Potential triggers this week: Covid-19 developments globally and the US earnings season with about a quarter of S&P 500 companies reporting second-quarter results. On the economic data front, US non-farm payrolls and trade figures for the US and China. Also in the news, but likely ignored, Fitch Ratings revised its outlook on U.S. credit score to negative from stable.

Summary: Investor sentiment remains high on stimulus fumes, except in China where it has gradually slipped into negative territory this past week brought down by renewed fears of geopolitical tension with the US. The rest of the world is officially in a bullish recession with stock markets being supported by the association of Speculators Against the Removal of Covid-19 Applicable Stimulus Measures (S.A.R.C.A.S.M.). Declining volatility remains the only consistent driver of positive sentiment, and were this downtrend to reverse as we head into the business end of a US presidential election year, sentiment could quickly deteriorate, tipping the supply and demand balance back in favor of risk-aversion, making investors a lot more sensitive to negative news than they have been since April.

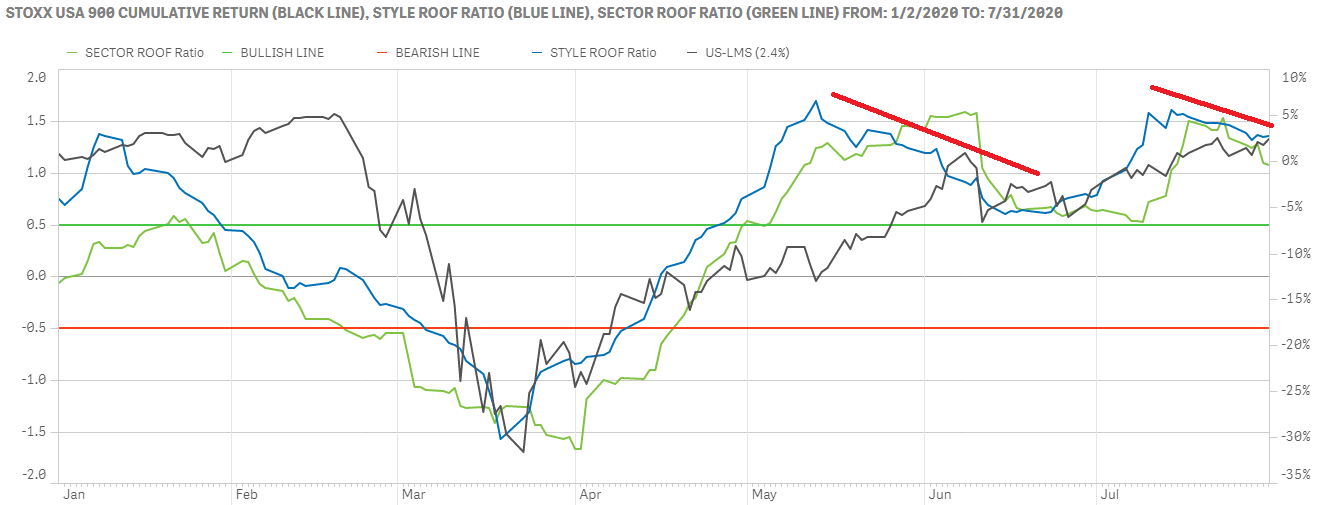

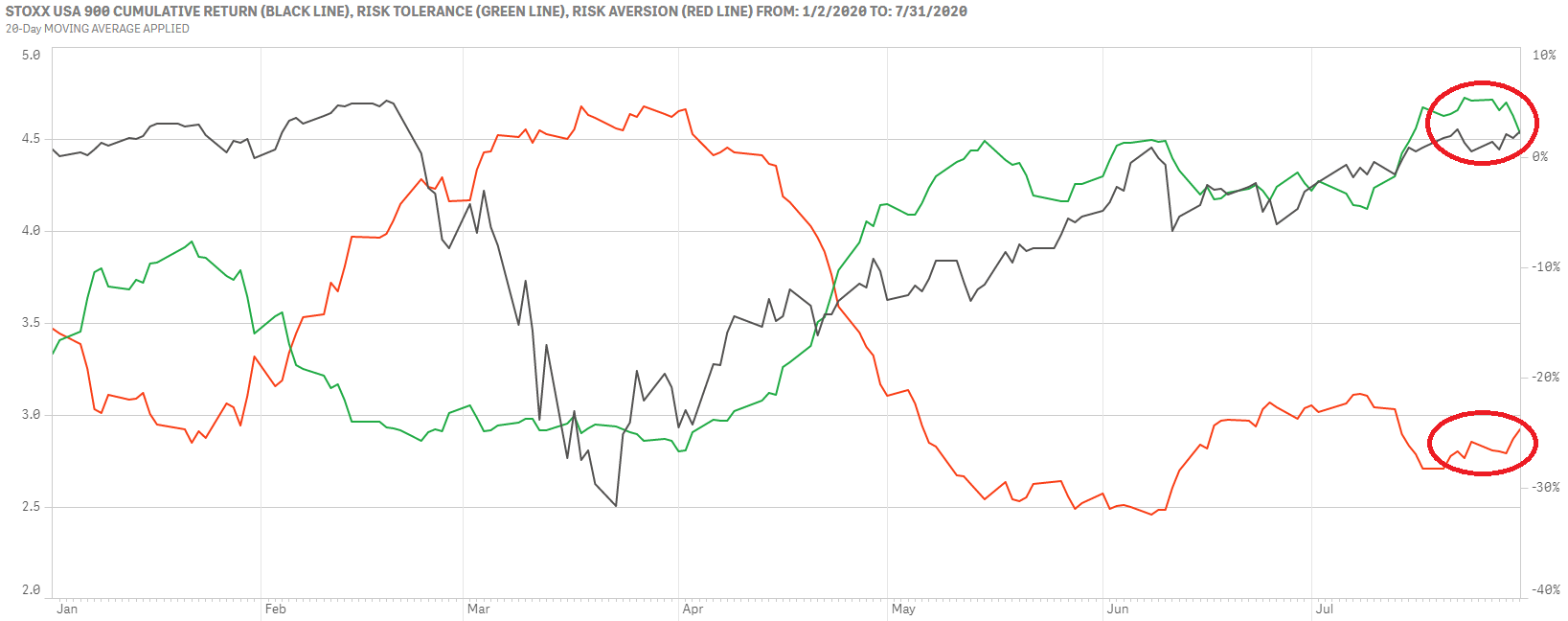

US investor’s sentiment remains high but continues its gradual decline for the second week.

The US is now officially in a bullish recession, classifying it as a technical oxymoron. The biggest driver of market return and the continued positive investor sentiment has been the strong negative correlation between Wall Street and Main Street. This is a temporal divergence as Wall Street is betting on a future recovery for Main Street once the Covid-19 pandemic is under control. But look past the declining volatility metrics and the rising FAANG stock prices and a very divergent picture emerges. Investors have been hedging their bets and were it not for the fiscal and monetary stimuli, would not be in such high spirits.

The problem is geopolitics promises to be anything but calm in the next few months and mismanaged reopenings continue to boost second wave numbers and increase the likelihood of another partial lockdown. Investor sentiment for both our variants is now in its second week of retreating from its previous lofty levels and may be signaling that investors have moved away from the V-shape recovery scenario and are now gravitating towards a W-shape one. Other safe-haven assets (USTB, Gold, JPY), are also showing signs of concern.

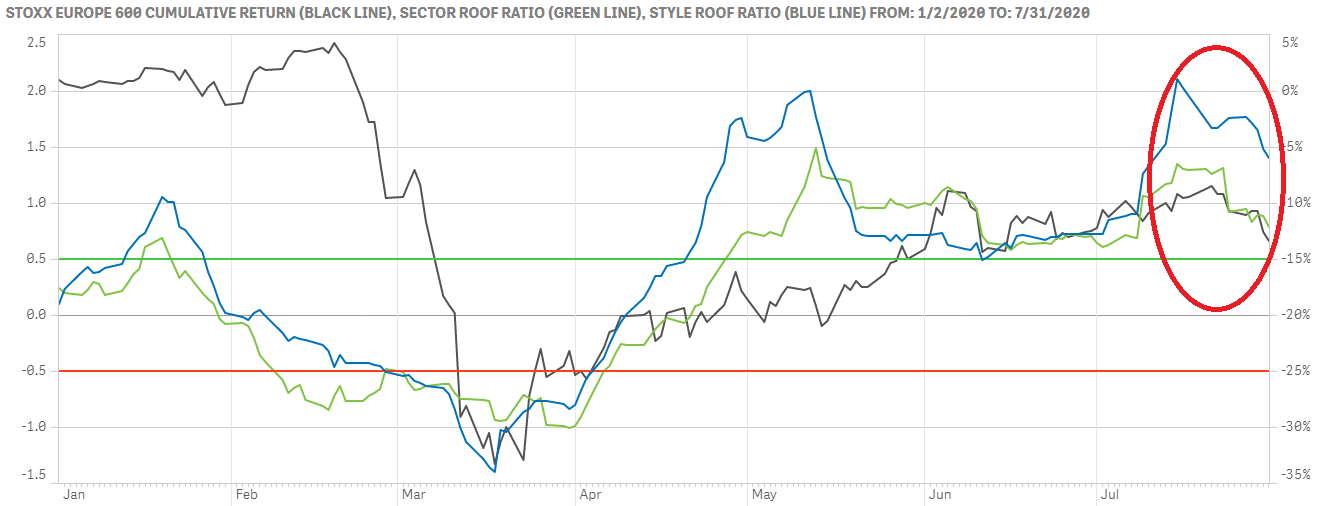

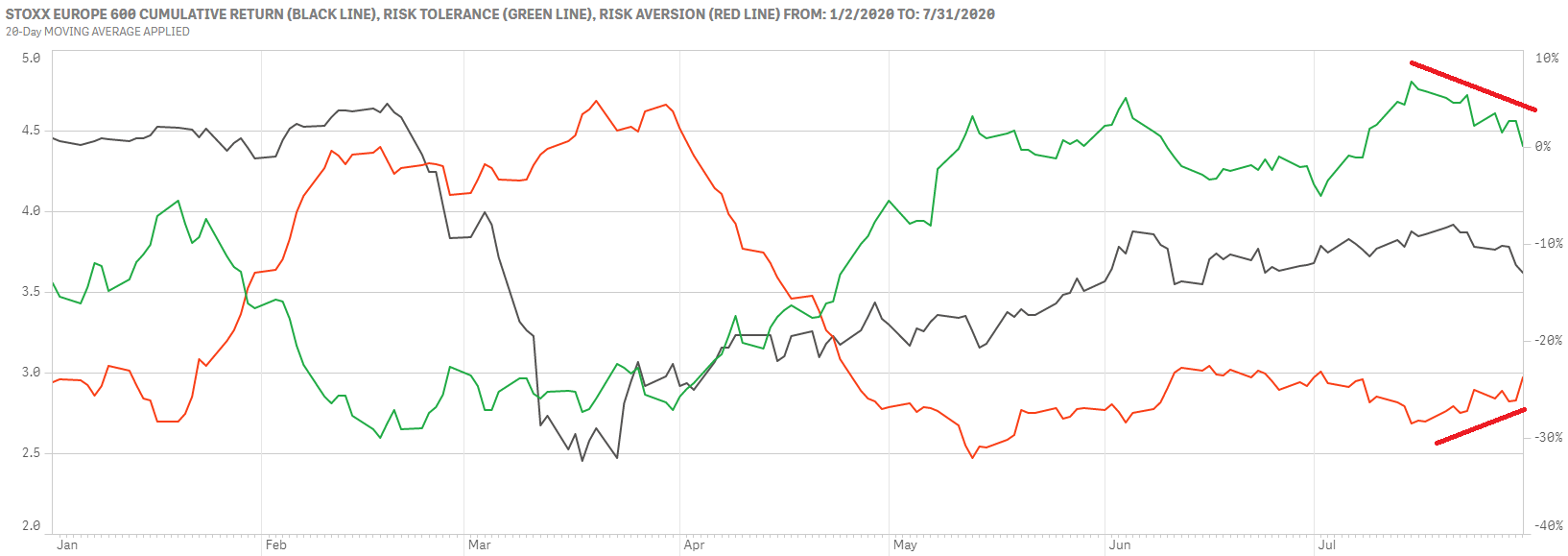

Sentiment in developed Europe weakens for the second straight week but remains positive.

For the second week in a row now sentiment has been declining for both our ROOF variants (top chart), signaling that investors may not be as confident as previously about the longevity of the economic rebound from earlier reopenings. Both indicators remain in positive territory, supported by negative bond yield and another healthy stimulus package.

Risk-tolerance has been declining and risk-aversion rising (bottom chart) with the bulk of the positive spread between the two coming from lower volatility readings. Recently, factors behind the surge in risk-tolerance since April (high beta, volatile, growth, technology stocks) have been batting for the risk-aversion side. Fiscal and monetary stimuli boosted investor confidence and bought markets some time via lower volatility levels but as the Covid-19 narrative turns negative once more and geopolitics flare-up, sentiment may fall victim of rising volatility and correlation levels. The less positive sentiment is the greater the impact of negative news on the collective risk appetite. So, while ROOF Scores are not yet saying “Sell”, they are saying that investors are gradually starting to pay more attention to the daily news flow. Time to brush-up those stress tests.

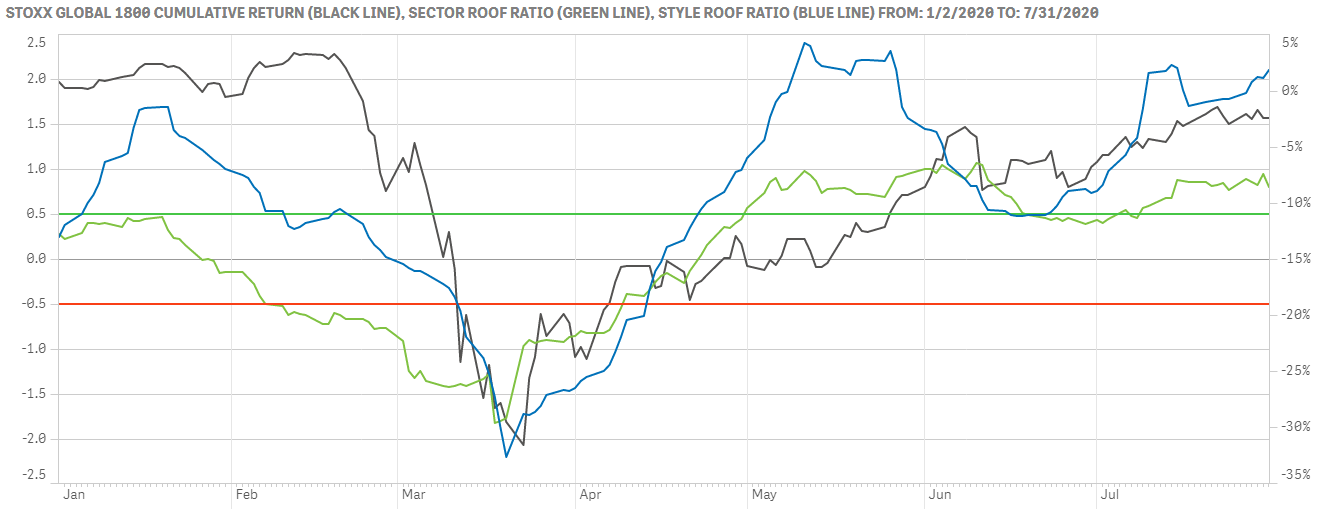

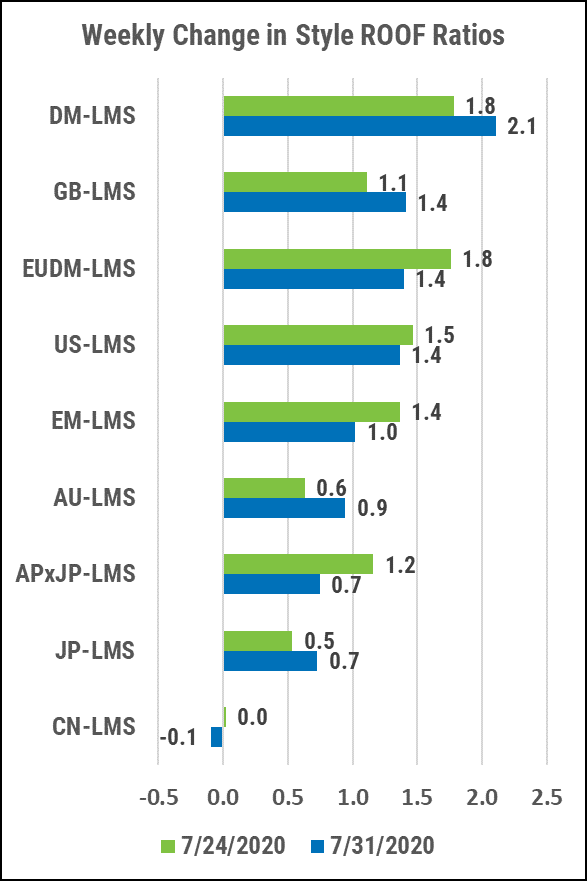

Sentiment in global developed markets rebounds but is divided in Asia ex-Japan

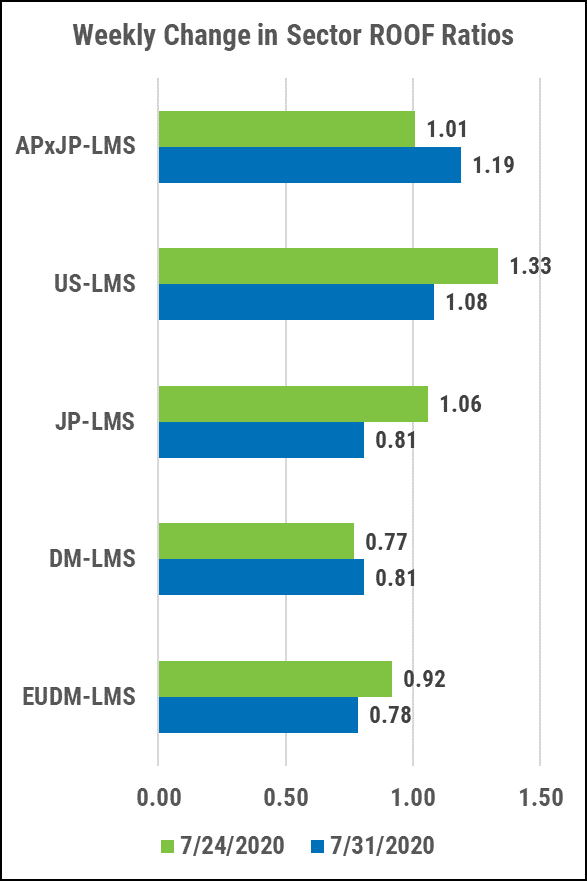

Sentiment among global developed market investors continues to benefit from a second wind (top chart). Underneath the surface, though, we see signs that risk-tolerance is weakening and risk-aversion strengthening. Last week, investors switched their style preference towards low beta, low volatility, profitable companies (all risk-averse styles). As with other markets, were the two volatility-related metrics in our methodology to switch sides, we would see a dramatically different risk appetite picture going forward.

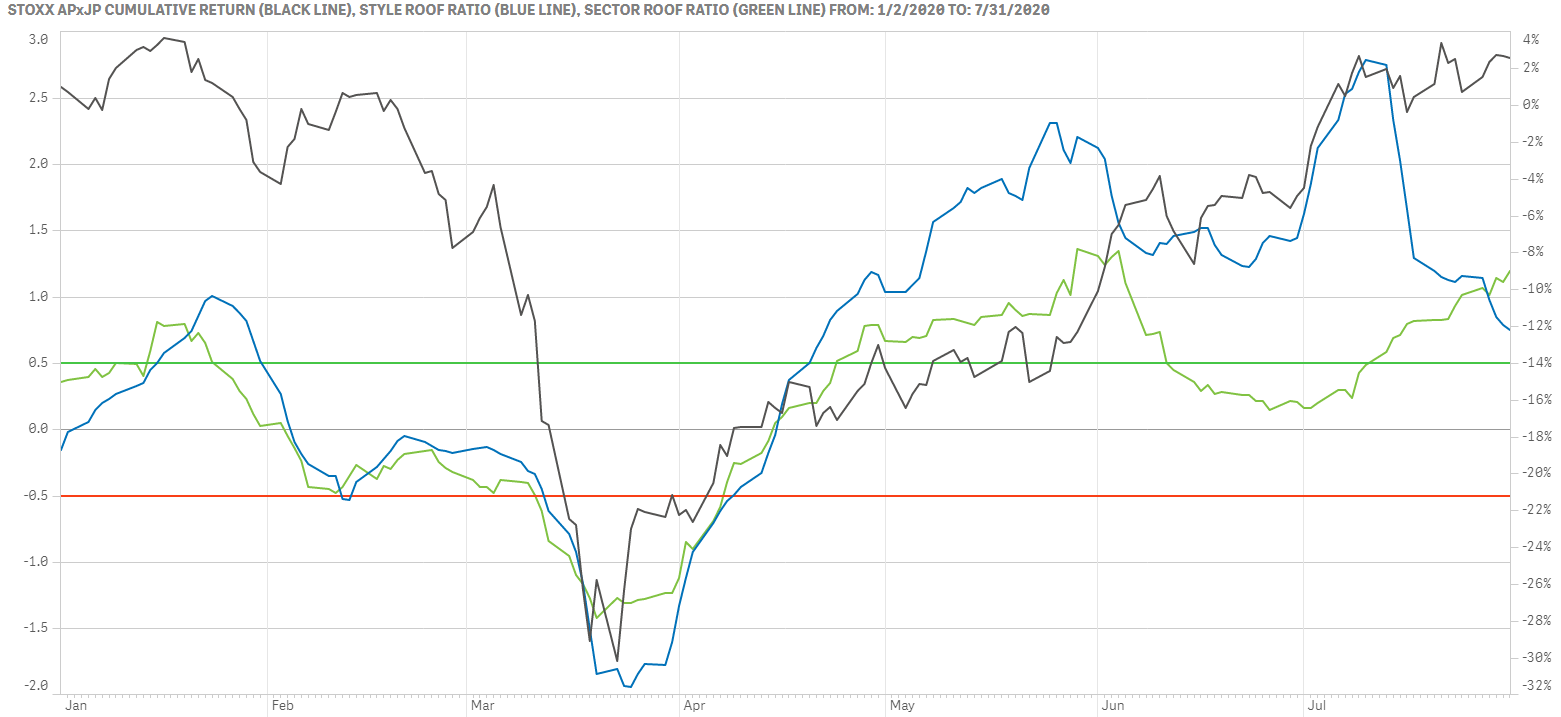

The situation in Asia ex-Japan is less clear with our Style ROOF variant showing a net deterioration of investor sentiment while the Sector ROOF variant continues to show positive risk appetite. The difference comes from rising risk-aversion levels in the former while the latter continues to show a preference for risk-tolerant sectors. Still, divergence between the two scores usually prefaces a change of heart on the part of investors and given how accustomed they have become to low(er) volatility levels, any rise in risk may tip the balance in favor of our Style ROOF variant.