Potential triggers this week: Jackson Hole symposium will be carefully watched for signs other central banks agree with the Fed that the economic impact of the pandemic is bigger than they thought. After last week’s Democratic National Convention, it is Republicans’ turn to hold their own convention. Macroeconomic data include second estimates of Q2 GDP for the US and Germany.

Summary: Sentiment continued to weaken from its strongly bullish levels of July in about half of the markets we track, remaining high or higher only in Europe, the UK, Japan, and Australia. A key factor behind the prolonged period of bullish sentiment since April was declining volatility, but the risk spread between our short and medium-term horizon risk models has now turned positive in the last three days indicating that in the short-term at least, risk may be headed back up. Additionally, both Market Sensitivity and Volatility factor returns have turned negative in all key markets, in a sign that taking more risk than average will no longer being rewarded. CEOs have stopped talking and Central Bankers are just getting started. Unfortunately for sentiment, the latter is a lot less positive on the economy than the former. News flow in the next three months will be dominated by US Presidential election theatrics and given the lead characters lineup, we can expect a bumpy ride.

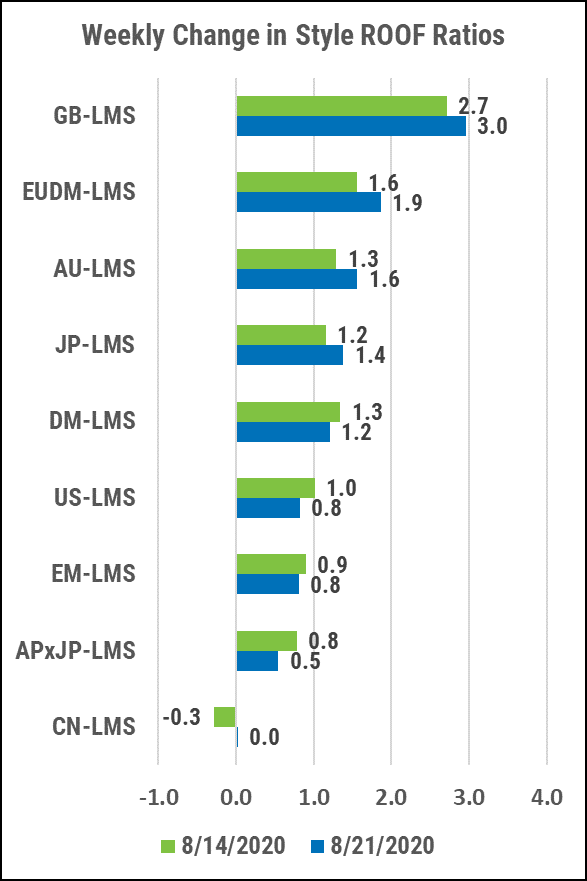

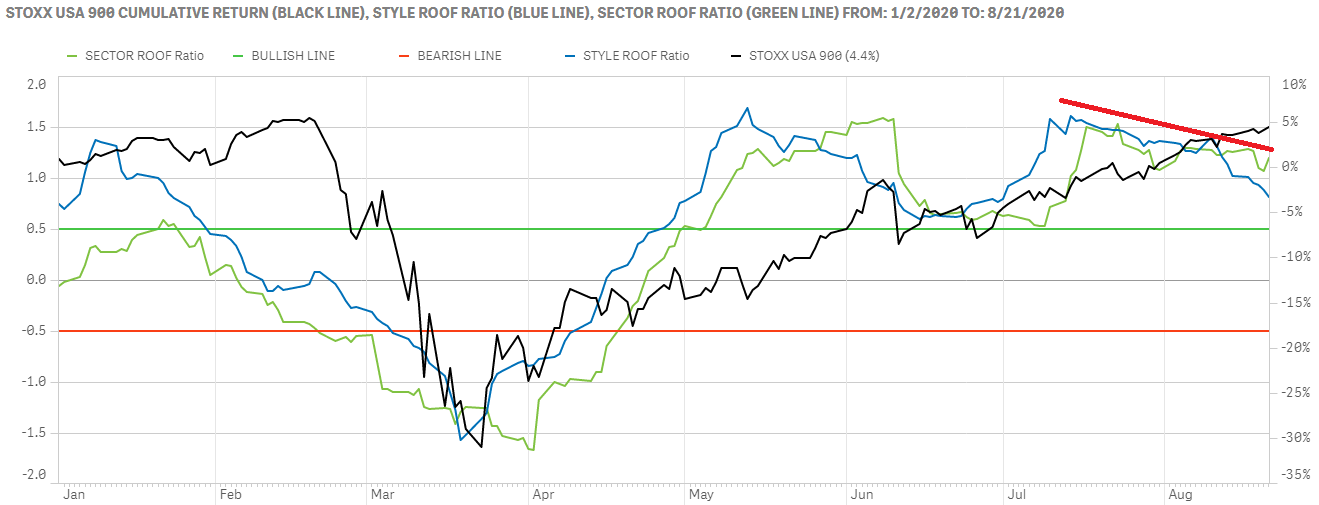

Drop in US sentiment since early July triggers a Sell signal for our Style ROOF variant.

Sentiment in the US continued to weaken this past week and has now been on the decline since mid-July (top chart). Sentiment remains in the bullish zone but the drop in the ROOF Ratio has triggered a Sell signal for our Style ROOF variant (bottom chart). Note that the Sector ROOF variant turned neutral from bullish back on August 10 but has not yet triggered a Sell signal.

The change in sentiment was triggered by a change with respect to volatility and the rewards for risk-taking, both of which have turned negative for risk-tolerance and positive for risk-aversion in the last four days. The short-medium horizon risk spread has turned positive and the factor returns for Market Sensitivity and Volatility has turned negative indicating that risk is not being rewarded in the market. The last time that happened was in early June.

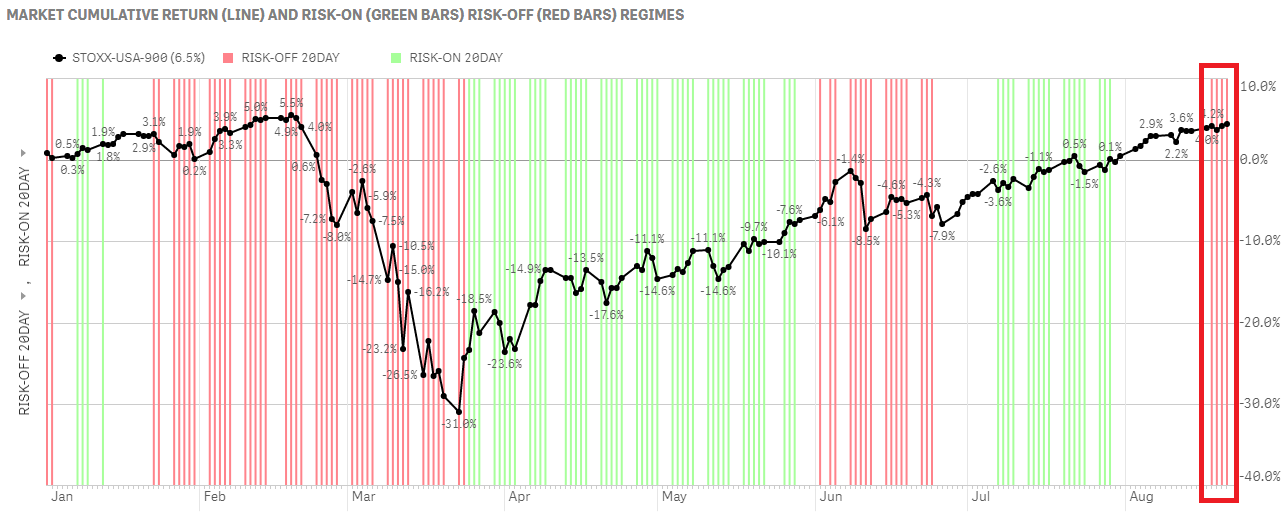

Now that the Q2 earning season is out of the way, macro and geopolitical news will drive sentiment in the next three months. Given the global context of an acrimonious US Presidential election, deteriorating relations between the top two economies, and a continuing global pandemic, we can expect both volatility and correlation to make a comeback and negatively affect sentiment.

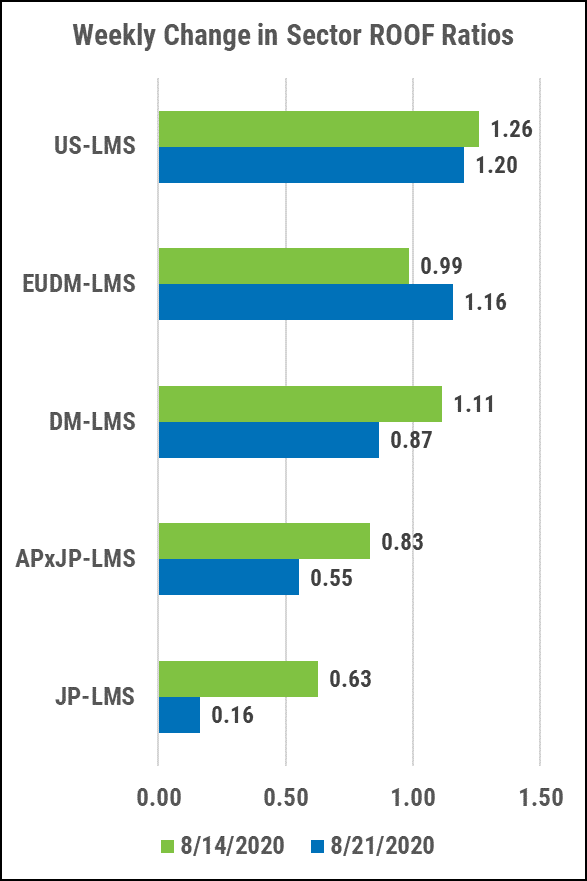

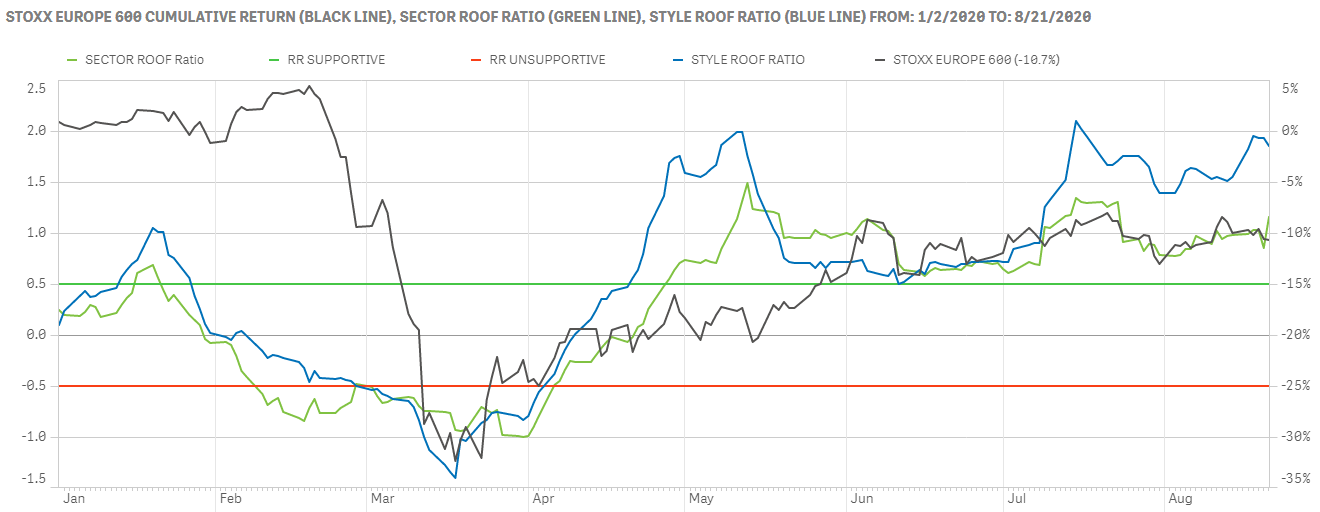

Developed Europe sentiment remains positive, but change may be lurking under the surface

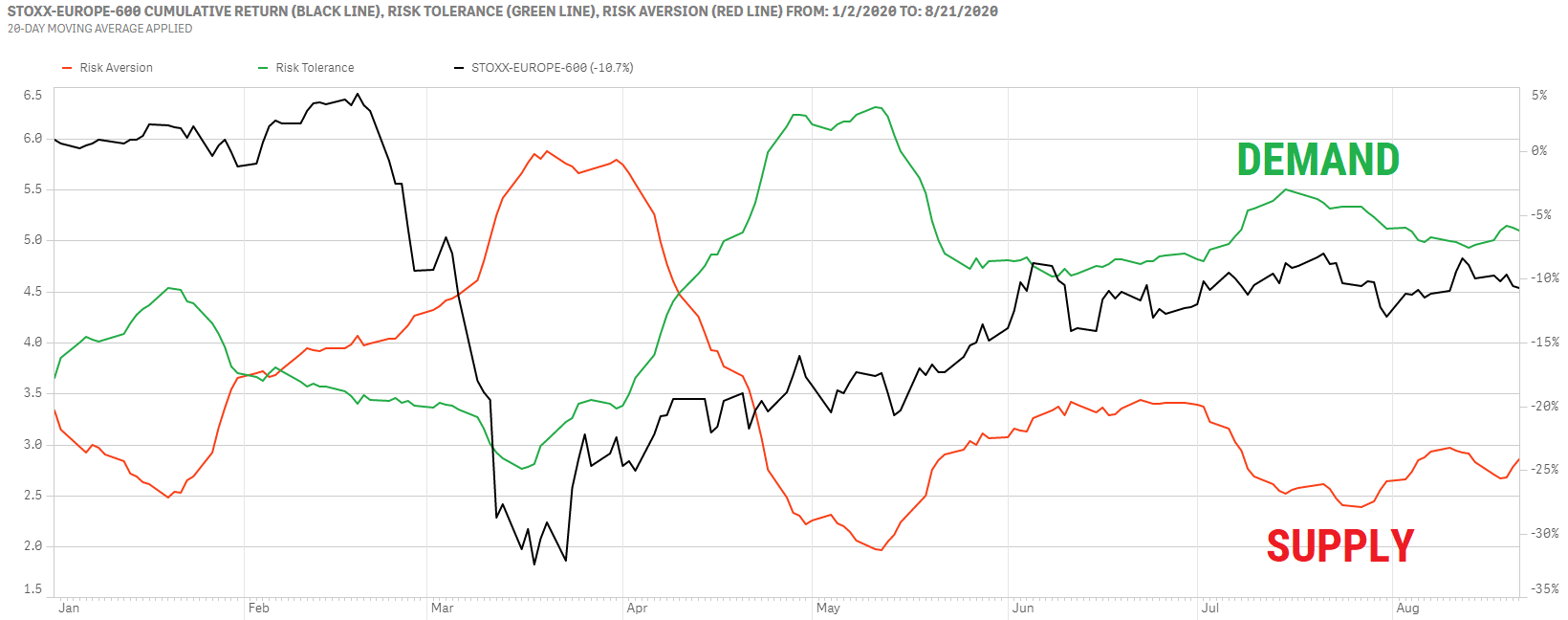

Sentiment in Developed Europe remains upbeat, in contrast to their peers in the US. Risk appetite rose on the coattails of the massive stimulus package passed last month and has not come down since (top chart). Like in the US, though, the spread between the short and medium horizon risk has turned positive in the last two days, and factor return for both Market Sensitivity and Volatility have been negative for the last four.

The supply and demand balance for risk remains in favor of demand, for now, but the STOXX Europe 600 index is still down about 10% YTD, giving European investors much less room for profit taking than their US counterpart should their mood turn negative (bottom chart). If risk-aversion continues to get a boost from rising volatility, given negative YTD returns, we could see a sharp rise in the supply of risk assets as investors focus on limiting downside risk. And as highlighted in last week’s note, given that sentiment momentum has weakened of late, there does not seem to be a lot of conviction behind the current demand for risk assets in the market.

Sentiment in both global developed and Asia-Pacific ex-Japan markets weakens further but remains in the bullish zone, for now.

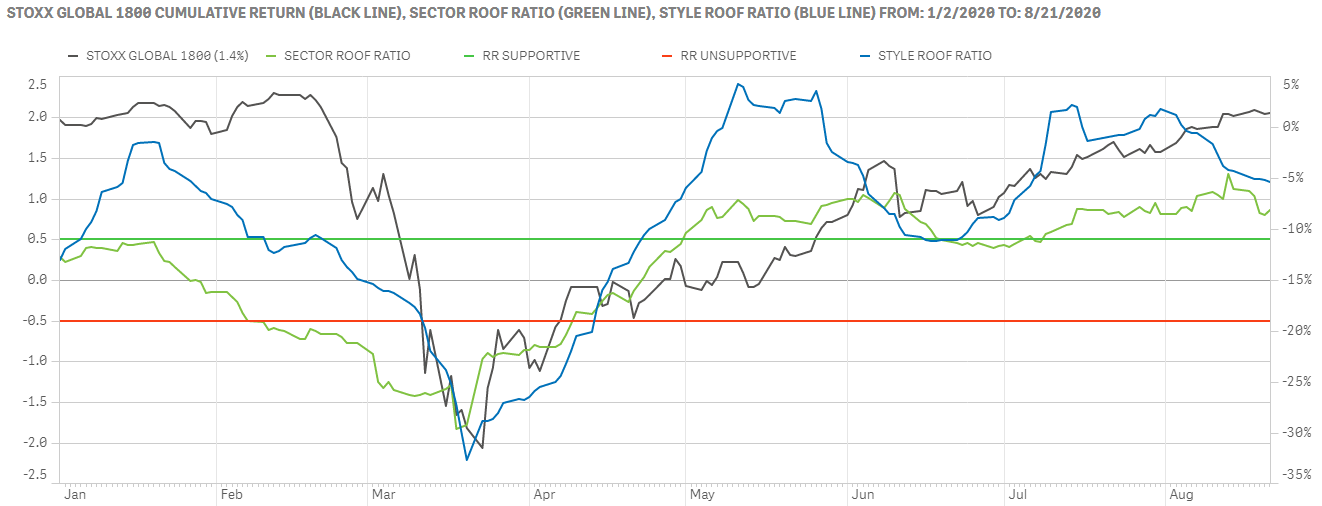

Sentiment in global developed markets weakened further preventing the market from hitting new highs (top chart). Like the US and Europe, the risk spread has turned positive and the factor returns for Market Sensitivity and Volatility negative for four consecutive days, signaling a possible change in sentiment as risk-aversion begins to rise. With plenty of short-term profits to be harvested, it will take an upward revision on expected returns to boos risk-tolerance. Absent that or another stimulus package, the supply and balance for risk asset may well soon turn in favor of supply.

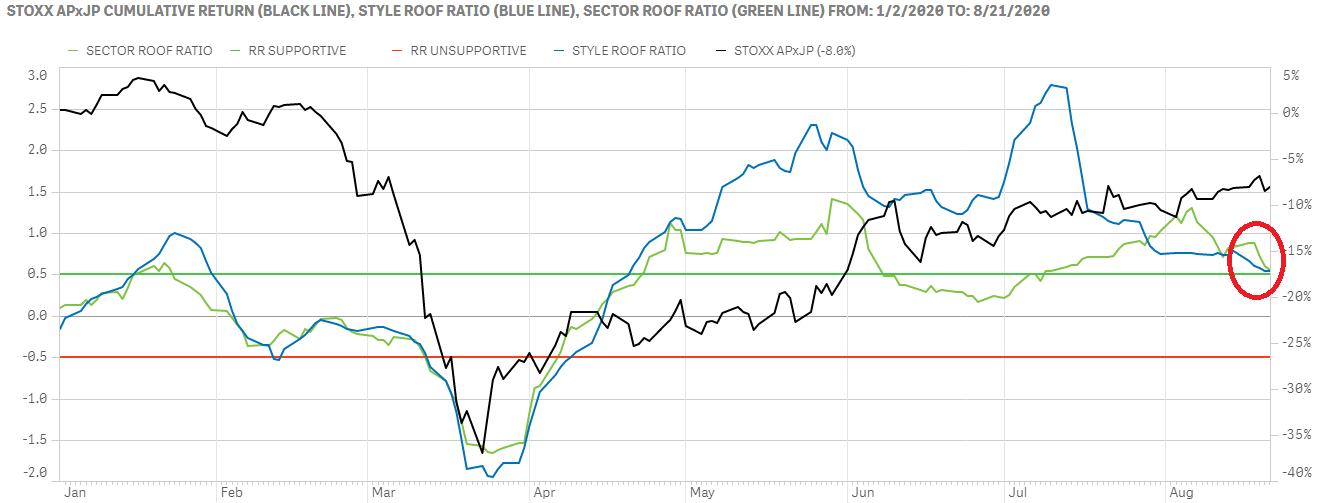

Markets in Asia-Pacific ex-Japan have lagged their peers when it comes to the strength of their Covid-19 rebound and are still down about 8% YTD. The gap between risk-tolerance and risk-aversion remains in favor of the former but only narrowly so, and both ROOF Ratios now sit right on the fence between the bullish and neutral zone (bottom chart). With trade talks between the US and China set to restart soon and be the primary football in the US presidential election race, sentiment in the region will remain under pressure unless strongly positive signs emerge that the trade war will not be reenacted at the detriment to global trade.