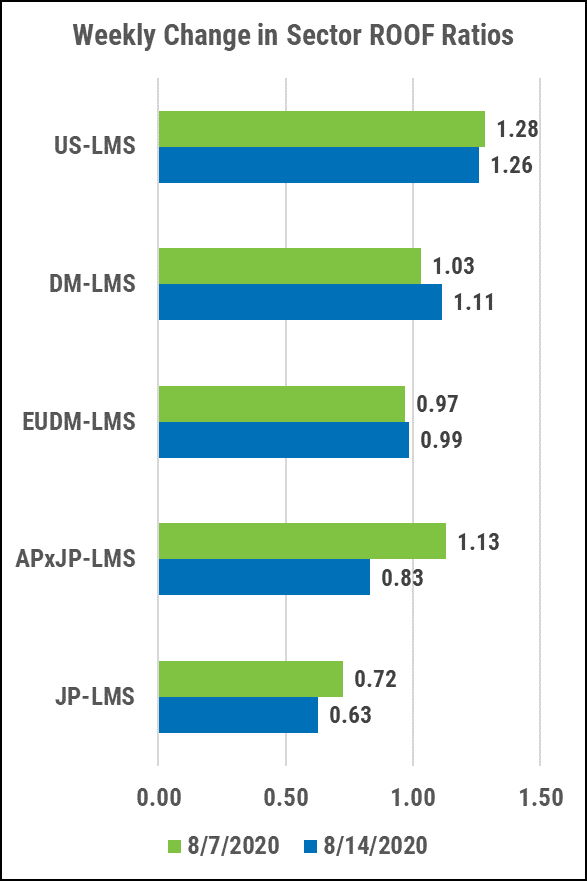

Summary: As we exit the Q2 earnings season, sentiment takes a breather. Earnings were good and for the most part better than feared. CEO guidance was positive, but bleak economic data on Q2 and potentially dark geopolitical clouds ahead seems to have curbed investor’s enthusiasm (except in the UK last week). All ROOF Ratios remain in the bullish zone, except China’s, but the sentiment momentum that we observed at the start of the earning season has weakened as company specific news is replaced by geopolitical and macro headlines, increasing the potential for a sharp volatility spike. Declining volatility was the main driver of positive sentiment in Q3. A sudden reversal would be enough to tip sentiment in favor of risk-aversion. At this point, risk-aversion is still well below risk-tolerance in all markets we track (except China), but rising volatility and correlation can put momentum behind a rise in risk aversion, driving risk appetite out of the market very quickly.

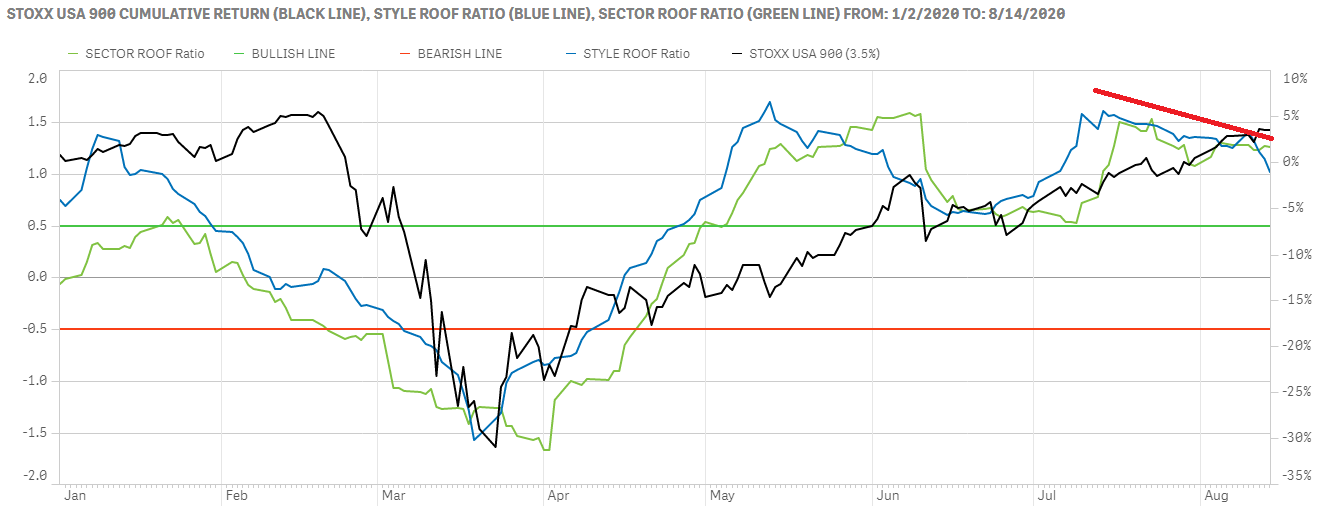

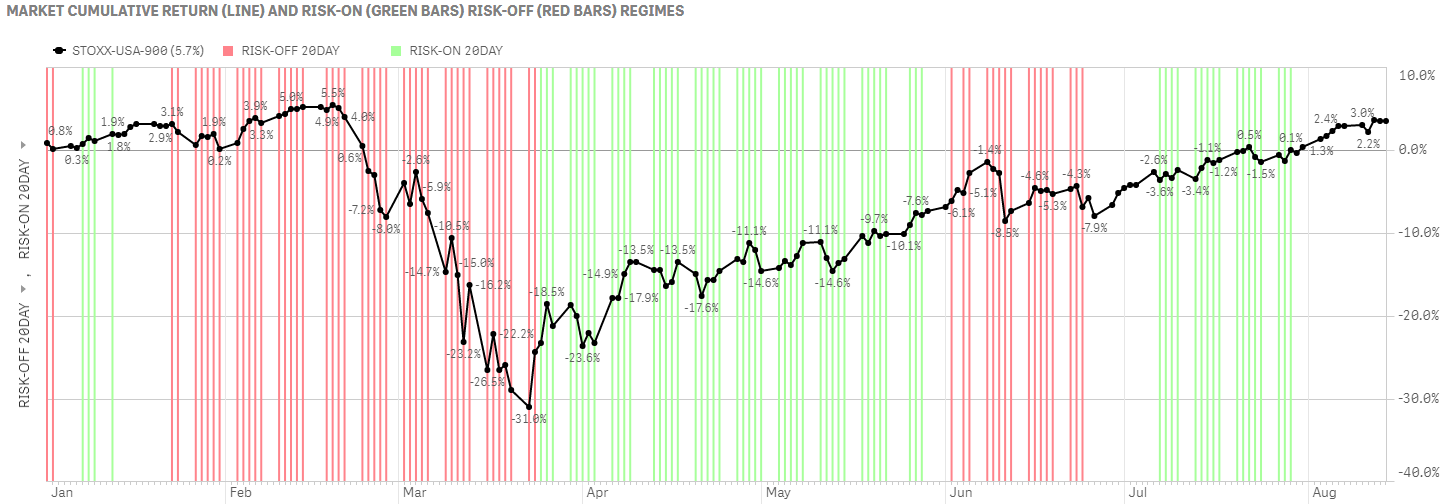

US investor’s positive sentiment continues to weaken but remains in the bullish zone.

Bullish sentiment peaked in mid-July and sentiment momentum has been declining steadily since. Both of our ROOF Ratio variants remain in bullish territory, but the weakening trend of the past three weeks mirrors a growing uncertainty with regards to the shape and sustainability of the economic recovery (top chart).

Both ROOF ratios have now dropped by more than 0.5 in the last twenty days signaling a change in sentiment. Both have now stopped giving a BUY signal since late July and have turned neutral despite still being comfortably within the bullish zone (bottom chart).

Looking at the contribution breakdown for the ROOF Ratios, the main contributor remains the 2 volatility metrics while both style factors and sectors remain evenly divided. Were volatility to start rising again and see those two metrics switch sides, sentiment could deteriorate further, faster, and trigger a SELL signal. With the end of the Q2 earnings season, macro and geopolitical news will once again dominate the headlines instead of company specific news. The former has a greater impact on volatility and correlation, so caution is warranted going forward.

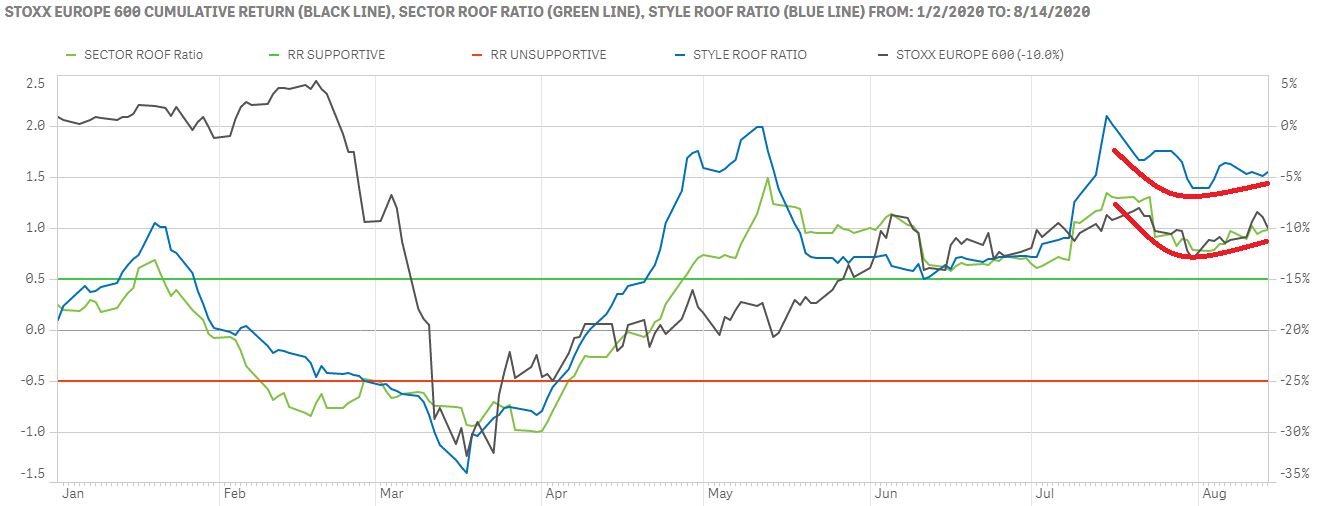

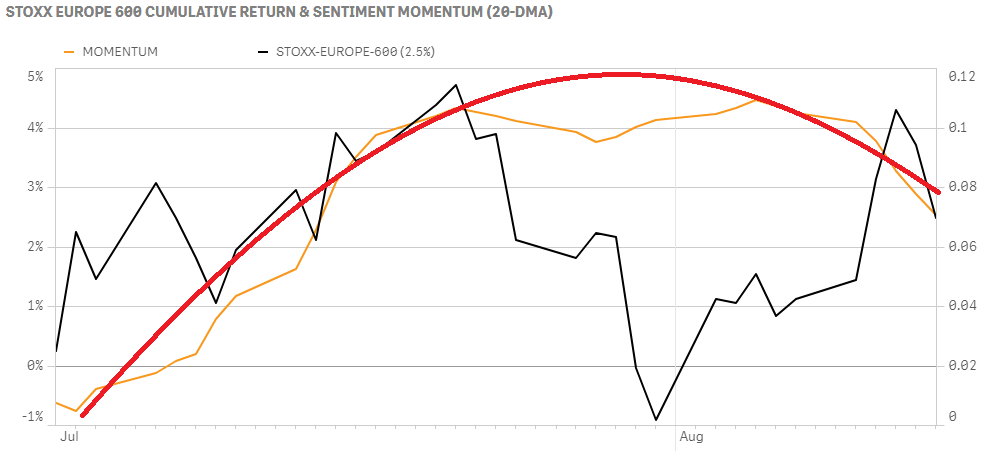

Sentiment in developed Europe rebounds without a lot of conviction.

Sentiment in Europe rebounded slightly this past week (top chart) to continue its lengthy staycation in bullish territory. Both ROOF Ratios came down from their mid-July peaks but have started to reclimb that decline in August (top chart). Sentiment in Europe has been in the bullish zone for what is now a very long time and yet the STOXX Europe 600 is still down about 10% versus it’s February 19 peak, in contrast to its US counterpart which is within reach of a historical new high.

Sentiment momentum peaked at the end of the first week of August and has since headed back down, giving the current resurgence of bullish sentiment in Europe only a mild support (bottom chart). Here too the 2 volatility metrics are what is making the difference between bullish support and bearish beginnings. With the end of the Q2 reporting season, the return from summer holidays and the controversial restarting of schools, macro, health, and political news is likely to restart dominating the papers which could affect the direction of volatility-linked metrics and drive risk-aversion higher in the coming weeks.

Sentiment in global developed markets converges across ROOF variants and finds the same support level in Asia ex-Japan.

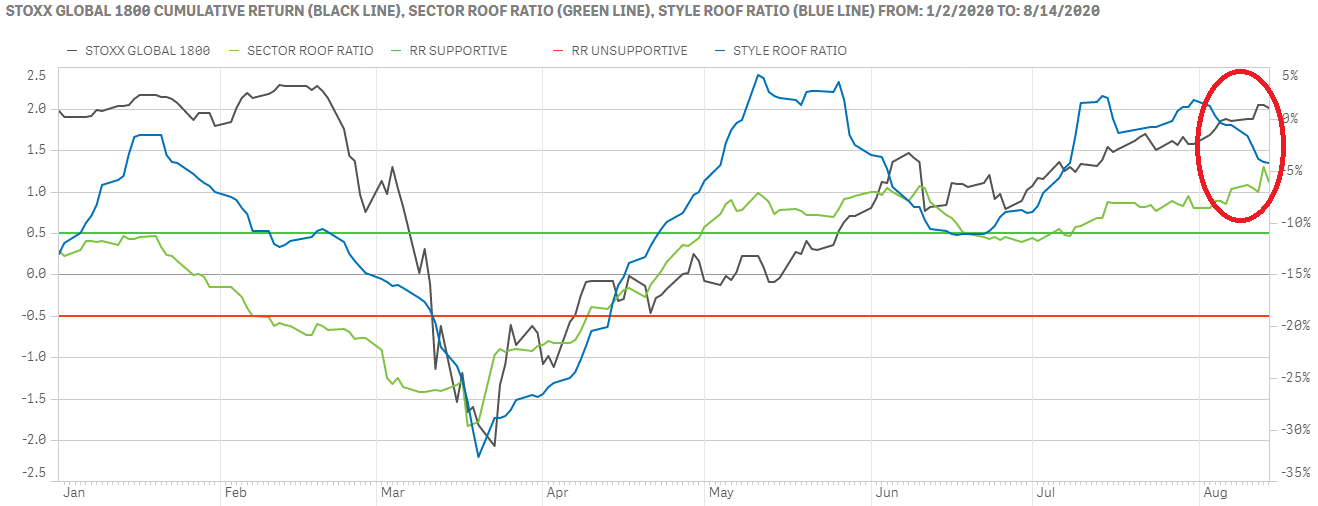

Sentiment in global developed markets continues to converge across our two variants settling well withing the bullish zone and closing the gap between them that started in mid-June (top chart). The STOXX Global 1800 index is now close to its February high and with sentiment this supportive, it will take a sharp volatility increase to reverse the current market uptrend towards new high.

The divergence across our two ROOF variants for Asia ex-Japan that opened in early June has also closed with both variants finding strong support at the same level, just within the bullish zone (bottom chart). Unlike its global and US counterpart, the STOXX Asia ex-Japan 600 is still well below its February high and remains stuck at -8% YTD despite positive sentiment, indicating a lack of confidence in the potential for a strong economic recovery. Covid-19 will leave scars on this region.