Potential triggers this week: GDP, durable goods orders, and existing and new home sales data in the US. Flash PMI surveys for the US, UK, Eurozone, Japan, and Australia. Eurozone, Germany, and South Korea consumer morale. Investors will also be closely monitoring coronavirus data as a spike in the US and China raised fears over a second wave of infections.

Summary: Investor sentiment continue to adjust to the coronavirus narrative. News of spikes in new cases in the US and China has increased the odds of a U-shape recovery scenario. The high level of positive confirmation bias since late April has prevented an over-reaction to negative news thus far, but as this bias veer to neutral, sentiment becomes sensitive to increases in uncertainty. A second wave of infections resulting in preventive measures hampering economic activity will trigger a negative confirmation bias leaving the market vulnerable to over-reaction to worsening news. Sentiment and markets are now both well off their highs of early June. Volatility, meanwhile, has risen in line with the uncertainty level surrounding the shape of the economic recovery curve. Investors are now facing higher risks, a lower visibility of returns, and a 30%-ish gain for Q2 behind them. With risk appetite softening for the fourth consecutive week, it may be time for profit-taking.

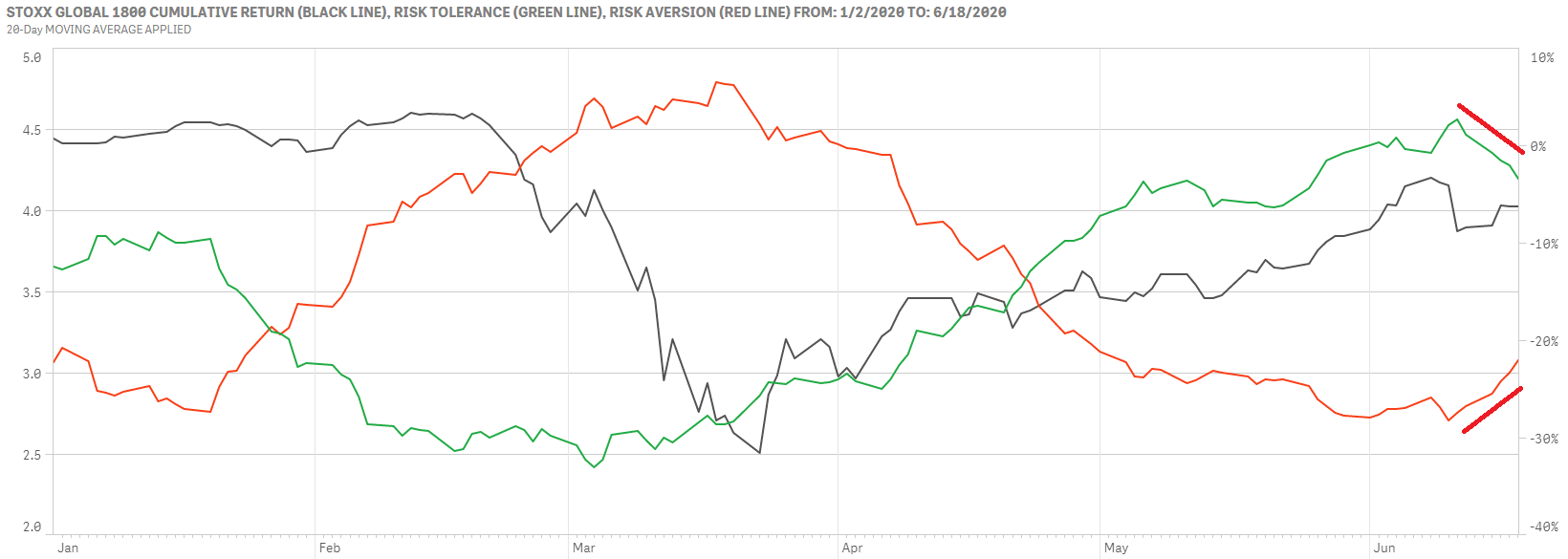

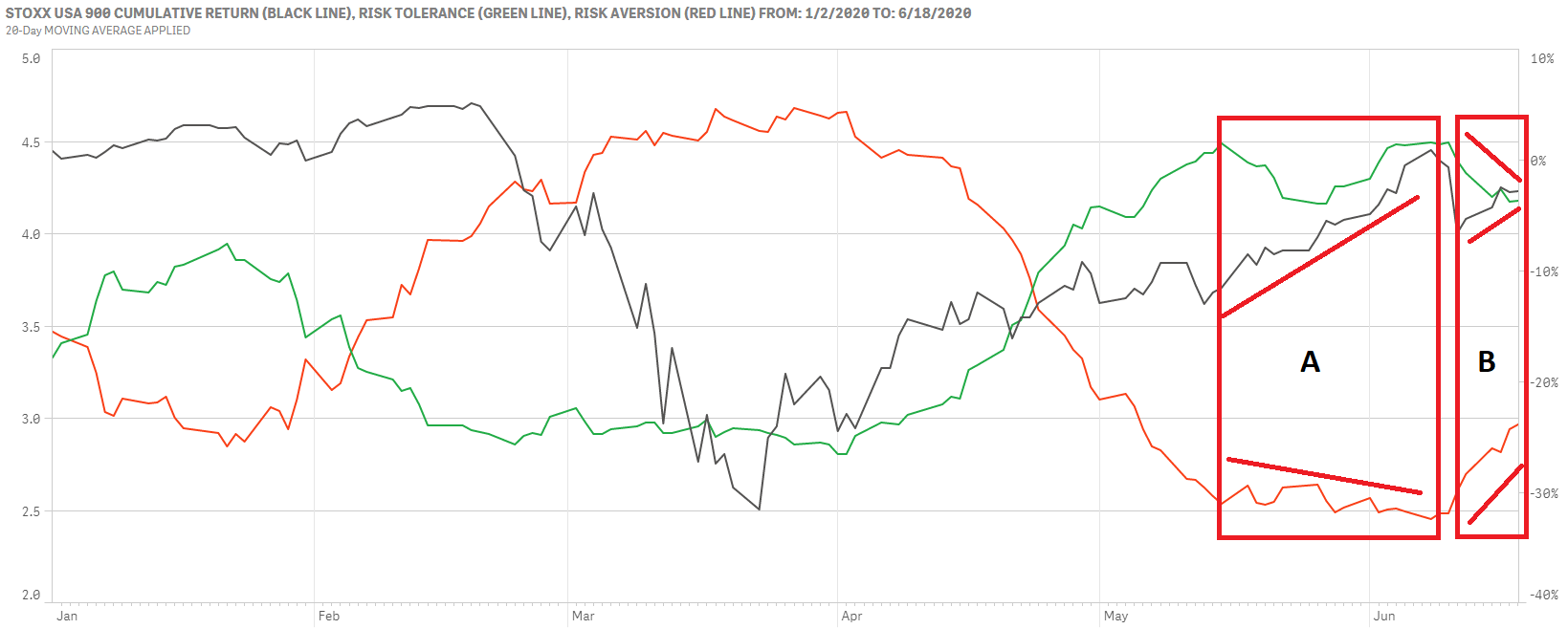

US market’s rise masks an increase in risk-aversion levels – the first since late January.

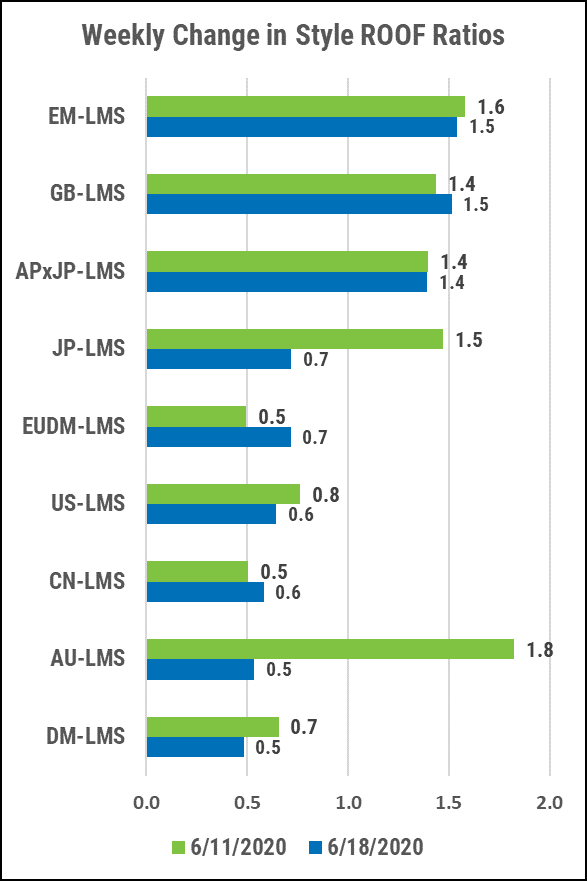

Wall Street and Main Street have been at odds for the last three months, with the former rising sharply on the hopes for a V-shape economic recovery, and the latter declining as economic activity grinded to a halt in an effort to stop the spread of the coronavirus. This disconnect was neutralized by rising levels of risk-tolerance (green line) and declining levels of risk-aversion (red line) since April 1st (see phase A in the top chart below). After a scare on Friday June 12, markets recovered this past week but this mask a change in sentiment. Last week, risk-aversion levels started rising sharply (phase B) and risk-tolerance levels declined. We also note that phase B started in late May for our Style variant of the ROOF scores, meaning that both are in now pointing to a weakening confirmation bias making investors much more vulnerable to negative news than they were up to now and confirming the early warning signal given on Thursday June 11 by the ROOF Ratio (bottom chart). This is an early signal, but rising levels of risk-aversion is concerning as it indicates that the supply and demand balance for risk may be on the verge of turning negative. It is also a clear sign that investors are downgrading their probability for the V-shape scenario in favor of the U-shape one.

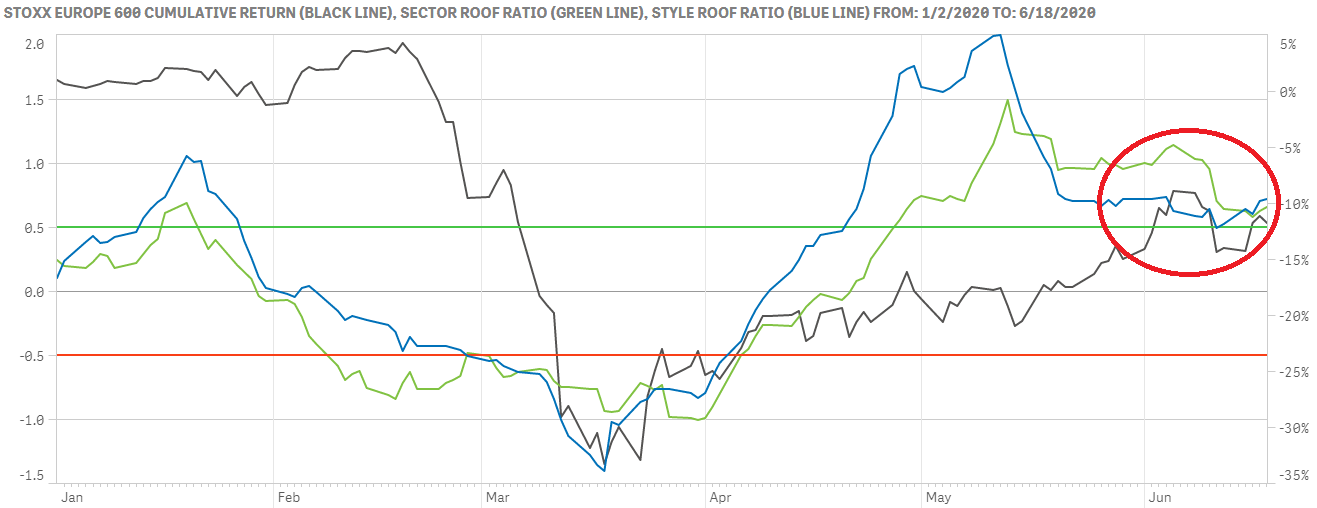

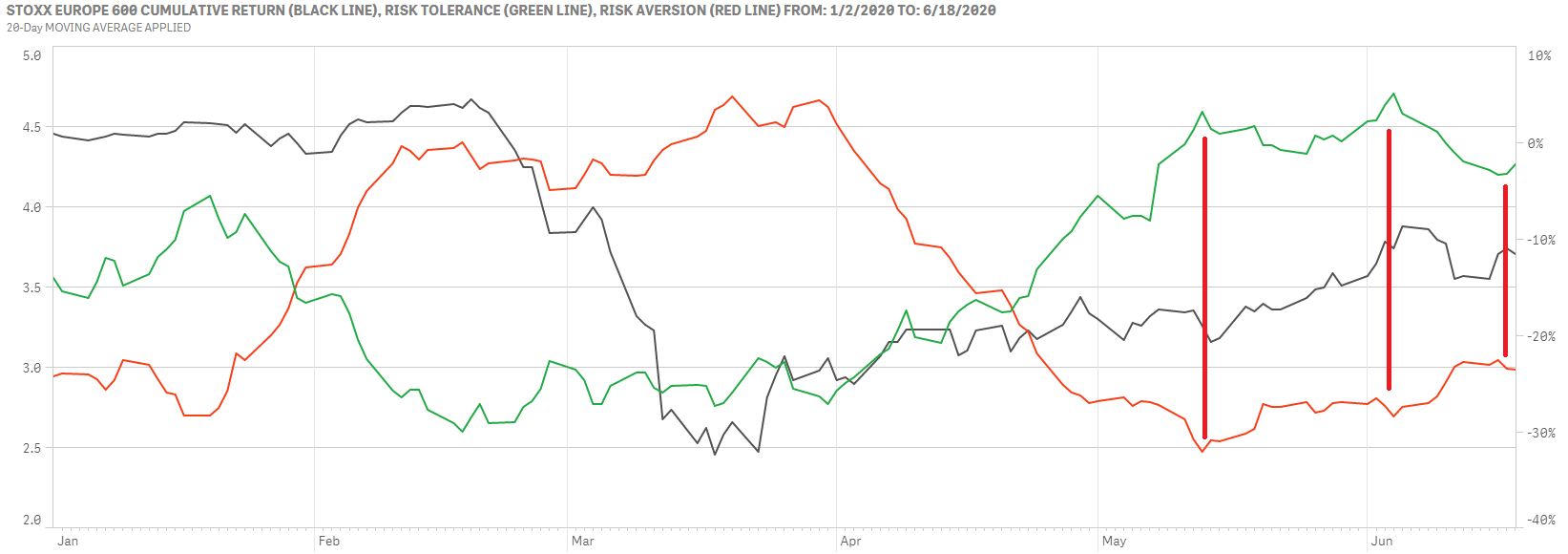

Sentiment in developed Europe remained flat last week, aligned with markets.

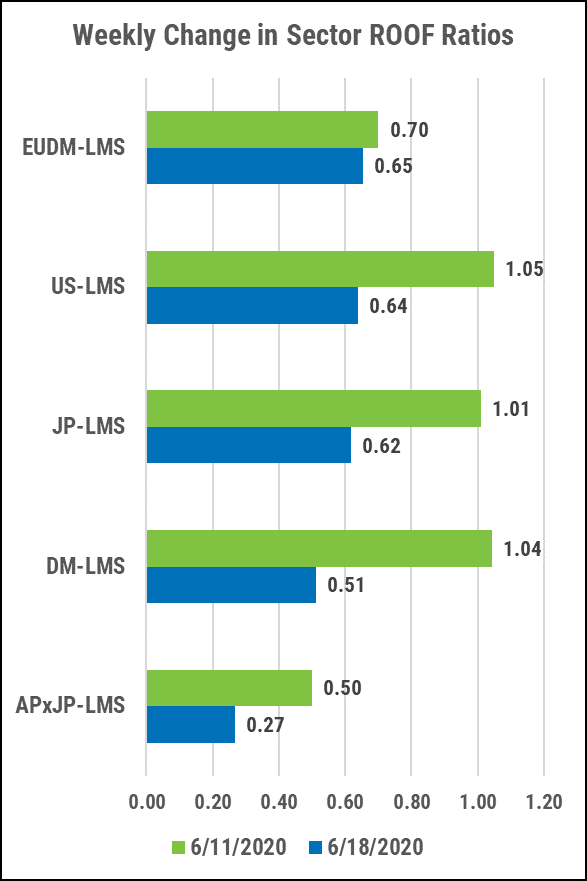

Sentiment and markets remained mostly flat for the week (top chart), but, here too, this equilibrium masks a narrowing gap between risk-tolerance and risk-aversion levels since mid-May (bottom chart). This narrowing has been developing slowly and net risk appetite remains supportive of higher market levels, but sentiment is clearly weaker now than a month ago, and signals an increased burden of proof required by investors to take the market to new highs from here. Positive news will be well received but consecutive negative news will boost the ranks of risk-averse investors tipping the supply-demand balance for risk in favor of supply.

Keep a close eye on the rising level of risk-aversion for clues as to when sentiment will tip in favor of over-reaction to the downside because of negative conformation bias. Once that happens, anything can trigger a rush to de-risk portfolios and head for the exits. For now, investors remain cautiously optimistic, but are becoming more and more nervous about the unsecured paper profits they have achieved thus far this quarter.

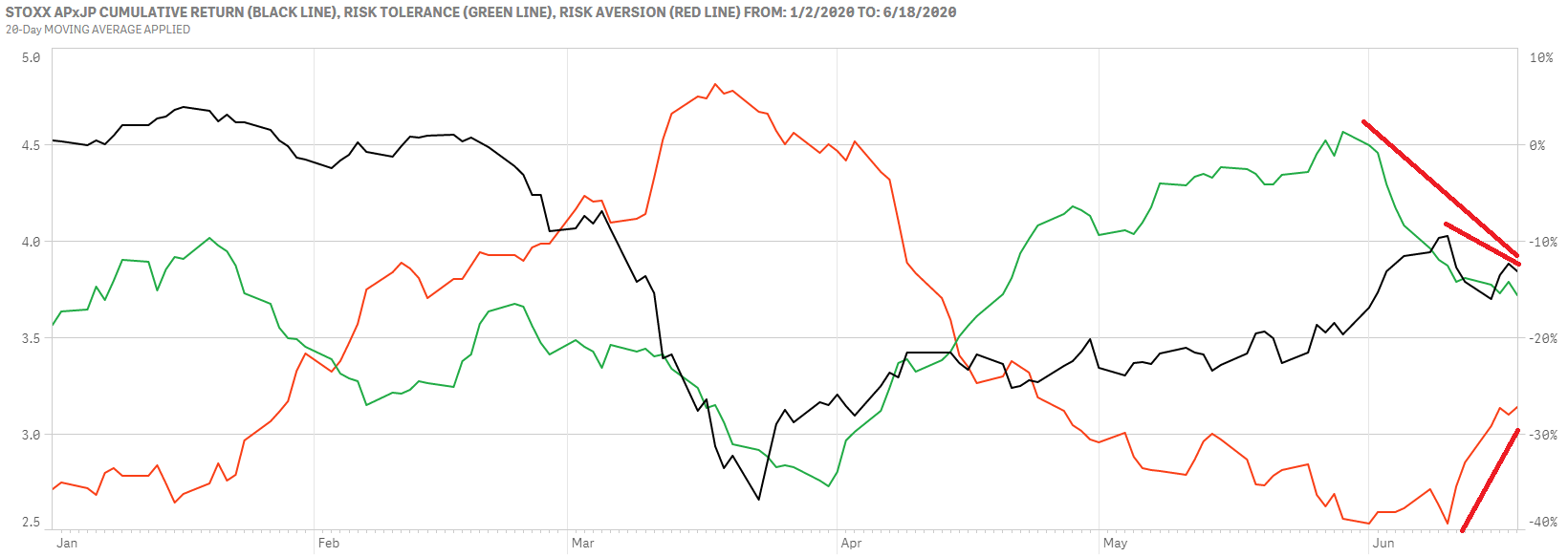

Sentiment in global developed markets and in Asia ex-Japan follow a similar pattern with rising risk-aversion and declining risk-tolerance.

The positive supply and demand balance for risk in global developed markets has started to turn slightly. As in other developed markets, risk-aversion has been rising and risk-tolerance declining since June 10(top chart). The net balance for risk remains positive, but a ROOF Ratio at +0.51 is only 1 bps above the neutral zone.

In Asia ex-Japan, risk-aversion has also been rising since June 10, but risk-tolerance has been declining since the end of May, resulting in a neutral risk appetite (i.e. ROOF ratio is at +0.27 – in the neutral zone). This development is most-likely due to the second spike in new cases in China which have necessitated renewed lockdown measures. This is an indication that the coronavirus narrative still dominates investor’s thinking when it comes to adjusting their outlook for the shape of the economic recovery. The ROOF ratio is likely to remain positive only if the rise in new cases stays confined to Beijing and does not spread to other cities, generating additional lockdown measures.